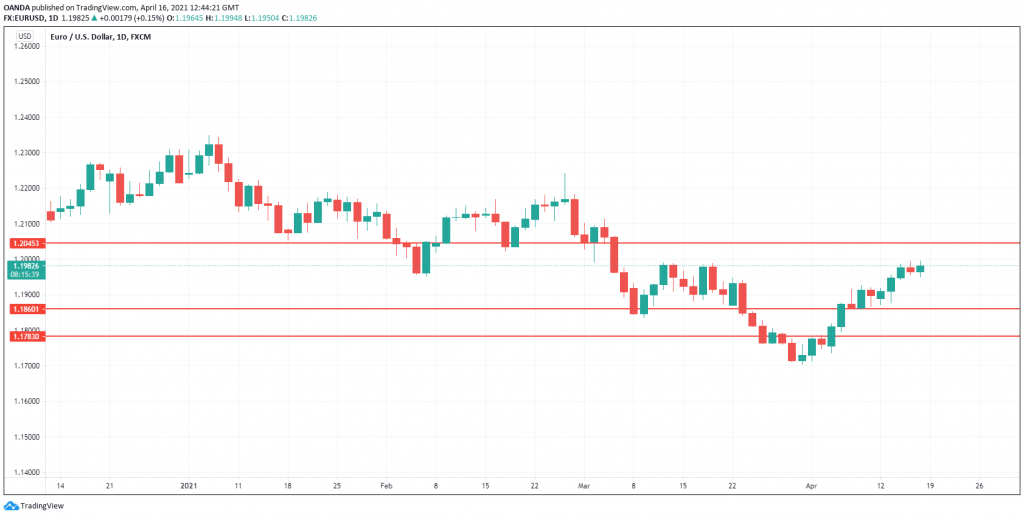

Euro hovering just shy of 1.20

EUR/USD continues to show limited movement, as it remains just below the symbolic 1.20 level. Currently, the pair is trading at 1.1981, up 0.14% on the day. The euro continues to put pressure on this line, which has held since March 4th.

Inflation in the eurozone remains below the ECB target of around 2%, but pent-up demand after months of lockdowns across western Europe means that inflation is moving higher. Eurozone CPI (YoY) rose 1.3% in March, up from 0.9% a month earlier.

Eurozone growth will be positive in Q1, and the ECB is projecting that GDP gained 1.7% from January-March. Still, a sluggish vaccine rollout in the EU has stunted growth and could weigh on the euro as well. The EU bet on the AstraZeneca vaccine to supply to its residents, and this move has backfired badly, with nagging concerns that the vaccine may be linked to blood clots. On Wednesday, Denmark became the first EU member to ban AstraZeneca vaccines; Germany, France and other EU countries have imposed restrictions on the use of these shots.

In the US, retail sales soared in March, as consumers opened their wallets. Headline retail sales sparkled at 9.8%, while Core Retail Sales rose 8.4%. Both releases easily beat their estimates of 5.8% and 5.1%, respectively. The surge in consumer spending was a result of the latest batch of government stimulus, with US households receiving stimulus cheques of 1400 dollars, as well as many states relaxing health restrictions. US consumers have responded with a spending spree, including the purchase of big-ticket items, such as automobiles.

Somewhat surprisingly, the explosive retail sales release failed to push the US dollar higher, as the currency markets appeared more focused on other matters, such as the vaccine rollout in Germany and France.

EUR/USD technical

-

EUR faces a critical cap at 1.1990, which is protecting the symbolic 1.20 level. Above, there is resistance at 1.2044.

-

On the downside, there is support at 1.1860 and 1.1784.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.