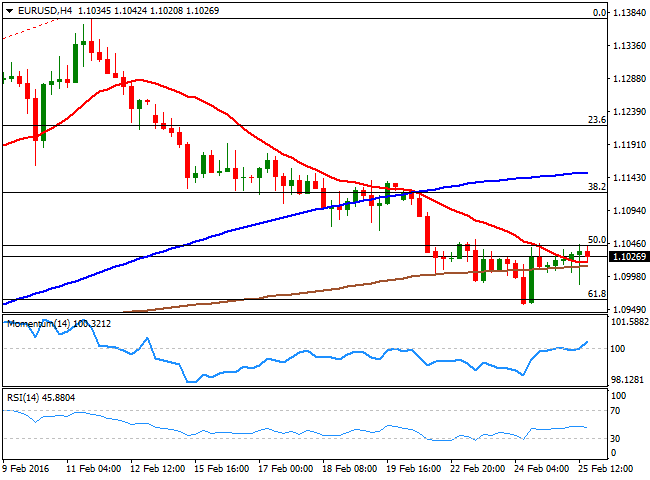

EUR/USD

The US dollar traded steady against the euro and the pound on Thursday, receiving a mild boost on the back of betterthanexpected US data. US durable goods orders rose a seasonally adjusted 4.9% in January, beating expectations of a 2.9% increase. Separated data showed claims for unemployment benefits rose by 10,000 to 272,000 in the week ending Feb 19, versus 270,000 expected. However claims have been below the 300,000 for almost a year, pointing to improvement in labor market. On Friday, US will release Q4 GDP revision, which is expected to show US economy expanded by 0.4%.The dollar benefited briefly from data dragging EUR/USD to a low of 1.0987 at the beginning of the New York session, only to give back gains afterward. Ending the day at the 1.1030 zone the shortterm technical picture has turned slightly positive, as per indicators pointing higher above their midlines. However, the pair needs to regain the 1.1045/50 zone, where the 200day SMA has been capping upside attempts over the last three days. On the other hand, a decisive break below the 1.0960/55 area, 61.8% retracement of the 1.0710/1.1376 rally and this week’s low, would put focus back on the downside, with the 1.0900 area as next bearish target.

Support levels:1.0960 1.0900 1.0880

Resistance levels: 1.1050 1.1090 1.1120

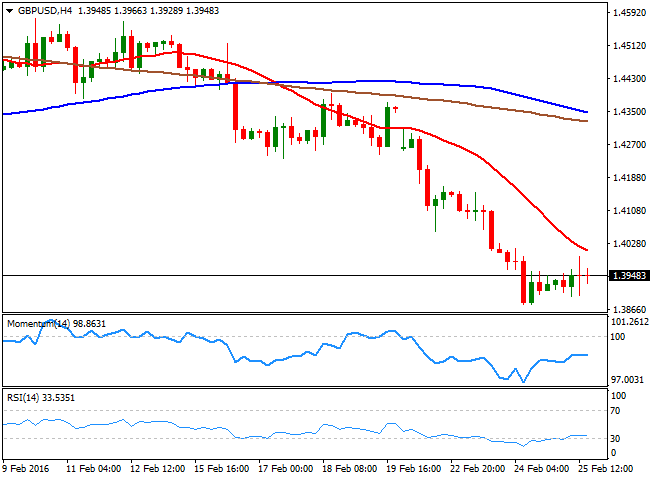

GBP/USD

The pound took a breather on Thursday following three days of sharp losses after UK scheduled an EU membership referendum for June 23rd. GBP/USD managed to move away a 7year low of 1.3877 scored the previous day, as fears of a downward revision in the initial estimate of UK Q4 GDP did not materialize and stood at 0.5%. However, GBP/USD recovery lacked momentum and remained capped by the 1.4000 level. In the 1 hour chart, indicators head higher above their midlines reflecting today’s bounce while the pair trades slightly above the 20SMA, suggesting room for further recovery. However, in the 4 hours charts indicators remain in negative territory and with the RSI having already corrected oversold conditions, limiting the upside potential. If GBP/USD breaks above 1.4000 it could extend the recovery to the 1.4080 zone, but the move will remain merely corrective as both technical and fundamental factors continue to favor the downside.

