Despite the recent deterioration in the Eurozone economic situation as well as the developments in Cyprus and the political turmoil in Italy, it is generally expected that the ECB will hold rates at its April monetary policy meeting. "ECB Chairman Mario Draghi failed to give any hints of further easing at the last meeting, and I believe this to be telling," states Nicky Ong, who suggests that the central bank will carry out a rate cut soon but not yet in April. Alistair Cotton predicts that "the ECB will look to extend more liquidity to the banking system as a whole rather than cutting rates at this stage," which in his opinion would just be a "symbolic" move.

Only Luciano Jannelli sees a 25bp rate reduction in April, justified by the recent slowdown in Eurozone growth and the softness of inflation. He admits that such a move would "do little to increase credit activity in Europe’s troubled periphery" but on the other hand, it would "put further downward pressure on the euro versus the US dollar and thus provide some terribly needed breathing space to the export industries of the Eurozone."

Meanwhile, the BoE's monetary policy meeting is once again expected to be a non-event by the majority of economists polled, who believe that no changes should be introduced before Mark Craney takes over as the central bank's governor in July. Some analysts however contemplate the possibility of an expansion of the asset purchase program in the nearest future, for example after the preliminary Q1 GDP data is released at the end of April, as Ilian Yotov suggests. The expert predicts that the pound "could come under pressure again if the market sees a Q1 contraction in the UK and begins to price expectations that the Bank of England might have no other choice but to ease monetary policy further."

The BoE and the ECB will announce their monetary policy decisions on April 4 at 11:00 GMT and 11:45 GMT, respectively. Below you will find the complete forecasts of the contributing analysts.

Alistair Cotton - Senior Analyst at Currencies Direct:

ECB:

"At his most recent press conference, Mario Draghi suggested that rate cuts were discussed by the governing council at the last meeting, so we can be very certain that they will be discussed again given the outlook is unchanged in any meaningful way.

More importantly, Draghi suggested financial market confidence has returned which will certainly be affected by the Cypriot bailout, specifically the way in which large depositors had to foot the bill and how EU officials now suggest this will be the template for future bank bailouts. That sentence alone has spooked depositors in other Eurozone countries and will negatively impact confidence in the banking system. It’s likely that the ECB will look to extend more liquidity to the banking system as a whole rather than cutting rates at this stage, given that it is more important to keep credit flowing into the real economy than using a symbolic cut in interest rates to improve sentiment."

BoE:

"It seems unlikely that we’ll see meaningful changes in the way the Bank of England sets policy until the new governor Mark Carney takes the reigns in July. That said, further QE is probably on the cards over the next few months, particularly if the recent cold snap depresses economic activity further than would have normally been the case. The last two meetings ended with a 6-3 split of the MPC, with Mervyn King on the losing side on both occasions. There is clearly a strong desire amongst some members of the MPC to try and keep economic momentum going. Whether we see action this month or next, more QE is likely on its way next quarter."

Nicky Ong - Co-Founder of Traders Corner:

ECB:

"A clear deterioration in the Eurozone economy can be seen in a poor employment number and declines in European manufacturing and services data. The emergence of the Cypriot banking crisis and on-going political turmoil in Italy is also weighing on sentiment.

However, ECB Chairman Mario Draghi failed to give any hints of further easing at the last meeting, and I believe this to be telling. We will see the ECB cut ease monetary policy again, but not this time around. I expect the central bank to hold rates at 0.75%."

BoE:

"A combination of soft manufacturing and construction data, along with the recent downgrade of the U.K’s credit rating makes a valid argument for the Bank of England to increase their Asset Purchase Facility. At the same time the number of MPC members voting to extend QE at the previous meeting grew to 3, and this included BOE Governor Mervyn King. All things considered I expect the Bank of England to ignore stubborn inflation and opt to add a further £25bn of stimulus. Should they fail to deliver this time around, it will not be long before the central bank pulls the trigger once again."

Luciano Jannelli, Ph.D. - Chief Economist at MIG Bank:

ECB:

"Latest PMI indicators suggest a slowing of growth also in Germany and other core countries. At the same time, we have seen that inflation, generally benign across all advanced economies, is now particularly soft in Europe, with downward pressure not only on goods and services, but also on labour costs. This provides the ECB with an excellent justification for lowering in April its reference rate. It is true that such rate reduction will do little to increase credit activity in Europe’s troubled periphery. It will, however, put further downward pressure on the euro versus the US dollar and thus provide some terribly needed breathing space to the export industries of the Euro-zone. Given the ECB’s traditional prudence, and reluctance to immediately shoot all its arrows, I would expect for now only a 25 basis points cut. One should, however, not underestimate the symbolic value of such measure, and its capacity to trigger a correction of the euro exchange rate. Of course, more LTRO (Long Term Refinancing Operations) might also be on the table. Yet, LTRO would affect different banks in a different manner. Also, at this stage it is equally unlikely to positively impact either private credit or intra-euro spreads. Therefore, I suspect that a reduction of the basic reference rate is more likely."

