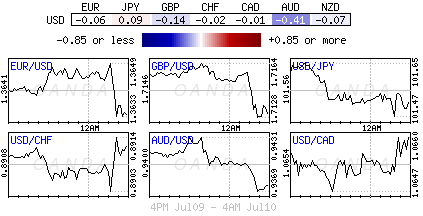

All that the forex Investor requires is some consistent intraday volatility - it provides opportunity. Overnight, Aussie trading is a prime example and certainly beats the 12-18 point EUR ranges that North America has been exposed to throughout the World Cup finals. Sessions like those have certainly poisoned market participation and enthusiasm.

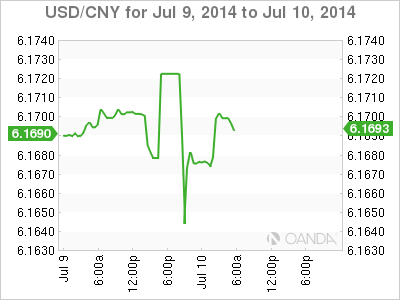

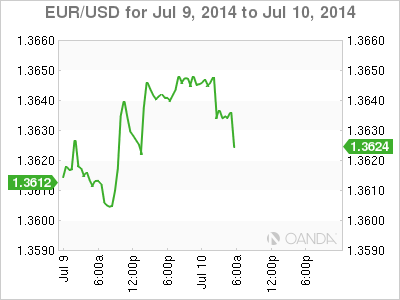

In general, the 'mighty' dollar has been trading weaker against a basket of major currencies, pressured by yesterday's FOMC minutes suggesting that the Fed is in no rush to tighten US monetary policy. The minutes shed no new light on potential Fed timing. In fact, a few investors have interpreted the Fed's minutes as being a tad more dovish, and enough to catch a few more 'hawk's' offside.

Aussie longs caught offside

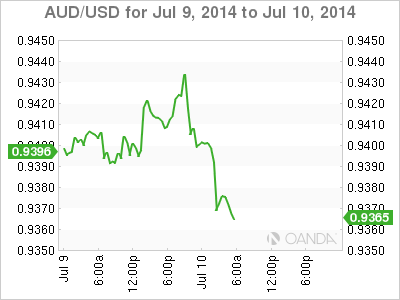

Investors will always gravitate towards currency movement and a rise in Australia's unemployment rate combined with a smaller than expected China trade surplus provided the overnight catalyst for a sell-off in the Aussie dollar.

At best, the Aussie jobs data is mixed, with an employment change of +15.9k beating consensus, but as per usual, it's the details that generally kill. The jobless rate rose to a four-month high of +6.0%, due in part to rising participation rate. However, digging deeper reveals a fall of -3.9k in the full-time component along with a rise of +19.7k in part-time work, leading to a lower increase in overall hours of worked (15.1m v 33.5m in May). On the surface, it's not a bad report, just a wrong mixture and reason enough to why a few long AUD 'carry' positions are again reassessing their commitment to that trade.

It's only natural for Australia to wonder how its largest trading partner is faring. Last night, China's June trade surplus was up +16%, y/y, but still came in shy of consensus at $31.6b. Exports were up over +7%, which was well below the +10% estimate, while trade to the US, EU, and Japan were all up in the single digits. H1 shipments of crude oil, iron ore, and copper were up +10%, +19%, and +26% respectively. Officials attributed this month's surplus to their fiscal policy measures, and also forecasted that Q3 exports growth to top Q2 levels (China Q2 GDP data will be released next week). The markets interpreted the Chinese data as not been as strong as expected - another soft Chinese report. Up till now, the RBA has been prepping the market very well, certainly in contrast to Governor Carney at the BoE, whom seems to continue to try to stamp his 'own' type of approval with the "Old Lady." The RBA had already expected Aussie unemployment to rise above the +6% and combined with the recent improvement of lead indicators of the labor market implies that there will be enough job growth to keep the Aussie unemployment rate gravitating towards that psychological +6%. A rise in employment and a steady trend in unemployment last month down-under is evidence enough that the Aussie labor market has stabilized. Despite some recent evidence of a loss of economic momentum (softer retail sales, building approvals, consumer confidence and a high AUD), there are still signs that "Australia's great rebalancing act is underway." Low interest rates (relatively) are supporting the housing market - their prices are also climbing. Although, key data maybe down, on a year-over-year basis it still comes out ahead. One thing for sure, the market should expect the RBA to continue to jawbone their AUD lower ($0.9370).

BoE 'No Change'?

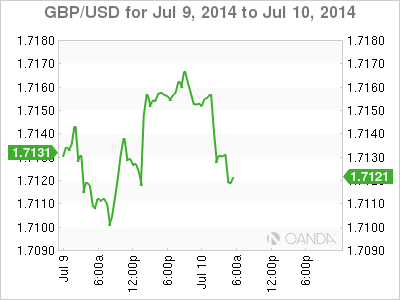

The BoE is "front and center" this morning. Many expect no change from Carney, an outcome that should leave the pound (£1.7118) largely unperturbed. Like it's major foes, sterling has been capitalizing on the USD softness and not on its own strengths. The UK's trade in goods deficit widened in May (£-9.2b vs. -£8.8b) due to 'unusually' high levels of import activity (aircraft). No matter the mixture, the rise continues to highlight that the UK's export and manufacturing still requires further support and development. This is a reasonable excuse for most Central Bankers on why interest rates are so.

Sterling has been a good earner for the 'longs' of late, and has even weathered a succession of weaker than expected UK data, but next week's data releases offer a bigger risk to those long GBP positions. Both CPI and average earnings are announced and do have a habit of tripping up the longs!

Euro industrial production not helping

In similar circumstances, the EUR has been led astray by the dollar, rallying to a one week high of €1.3651, however, the Euro bears can thank a poor run of European industrial production data to squeeze some of the life out of the 18-member unit. Italian May IP fell -1.2% on the month against +0.1% expected. While France, the union's second largest economy, fell -1.7% against a -0.2% forecasted.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD appreciates amid hawkish RBA ahead of policy decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends recovery as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.