Support levels: 1.3877 1.3800 1.3700

Resistance levels: 1.4000 1.4080 1.4155

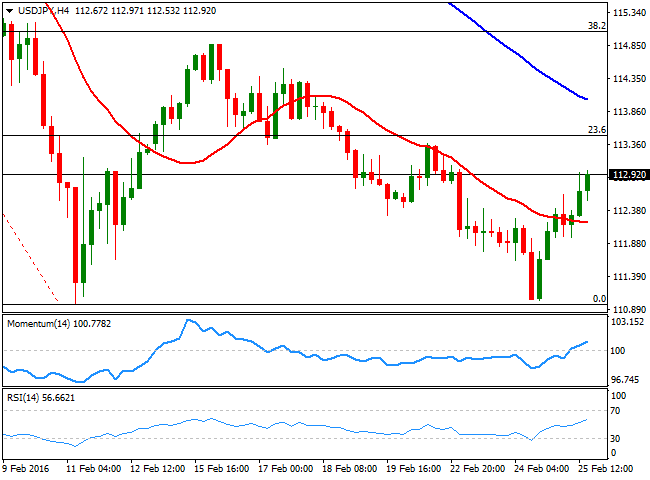

USD/JPY

USD/JPY continued to recover from 2week lows on Thursday as the dollar benefited from upbeat durable goods orders report, while broad JPYweakness fueled the upside. The pair climbed to a high of 113.01 during the American session helped by the positive tone in stocks but failed to consolidate above the psychological level. From a technical perspective, indicators in 1 hour chart are heading higher above their midlines while spot hovers above a bullish 20SMA, all of which suggests the pair might extend the bounce. Indicators in the 4 hours chart also favor a steeper recovery, with 113.50, 23.6% retracement of the 121.68/110.97 fall, as key level. A break above 113.50 will be a positive sign, confirming the double bottom at the 110.97/111.00 area.

Support levels: 111.90 110.97 110.10

Resistance levels: 113.05 113.50 114.15

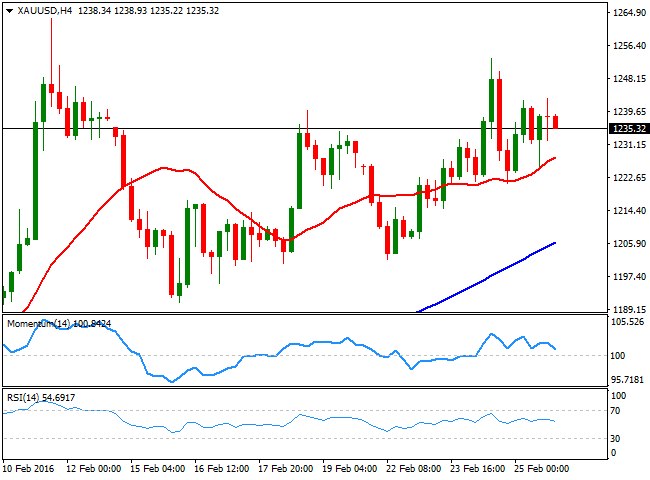

GOLD

Gold prices strengthened 1% on Thursday to $1,238 a troy ounce as the slide in Chinese stocks, oil price volatility and Brexit related fears kept the safe haven demand for the metal intact despite the rise in European and US equities. However, the gains remained restricted at $1,243 levels after US Commerce Department data showed a sharp rise in the US durable goods orders in January. Metal remains at the mercy of oil price moves ahead of the preliminary US GDP release ahead of the weekend. From a technical view, the rising 20SMAs in the daily and 4 hours charts keep the bullish tone intact. However, daily RSI turning lower and repeated exhaustion on the part of bulls at/above $1,240 levels indicate gold could be sold on rallies. Overall, the metal appears due for technical correction, which may gain pace if prices dip below 20SMA support in the 4 hours chart.

