It's business as usual until the markets tell us otherwise. Ukraine remains in the background and has so far been unable to derail any euro economic objectives, but cracks are beginning to appear and some of the economic costs of rising geopolitical uncertainty in the region seem to be developing. Already yesterday's weak German ZEW reading suggests that investors have begun to scale back some of their bullish expectations. There is no denying that Euro-zone has tight trade relations with Russia and any further sanctions will have a negative blowback effect on Europe, especially on Germany, Europe's backbone.

Draghi and company have every right to sound off more dovish, especially if they knew what was coming. The threat of deflation seems to be spreading across Europe and not just confined to members that share the EUR. This mornings consumers price headline for the 28-member European union rose at the slowest pace in just under five-years in the 12-months to March (+0.6%). For all single-currency members, prices were +0.9% higher than in February, and +0.5% higher than in the same month last-year. The core-rate, which excludes food and energy, fell to +0.7% in March from +1% in February.

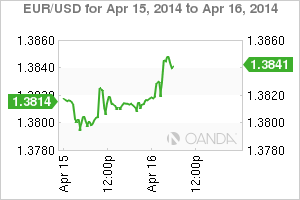

Even with more proof, the ECB continues to sound and act adamant that they do not expect to see a period of falling prices across the continent as a whole. Apparently the European situation is nothing like what occurred in Japan. The ECB believes it has and is acting more aggressively than the BoJ in days gone by. Perhaps the long-suffering EUR bear would say otherwise. Every time the single currency seems to be on the cusp of a market breakdown, support seems to reappear for the single currency. The bears would not disagree with some more dovish actions in current conditions - it would suit the majority of the markets short EUR positions.

Despite obviously being worried by the low rate of inflation, Draghi and company currently prefer to use rhetoric rather than monetary tools to combat the effects of lower prices. The market still waits for the ECB to use proactive measure rather than acting reactively. For the time being EUR shorts have to hang in and sit tight, while listening to the ECB trying to talk its own currency down from such a lofty position.

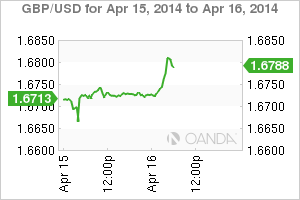

The Bank of England certainly has "egg on its face" when it comes to forecasting UK unemployment. This morning's unemployment rate for the country over the three-months to February dropped to +6.9% from +7.2%, the lowest level in five-years. The headline message was much stronger than anticipated (+7.1%) and is now lower than the initial level originally pegged by Governor Carney at the BoE (+7%), a level at which the BoE would consider tightening monetary policy. The sterling market has reacted to the headline print and not on the details. GBP initially spiked higher to a new two-month high ($1.6820) after the employment picture continued its improvement. But the pound has since moved lower now that some of the initial euphoria has worn off.

Expect investors to look to key data releases out of the US this morning for more solid guidance. Housing starts, building permits and industrial production are the key releases, while the Fed's beige book may provide some commentary on how the US economy toiled post-winter conditions.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

TON crosses $200 million in Total Value Locked as its network integration continues to scale

In a recent development, the TON network surpassed $200 million in total value locked on Monday after seeing a major boost through The Open League reward program.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.