BoE:

"If it is not yet entirely clear whether the BoE will already in April increase the size of its asset purchase program (up from the current £375 bln), it is at any rate unlikely to do so in a significant manner. In spite of all the talk, the UK monetary base has, since 2008, already expanded more than any other G-4 currency (USD, JPY, EUR). I expect some more action, in particular, regarding more aggressive forward-looking guidance to influence rate expectations, as well as clarity concerning the on-going duration of stimulus, once Mr Carney takes offices. Given the dire state of the British economy, I expect indications for asset purchases to last longer. Further weakening of the pound sterling versus the greenback will occur as markets realise that, while the BoE will do more for longer, the Fed will start exiting QE3."

Ilian Yotov - FX Strategist and Founder at AllThingsForex:

ECB:

"The current economic reality in the euro-zone continues to spell recession with chronic contraction in the area's manufacturing and services sectors. As if this is not bad enough, the Cyprus debacle has created more uncertainty and a sense of distrust, while the euro-area's third-largest economy Italy still remains without a government. As a result, the European Central Bank is faced with major challenges to find a way to help the economy grow and to calm the nerves of investors. The euro would be likely to head lower into the $1.20's if the European Central Bank reduces the benchmark rate or hints of an impending rate cut in the near future."

BoE:

"Although in the last couple of months the Bank of England policy makers have shown that they are not in a hurry to do more QE, with the U.K. economy contracting in the final quarter of last year and possibly in Q1 2013, a triple-dip recession will increase the odds that the Bank of England would have to consider another expansion of its Asset Purchase Program, and possibly even a rate cut in upcoming months. The Monetary Policy Committee would probably prefer to sit on the sidelines and maintain the existing monetary policy at the April meeting until they see the first Q1 2013 GDP estimate, scheduled for release on April 25. The pound has found some bids as a euro alternative during the Cyprus debacle, but could come under pressure again if the market sees a Q1 contraction in the UK and begins to price expectations that the Bank of England might have no other choice but to ease monetary policy further."

Steve Ruffley - Chief Market Strategist at InterTrader.com:

ECB:

ECB:"Bad news from Germany’s growth forecast and recent worries from Cyprus all point to less than ‘united’ European Union. The fact that Cyprus needed a bailout was not the issue, it was the way that a seemingly insignificant member of the EU could get so much world attention and test the Euro’s already flagging credibility even further. The ECB will just have to follow suit with the FED. There seems no obvious end to the situation in Europe and there is certainly more bad news to come before the data proves otherwise. Right now the ECB will just have to stand behind the decisions they have made and promise to help stimulate the economy where it can and to make sure the ‘too big to fail’ and the ‘Euro is as strong as the weakest nation’ are funded in order to keep the Euro trading a reasonable levels within the market. I fear greatly for the Euro and think it is only a matter of time before it is is no longer viable a one single currency."

BoE:

"There has been too much time and money invested by the BOE to mean the there will be any significant or instant changes to the BOE’s remit. Trying to alter the course of the BOE is like trying to stop a cruise liner at full speed on a penny. George Osborne has made his stance clear and the austerity budget was a strong message to the UK that there is still plenty of pain to endure before things get better. The role of the people is to ‘get on with it’. The role of the BOE as always, is to stimulate the economy and provide an environment in which business can flurry and create jobs and wealth. This again has been promised for years and not done! We are still recapitalising the banks, which in turn are now paying back the treasury, rather than lending to small and medium business. The fact of the matter is simple. Like the FED and the ECB the BOE will have to realise one you start with QE you can’t just stop, this is heroin for the markets."

Adam Narczewski - Financial Analyst at X-Trade Brokers, XTB:

ECB:

ECB:"The ECB is an interesting case. We have Cyprus from one side, and poor economic indicators on the other. Is that enough for the ECB to cut interest rates? I do not think so. Sure, there is a slight chance for that but I do not expect Mario Draghi will decide on that now. If the ECB cuts the main reference rate, it would need to decrease the depositary rate to negative since now it is at 0%. I rather expect the ECB announcing any alternative methods to stimulate the economy. Which ones? That is really hard to say. A bond buyback program is rather out of question. The ECB used to do that with the southern countries’ bonds, but it would sterilize them (issue bills for the nominal amount of bonds bought back so the amount of currency in circulation has not changed). Another LTRO round? Also, hard to expect that one as currently banks are paying back the funds they got through LTRO. So we see it is hard to forecast what the ECB can do on its next monetary policy meeting. For sure, Draghi’s press conference will be interesting."

BoE:

"I believe the Bank of England’s expected movements are the easiest to analyze nowadays. The last MPC minutes showed only 3 members (out of 9) voted for an expansion of the current asset repurchase program. In this case I expect the BoE will stay on hold and we shouldn’t not expect any action from them until July, when Mark Carney takes over the Governor’s position. In my opinion the recent changes to the central bank’s remit, introduced by finance minister George Osborne, will not affect the BoE decision. Summarizing, I am waiting for the summer when new measures could be introduced."

