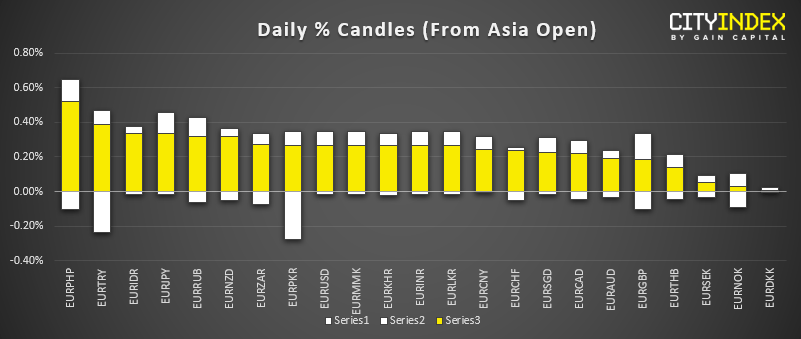

Around 1am London, EUR/USD spiked higher and, upon closer inspection saw the bid for Euro was broadly based. This leaves a potential bullish breakout on the cards for UK or US trading session ahead of the weekend.

Whilst the driver is currently unknown, it may be related to Jerome Powell reportedly asserting “Fed independence” at a Democrats’ retreat, or ‘unnamed sources’ claiming Powell thinks rates are in the right place. However, whilst some USD crosses traded lower, it was not as broad-based as the strength seen on Euro. Anyway…

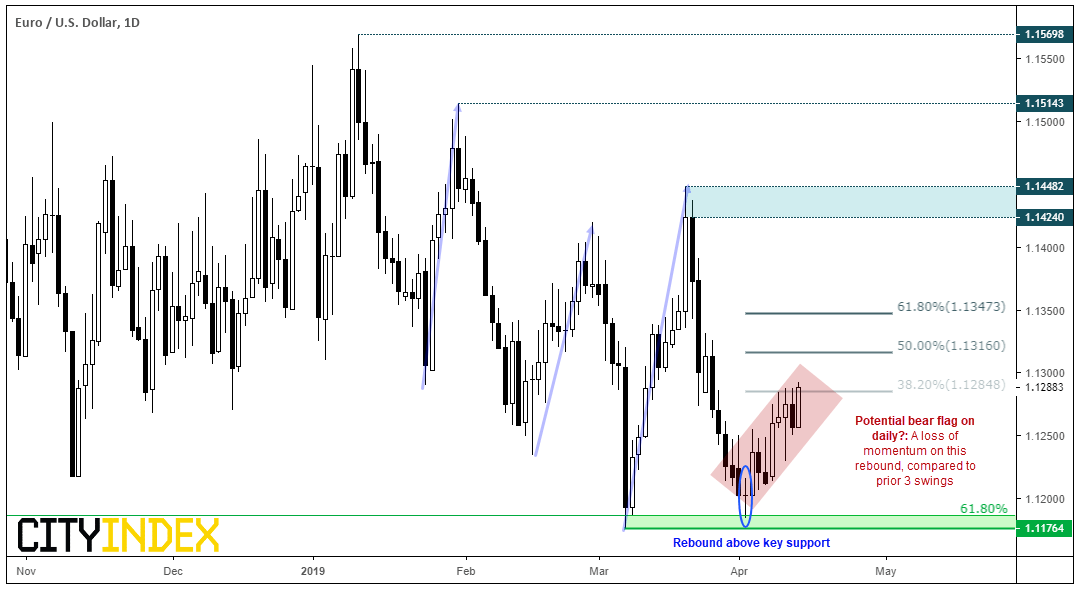

Since our prior post, EUR/USD has bounced from key support and recouped around 0.75% since the low. That said, the magnitude of the bounce is a little underwhelming, having taken 8 days to achieve it. The 1.14 target we previously floated assumed the underlying characteristics of the choppy decline remained unchanged. Given the lacklustre nature of the ‘rebound’, the underlying characteristics of the decline have changed, so we need to be more flexible with our view and perhaps consider a lower, bullish target on the daily chart.

From here, two potential scenarios stand out as worthy of monitoring:

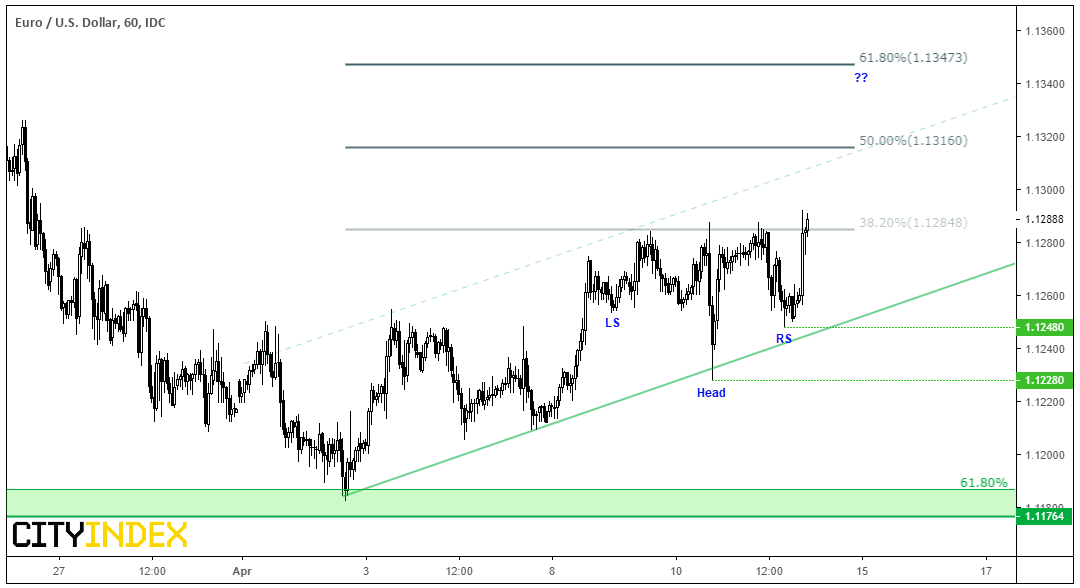

- A bullish breakout on the hourly chart (with an inverted head and shoulders pattern)

- A breakdown of a bearish flag on the daily chart

The hourly chart is carving out a potential inverted head and shoulder pattern, which is a continuation pattern in an uptrend. A bullish channel is being carved out, with the ‘Fed minutes spike’ providing a prominent low around 1.2280 and the right shoulder (RS) providing a higher-high at 1.1248. Today trade has seen a pickup of bullish momentum towards the 38.2% retracement level and, if successful, the inverted head and shoulders projects an approximate target around near the 61.8% Fibonacci level.

The daily chart continues to grind higher, but if bearish momentum is to sufficiently return, we can monitor its potential for a bear flag. With momentum bullish on intraday timeframes, this is on the backburner for now, but we’ll update accordingly if this starts to play out.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.