Support levels: 1,228 1,217 1,212

Resistance levels: 1,240 1,253 1,263

WTI CRUDE

WTI oil prices strengthened 2.8% to $33.05 a barrel on Thursday on hopes the OPEC and nonOPEC members might be closer to a deal on output cut. Oil prices were down almost 1.5% in Europe as investors shifted their focus to OPEC’s reluctance to cut production. However, prices recovered losses and turned positive after Russian oil minister said OPEC and nonOPEC oil ministers are planning to meet in March and Russia is ready to attend. Oil futures may extend gains heading into the weekend if the Baker Hughes data in US shows a further decline in oil rigs. From technical perspective, a rebound from 20SMA in the daily chart indicates scope for further upside. The RSI and the Momentum indicator in the 4 hours chart are bullish as well. Overall, crude futures may continue to rise unless a failure to sustain above $34 levels triggers a break below 20SMA support in the 4 hours chart.

Support levels: 32.10 31.33 30.92

Resistance levels: 33.47 34.19 35.50

DAX

The German DAX index closed 163.68 points or 1.79% higher on Thursday at 9,331.48. Bank and commodity shares across Europe paused recent declines, helping the regional benchmark to post its first rise in three sessions. Shares in Fresenius Medical Care AG advanced 4.71% after declining 4.60% in the past 5 trading sessions. Deutsche Bank and Commerzbank rose more than 2% each. Among index stocks, only Henkel Vzo ended with marginal losses. A weakerthanexpected Eurozone CPI released today underscored the necessity and importance of ECB’s easing efforts, which further supported stock prices. From technical viewpoint, there is less scope for upside in prices as the 20SMA in the daily is declining, while the index stays below confluence of 200SMA and 100SMA in the 4 hour chart. The daily RSI also remains below 50.00. Overall, the index could be offered on upticks and the selling pressure may become intense if prices fall back below daily 20SMA.

Support levels: 9,308 9,256 9,122

Resistance levels: 9,396 9,586 9,787

DOW JONES

Wall Street ended on a high note on Thursday, with 30share Dow index closing 212.44 or 1.29% higher at 16,697.36. The SandP 500 index advanced 1.13% to 1,951.70 and the tech heavy Nasdaq strengthened 0.87% to 4,582.21. Stocks opened higher, but quickly fell into losses after news of big energy firms defaulting on their loan payments hit the wires. However, oil prices rally calmed market nerves and helped the battered indices to score gains. On data front, a sharp rise in the durable goods orders in January triggered speculation that the manufacturing sector may have bottomed out. Shares in Du Pont and Nike rallied at least 2% each. Losing side included Walt Disney, which dipped 0.32%. Equities could be influenced by the US preliminary Q4 GDP reading on Friday. From technical viewpoint, a rebound from 20SMA support in the daily chart followed by a bullish daily close above 16,665 indicates the gains could be extended further. The daily and the 4hour RSI are in the positive territory and rising, which further adds credence to the bullish view. Overall, the doors are open for further advances.

Support levels: 16,570 16,482 16,277

Resistance levels: 16,753 16,900 17,031

FTSE 100

The UK’s FTSE index ended 145.63 points or 2.48% higher on Thursday at 6,012.81. Investors ignored the sharp drop in the Chinese equities as well as wobbly oil prices and Brexit fears on hopes the OPEC and nonOPEC members may reach some kind of agreement to cut output at a possible meeting in March. China also signaled increase in oil imports, which helped risk sentiment. Lloyds Bank shares advanced 13% and pulled other banks stocks higher. Mining stocks except Rio Tinto strengthened as well. On data front, the ONS left the Q4 GDP unrevised at 0.5% QoQ and thus received no attention from the trading community. From technical perspective, a rebound from the 20SMA in the daily chart coupled with a bullish RSI indicates the positive tone may persist. However, the falling trendline resistance could play a spoil sport. Overall, the index could be bought on dips unless prices fall below 20SMA.

Support levels: 6,000 5,950 5,886

Resistance levels: 6,057 6,134 6,222

The information set forth herein was obtained from sources which we believe to be reliable, but its accuracy cannot be guaranteed. It is not intended to be an offer, or the solicitation of any offer, to buy or sell the products or instruments referred herein. Any person placing reliance on this commentary to undertake trading does so entirely at their own risk.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.