Euro and pound forecasts

EUR/USD

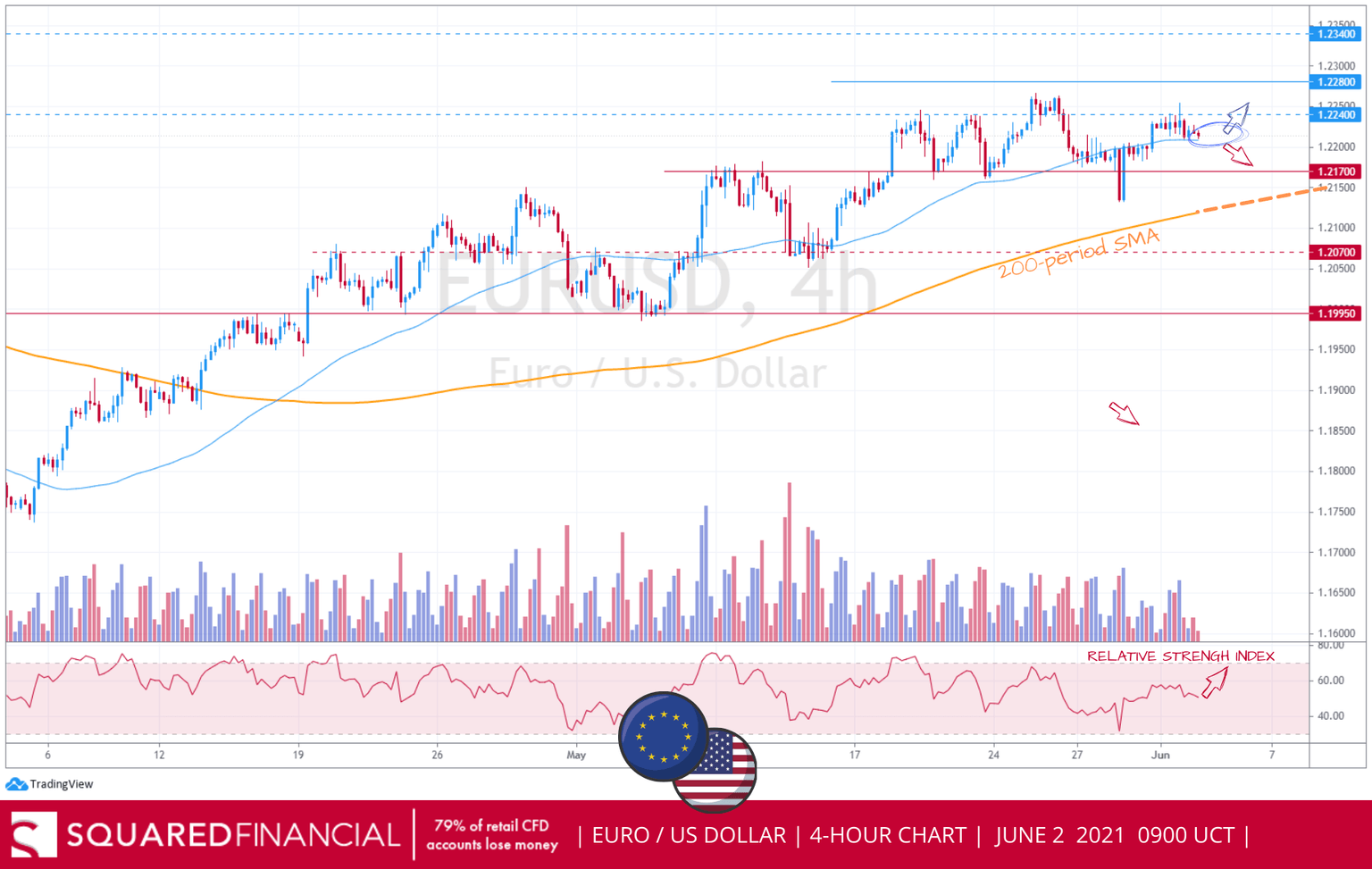

German retail sales figures for April released earlier this morning showed a drop of -5.5% while economists had forecast a drop of only -2%. However, the Euro is not yet experiencing any selling pressure despite the more-than-expected drop, as traders might be waiting for ECB President Lagarde, scheduled to speak late in the day. The EURUSD is still range-bound between the 4h 200-MA support around 1.2170 and the key strong resistance area at 1.2240/1.2280.

Support: 1.2170 / 1.2070.

Resistance: 1.2240 / 1.2280.

GBP/USD

Failing to crack above the key resistance level at 1.4240, the British Pound charted a key reversal dropping below the 50-period moving average and below the 1.4170 support level, with technical indicators favoring more downside with 1.4110 as nearest support target amid a lack of major economic data out of the UK today.

Support: 1.4110 / 1.40.

Resistance: 1.4170 / 1.4210.

Author

Rony Nehme

SquaredFinancial

Rony has over twenty years of experience in financial planning and professional proprietary trading in the equity and currency markets.