Fed’s MBS buying high on agenda as officials begin taper talk

Global developments

The risk sentiment had recovered in the middle of last week as strong US corporate earnings overshadowed surging cases across the globe and US-China tensions. However, we are again seeing a bit of risk-off in the early Asia session today. US treasuries have gained, Equities are trading weak, crude prices are lower, Dollar is stronger but is underperforming low yielding carry currencies. We could see some sideways price action till the Fed meeting on Wednesday. We do not expect any major changes in the Fed policy.

Domestic developments

The tax collections in Q1 at Rs 5.6 lakh crs have been healthy which raises optimism of the government exceeding its budgeted tax collection of Rs 22.2 lakh crs for FY22. Exports in the first 3 weeks of July have been solid, putting us on the course of recording the 8th straight month of export growth.

Equities

Last week the Nifty recovered from lows to end the almost flat week on week. The Nifty continues to trade a 15450-15950 range. We expect the range to hold this week as well.

Bonds

There was a bit of sell-off in bonds after the 10y benchmark got devolved in Friday's auction. The Yield on the 10y benchmark had ended at 6.16%. Rates had rallied with 3y and 5y OIS ending at 4.66% and 5.20% respectively. We expect the bonds to trade with a positive bias today given lower US treasury yields and lower crude prices.

USD/INR

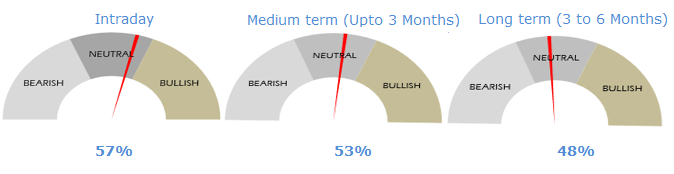

With IPO flows out, cash Tom has normalized. This has caused the near-term forwards to correct as well. Cash-Tom is trading at 3.50% while 1y forward yield has been hovering around 4.50%. 74.35-74.40 has held quite well.

Strategy: Exporters are advised to cover a part of their near-term exposure on upticks toward 75.30. Importers are advised to cover through options. The 3M range for USDINR is 73.20 – 75.50 and the 6M range is 73.50 – 76.50.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.