Yohay Elam - Analyst at Forex Crunch:

ECB:

ECB:"The ECB will likely keep interest rates unchanged once again, even though some members wanted a rate cut back in March. The economic situation is getting worse in the euro-zone, and the crisis in Cyprus looms over the banks. These issues could change the tone, but not the rate. Mario Draghi will probably express less confidence than in March, when he boosted the euro. New measures to stabilize the banks are more likely than a rate cut at this point. Real interest rates are still low. An unexpected rate cut would send the euro tumbling down."

BoE:

"The BOE is expected to keep its powder dry once again, despite a weak economy and the new remit from Osborne. While the BOE has more room to allow for higher inflation, it is already above target and the low value of the pound threatens to push inflation even higher. Contrary to some other economies, a weaker currency does little to help the UK. More QE would contribute to a weaker currency and would also do little to push borrowing costs down: the current round of the debt crisis already pushes gilts lower."

Bill Hubard - Chief Economist at Markets.com:

ECB:

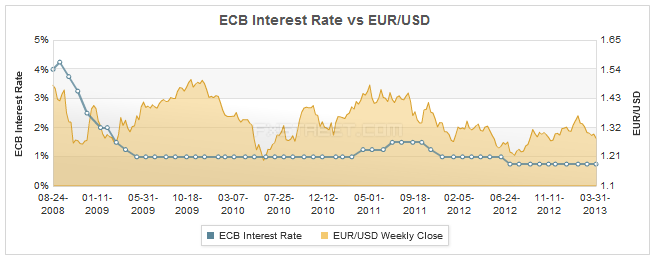

ECB:"Draghi noted that the ECB’s policy stance will remain accommodative 'for as long as needed.' Although we should be careful in comparing this to the Fed’s 'low rates' pledge, it does suggest that the ECB will be extremely careful to avoid past mistakes of hiking rates too soon. Since we have seen EUR/USD fall from $1.3711 on 1 February to $1.2838 on 25 March, implying a 40 bps drop from the current refi rate for the OIS/option-adjusted swaps spread for December 2013, we have dropped our call for a cut, but we expect rates to stay 'on hold' well into 2014."

BoE:

"While they have promised to 'look through' a protracted period of above target inflation, the 7.0% decline in sterling on a trade weighted basis puts upside risk on the inflation profile. With wages flat lining this risks squeezing households even more, implying on going weakness in domestic demand. Therefore, they may have taken the view that they didn’t needs to add to sterling’s woes by printing more money this month. In any case, UK bond yields have fallen back despite the rating downgrade while equity markets remain buoyant. We still look for more stimulus given the weak demand story in the UK, but it is more likely to come in May when the BoE release their new growth and inflation forecasts."

Clemente De Lucia - Economist at BNP Paribas:

ECB:

ECB:"Given the slackness in the economy, ongoing disinflation and excessively tight monetary conditions in peripheral countries, renewed wave of uncertainty, mainly related to Italian and Cyprus developments, the ECB might decide to cut the refi rate further going forwards. Will the ECB deliver a cut as soon as next week? Answer this question is more complicated. Before acting, the ECB might decide to wait and see how the economy evolves after the recent bail-out for Cyprus."

Alberto Muñoz, Ph.D. - Forex Analyst at FXstreet.com:

ECB:

ECB:"Despite the fact that the European Central Bank downgraded its forecast for the Eurozone economy in March I would not expect a rate cut in April. The Cyprus crisis has finally been resolved and the risk premium for peripheral countries remains stable so probably Draghi will consider there are not enough arguments for a rate cut, therefore keeping an acommodative monetary policy. In fact the ECB head said in his last press conference that the forecast downgrade didn't reflect 'a significant change in the bank's view that a gradual recovery should begin in the second half of 2013' suggesting there won't be changes in the ECB policy."

BoE:

"I would not expect any change in BoE monetary policy this month as Osborne asked the central bank to report back to him in August about the benefits of setting 'intermediate thresholds' for monetary policy. Anyway we should expect that the changes would imply the Bank of England operating in a way similar to the US Federal Reserve.

Considering that the Federal Reserve said last year it would keep interest rates near zero unless there was an improvement in labor market or inflation breached specific levels, and that Mark Carney did something similar in Canada when he was the BoC governor, we should expect a very dovish policy and even special measures such an Operation Twist."

Valeria Bednarik - Chief Analyst with FXstreet.com:

ECB:

ECB:"Market has been speculating on a possible rate cut since the year started, but Mario Draghi has denied the possibility with quite optimistic speeches so far. But Cyprus bail-in is a big game changer, and with ongoing issues also in Italy, ECB's president has little to offer to restore confidence in the common currency. A rate cut although possible, is hardly significant with rates at historical lows, although may produce the effect of calm distressed markets. The possibility of implementing new tools is low, as OTM is still in place, and in fact, has not been used yet. Acknowledge the area damage with dignity is the most the ECB can do this month."

BoE:

"Again, nothing is expected from the BOE. The Central Bank has kept his monetary policy unchanged over the past few months, and the chance of a larger asset purchase program has diminished last month, keeping speculation at it's lowest. Indeed, a movement will be a strong surprise for the markets, and if further easing is announced, Pound may regain latest strength."

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.