Fed Preview: Warming up to controlling the yield curve, nudging lawmakers, keeping markets happy

- The Federal Reserve is set to leave its policy unchanged but may show openness to controlling the yield curve.

- Fed Chair Powell may gently call on lawmakers to act as negotiations come to the wire.

- While stock markets may seem rich, the Fed is unlikely to express concern.

"Not even thinking about thinking about raising rates" – these words by Jerome Powell, Chairman of the Federal Reserve, have been echoing in investors' minds. The bank's unequivocal commitment to low borrowing costs means no change in Jul's meeting. However, is the Fed thinking of new programs?

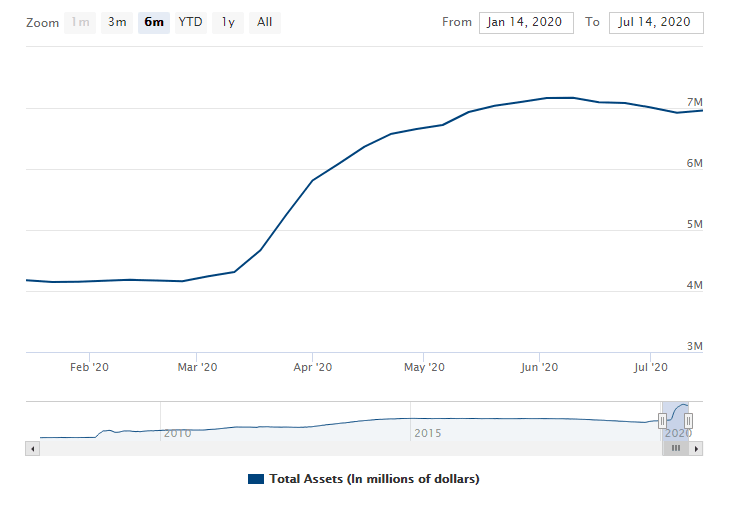

Back in June, the world's most powerful central bank took stock of its frenetic action to mitigate the fallout from the coronavirus crisis. The Fed expanded its balance sheet by nearly $3 trillion within three months, unleashed unlimited Quantitative Easing, and ventured into formerly unchartered territory. That includes buying municipal bonds and "fallen angels" – bonds recently downgraded to junk.

Balance sheet worth around $7 trillion:

Source: Federal Reserve

Its dot-plot signaled no chance of raising interest rates at least until 2022 and Powell's words quoted at the outset are the gist of the clear accommodative message.

What else can the Fed do?

Powell and his colleagues removed the option of negative rates – described as President Donald Trump as "the gift" – but remain open to additional policy tools. While its Main Street lending scheme has yet to be fully implemented, reporters may ask Powell about Yield Curve Control (YCC).

The idea is that the central bank keeps long-term borrowing costs depressed to a specific level or range. The Bank of Japan allows 10-year Japanese bonds to trade at a limited band around 0%, thus lowering long-term borrowing costs.

Powell is likely to leave an open door to such a program but may show more openness. Benchmark ten-year Treasury yields are already at historically low levels, under 0.60% at the time of writing. Dim prospects for the economy, massive QE – and perhaps expectations for YCC – are already pushing returns lower.

Just by showing less reluctance to examine the idea, Powell would send investors rushing to bonds. Diminishing returns on American debt may, in turn, send the dollar further down and stocks higher.

Fiscal stimulus in the works

Powell may opt for a poker face or to reiterate that YCC is a distant option currently not under active examination. He may refrain from any hint about new moves apart from the general commitment to do more if needed and raise rates only when inflation rises above 2% in a sustainable manner.

The Fed decision is due out on July 29, two days before a set of emergency federal assistance – most notably a $600/week top-up for the unemployed ← expires. Republicans and Democrats are negotiating the next steps and Powell may prefer not to get in the way.

In the past, Fed officials, including the Chair, encouraged elected officials to act. Powell may reiterate that message, albeit perhaps more subtly, as the elections are coming closer and any comment could be seen as crossing the line.

He will have to walk a fine line between nudging fiscal spending and not sounding desperate – triggering fear that the Fed has run out of tools, thus spooking investors.

In the unlikely case that politicians cut a deal before the Fed decision, Powell will likely raise their moves,

Froth in stock markets?

The S&P 500 Index already turned positive for the year – recovering its COVID-19 losses. All-time highs are within sight. The surge comes despite signs of coronavirus' resurgence in most US states, rising jobless claims, and political uncertainty. More recently, intensifying tensions with China – the world's second-largest economy – pose another threat.

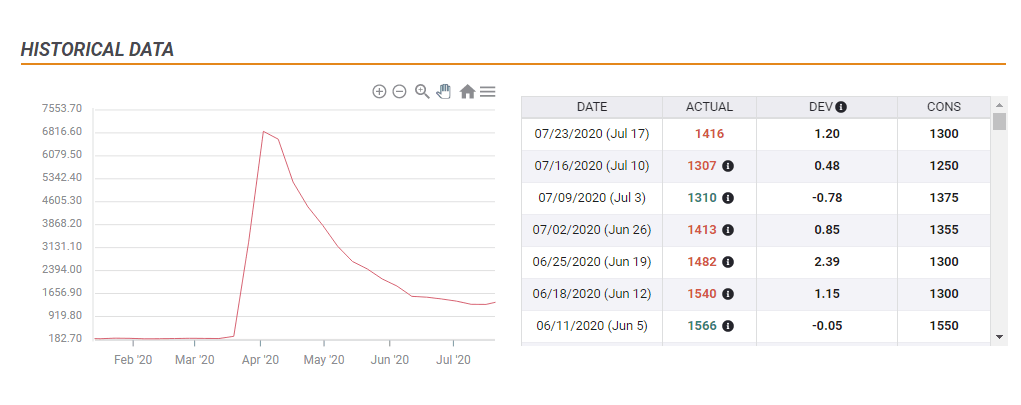

The labor market, one of the Fed's dual mandates, has stopped recovering:

Is there a new stock market bubble? Reporters may ask that question and Powell will likely fill up the punch bowl – just by avoiding any alarmist remarks. The Fed is closely watching equities and aims for favorable "financial conditions" – a codename for happy markets.

Shares may plunge and the safe-haven dollar would surge if Powell pulls away from the punch bowl by saying there is "froth" in some parts of the market. That would be a hint that technology stocks are worrying about the central bank. In the extremely unlikely cases that such words make it to the Fed's statement, markets would panic.

Conclusion

The Federal Reserve is set to leave its policy unchanged once again, leaving the stage for politicians to provide their share of the stimulus. Warming up to Yield Curve Control would boost markets while expressing worries about valuations – a low probability scenario – would send them down.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.