Dollar takes advantage of thin trade conditions

U.S Yields back up to two-month highs

Commodities currencies false positive backed by PBoC

RBA does what’s expected, concerned by AUD value

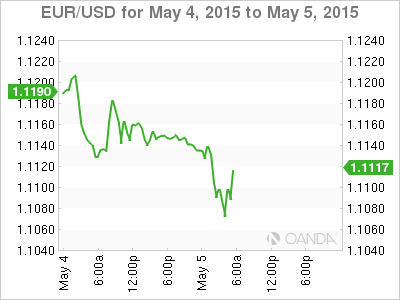

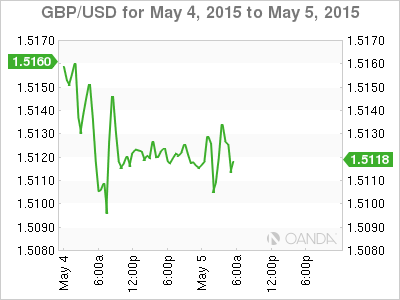

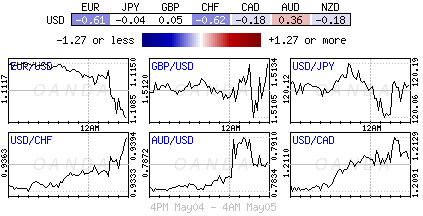

The mighty dollar took advantage of thin holiday trading conditions yesterday and rallied against the single currency. That trend continues this morning with the sell off in U.S bonds pushing the 30-year yield (+2.86%) back to highs last seen in December, a move, which seems to be solidifying a bid tone for the buck against G7 currencies.

Some investors seem content to book profit on the recent gains for the EUR ahead of the nonfarm payrolls release on Friday. In the past three-week’s the EUR has appreciated +5% outright, supported by a spate of weak U.S data (business investment, GDP and jobs) and on some early positive signs that the ECB’s QE program is providing dividends.

With the Greece situation remaining on front burner, Greek risk is again fueling and supporting fresh EUR short positions. Investors should expect Greece headlines to continue to flourish ahead of tomorrow’s +€200m payback to the IMF and next week’s +€750m payback.

Provide support for the ‘single’ currency.

Friday’s U.S jobs report will provide the EUR its biggest test for some time. A disappointing report (market expects a +213k headline gain and an unemployment rate falling to +5.4%) would boost the dollar bears Fed hike timing theory – a weak number could encourage the Fed to wade to the sidelines, a move that pushes the timing of the first rate hike further out the curve. This will renew support for the EUR and pressure the dollar across the board.

The first barrage of Fed speakers since last week’s FOMC’s meeting seems to have one message in common: the June Fed meeting remains in play for rate hikes. Last week, Cleveland’s Mester and San Francisco’s Williams suggested that even with the weak start to 2015 they are keeping an open mind about the rate outlook. Yesterday, Chicago Fed leader Evans, one of the Fed’s biggest doves, true to form indicated that with weak U.S inflation that this year would not be a good year to begin the rate normalization policy. Tomorrow, keep an eye out for Atlanta Fed Lockhart who is speaking on the U.S economy and monetary policy (13:30 EST). The market usually considers him to be a bellwether for FOMC outlook.

Yields provide the clues

Treasurys are a touch higher ahead of the Euro session handover this morning, steading after the selloff seen in the last few days (U.S 10’s +2.136%), and close to their two-month high print on Monday. This morning’s gains come despite further weakness in German bunds, which have been the driving force in fixed income markets over the past week. Investors have to decide are we experiencing a healthy correction or a new trend?

The U.S 10-year Treasury has never offered an extra +2% in yield over the German 10-year bund. The current yield gap is straddling +170 bps. Fixed income traders are beginning to price in the +200 bps rate divergence actually occurring by year-end. Investors will always demand more yield from U.S bonds when inflationary pressures mount. In Europe, deflation remains one of the ECB’s biggest concerns, and reason enough to expect eurozone sovereign bond yields to underperform its counterpart.

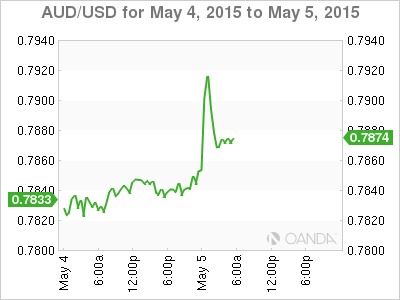

RBA does what’s expected

The RBA’s decision to cut rates to a new record low (+2%) confirms that Governor Stevens and company have grown more worried about the Aussies recent rise. An above inflation print, or a hot property market down-under, was not a barrier to Aussie policy makers. The AUD immediate reaction was to print new fresh lows, but has since rallied (A$0.7870) as investors wondered whether the easing cycle might now be over. Indeed, the statement announcing the move noted some improvement in the economy while omitting a mention that further action could prove necessary. The lack of explicit easing bias in the statement is nothing unusual – the February cut also came with a neutral outlook.

Are commodity currencies rally a “false” positive?

The bulk of commodity currencies (AUD, NZD, NOK and CAD) rise over the past eight-weeks have been fueled mostly by the markets expectation of further easing policy by China’s PBoC. Excluding the markets feeling on the RBA, the AUD (a proxy for China risk), the loonie and NOK have found support from China’s April manufacturing PMI data miss on the weekend.

The final print was the worst reading in a year (48.9 versus 49.4 expected) and is leading to more speculation of pending rate cuts from the People’s Bank of China. The market should be wary on how much future PBoC monetary easing has already been priced in. Depending on how so, the upside for China in the short-term could be capped, and so with it are the rallies in commodity prices, which will have a direct impact on commodity currencies. If commodity prices do not find consistent traction, prices will run out of stamina when investors least expect it.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.