The euro has edged higher in the Monday session. Currently, EUR/USD is trading at 1.2298, down 0.07% on the day. On the release front, it’s a very light calendar, with no major releases in the eurozone or the US. On Tuesday, the US releases CPI, which is expected to drop to 0.2%.

US employment numbers were a mix on Friday. Wage growth dropped to 0.1% in February, down from 0.3% a month earlier. This missed the estimate of 0.2%, and marked the lowest gain in four months. The news was much better from nonfarm payrolls, which soared to 313 thousand, crushing the estimate of 205 thousand. The strong reading has eased concerns about the Fed raising rates four times in 2018.

Is the German industrial sector in trouble? Last week’s numbers were surprisingly soft. Factory Orders in January plunged 3.9%, worse than the estimate of -1.9%. This marked the second decline in the past three months. This was followed Industrial Production, marking a second straight decline. Still, the German economy has performed well, and has led the impressive recovery in the eurozone.

The EU is seeing red after US President Trump made good on his threat, and signed an order imposing 25% tariffs on steel imports. EU policymakers have threatened to retaliate with tariffs on US goods, and European Commission President Jean-Claude Juncker was particularly blunt, saying “we can also do stupid”. Fears of an all-out global trade war are weighing on the US dollar and the stock markets, and the resignation of Gary Cohn, a senior economist in the White House who opposed the tariffs, will only dampen investor risk appetite. The ball is now in the EU court, and if the Europeans retaliate and Trump responds with further tariffs, we could see some sharp movement from EUR/USD.

Goldilocks is back at the table

EUR/USD Fundamentals

-

All Day – Eurogroup Meetings

-

13:01 US 10-year Bond Auction

-

14:00 US Federal Budget Balance. Estimate -222.3B

-

8:30 US CPI. Estimate 0.2%

-

8:30 US Core CPI. Estimate 0.2%

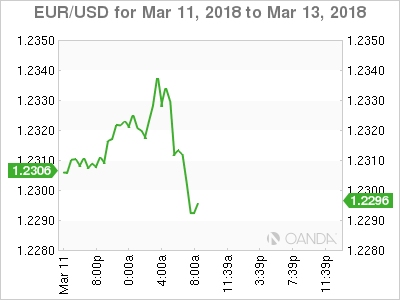

Open: 1.2306 High: 1.2341 Low: 1.2295 Close: 1.2298

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2092 | 1.2200 | 1.2286 | 1.2357 | 1.2460 | 1.2581 |

EUR/USD inched higher in the Asian session. In European trade, the pair edged higher but has retracted

-

1.2286 is a weak support level

-

1.2357 is the next resistance line

Further levels in both directions:

-

Below: 1.2286, 1.2200 and 1.2092

-

Above: 1.2357, 1.2460, 1.2581 and 1.2599

-

Current range: 1.2286 to 1.2357

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.