Asset prices still dominated by contagion and risk aversion

PM Tsipras to tease markets until officially in arrears

Month end demand to play havoc with asset prices

Yen the favorite in flight scenario

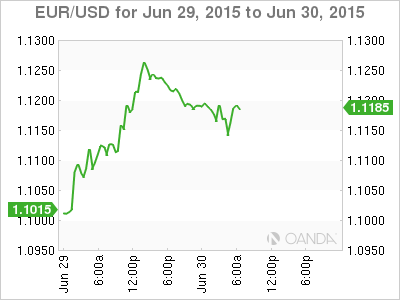

For the remainder of this week, market moves are to be dominated by contagion and risk aversion, but most likely not to the same extent of the recent past. The EUR’s impressive rally after the fact yesterday (€1.0966 to €1.1262), referred mostly to investor confidence on how Euro policy makers have potentially ringed the worst effects of a possible Grexit.

After the initial shock of not obtaining an eleventh hour deal, market moves have since been relatively orderly and fluid, and this despite the nature of this week. It’s a holiday-shortened trading week, dissected by quarter and half-year end demands, with the granddaddy of U.S economic indicators thrown in a day early (Thursday July 2) for good measure.

Since the initial Greek market shock over the past weekend, capital market moves have been far less violent than in years past, as Europe today is considered more capable to handle the fallout from any Greek turbulence. Core and periphery economies are nowadays more stronger. Their budget deficits are considerably smaller. The Eurozone has a much stronger financial system and the ECB has more tools at their disposal, like their QE to program, to be far more proactive and aggressive when needed to be. All of this is giving investors some confidence.

Risk Diversion Diminished, But Not Abated

Barring an unexpected disorderly Greek exit or possible contagion, the consensus believes that the various asset classes (equities, fixed income and forex) should be capable of performing reasonably well. Investors should at least anticipate the odd price gaps amongst the various asset classes, similar to last Sunday’s Asian open (EUR plummeted 100 pips from its Friday close), but this should have more to do with price discovery and liquidity constraints, rather than investor panic.

The risk aversion theme has diminished, but has not abated at this time. Greece continues to overshadow market moves as the country is set to technically fall into “arrears” on today’s IMF loan repayments. Greece is expected to default on its €1.6b IMF payment due midnight. Today is also the official end to Greece’s current bailout program. Be forewarned, Greek PM Tsipras is likely to tease markets with possible positive rhetoric down to the official deadline – he will always consider a last minute initiative for an agreement.

When Athens is officially unable to come up with the funds, the market will be hoping for the ideal scenario of a YES vote in next Sunday’s referendum followed by a pro-creditor government transition to move to the next negotiating stage between Greece, its creditors and the Eurozone. Until the deadline has passed, traders will have to deal with liquidity constraints, market hearsay and innuendo. Despite the situation remaining fluid, market moves will be headline driven and subject to change in direction.

Safe Haven Bets Not Easy

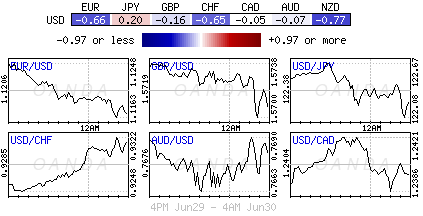

There are no sure safe-haven bets. In times of flight, investors historically gravitate toward the reliable – gold, CHF, JPY, USD, bonds — but they, too, are currently sending mixed signals.

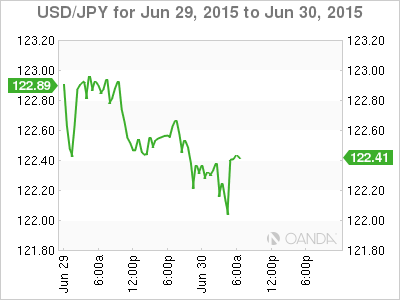

The SNB has been intervening in the forex market since it abandoned the EUR/CHF peg five-months ago (€1.200). However, this week is different, Swiss policy makers have been vocal about their actions and intentions. Their objective is to discourage speculative “long” CHF positions from accumulating. Because of the SNB’s actions, investors seem to be gravitating more toward JPY for primary surety reasons.

Despite the JPY currency about to officially end Q2 for its fourth straight quarterly loss, the currency is probing its way to a five-week high outright (¥122.10) mostly on risk aversion support. Market penetration through the psychological ¥122.00 handle would indicate the possibility of new downside risk to ¥120.46, however, before then, the traders have a lot of wood to chop. The market has been building up their ‘short’ Yen positions for sometime, mostly supported by U.S yield differentials.

With SNB actively opposed to an overvalued domestic currency, investors will remain hesitant to own any significant positions in this currency. With Japanese officials somewhat more sanguine on today’s value of their own currency, seems a far more appealing opportunity for investors in a flight situation.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.