EUR/USD Price Forecast: The 200-day SMA holds the downside… for now

- EUR/USD added to Wednesday’s decline and approached 1.0800.

- The US Dollar gathered extra steam and rose to weekly peaks.

- The ECB’s Lagarde warned against a US-EU trade war.

EUR/USD extended its retreat from recent yearly highs on Thursday, dipping into the 1.0820-1.0810 range as the US Dollar (USD) regained ground. The Greenback’s rebound propelled the US Dollar Index (DXY) above the 104.00 mark, buoyed by Fed Chair Jerome Powell’s remarks suggesting no rush to continue cutting rates.

Trade tensions keep the Greenback in check

Lingering anxiety over US trade policy continues to influence market sentiment, driven by President Trump’s unpredictable approach to tariffs. Although Canada and Mexico secured a temporary reprieve until April 2, fears of a global trade war remain, overshadowing growth prospects and clouding the Fed’s policy outlook.

Tariffs can fuel inflation, potentially pushing the Fed to keep a tight grip on its monetary policy. At the same time, they threaten to erode economic momentum—creating a tug-of-war that leaves the near-term direction of the US Dollar uncertain.

Peace talks on the Russia-Ukraine front should help the Euro

The Euro (EUR) has found additional support on signs of progress in the Russia-Ukraine peace process. The Kremlin recently announced that Russian President V. Putin accepted US President D. Trump’s proposal for a 30-day pause on attacks against energy infrastructure, following a nearly two-hour phone call between the two leaders.

Central banks in the spotlight

On Wednesday, the Federal Reserve kept interest rates unchanged, as widely forecast, but signalled plans to cut rates by a total of 50 basis points before year-end, citing slowing economic activity and an eventual dip in inflation. While officials raised their 2025 inflation outlook to 2.7% (up from 2.5% in December), they lowered this year’s growth forecast to 1.7% from 2.1% and projected a slight uptick in unemployment by year-end. Policymakers also cautioned that economic risks remain “unusually elevated.”

Fed Chair Jerome Powell warned that inflation’s retreat might be delayed in part by rising price pressures tied to US tariffs. While he acknowledged the possibility that tariffs are already pushing prices higher, he emphasized that the ultimate impact on consumer behaviour and inflation expectations remains uncertain. Powell reiterated there is no rush to reduce rates further unless conditions deteriorate.

Across the Atlantic, the European Central Bank (ECB) recently lowered key rates by 25 basis points and hinted at additional easing if uncertainty persists. Policymakers trimmed Eurozone growth forecasts and nudged near-term inflation estimates higher, although they still expect price pressures to moderate by 2026. At the same time, speculation that the ECB might pause its easing cycle has added another layer of complexity for the Euro’s trajectory.

ECB President Christine Lagarde cautioned on Wednesday that a potential US-EU trade war could shave as much as 0.5 percentage points off eurozone growth if both tariffs and retaliatory measures escalate, though she added that deeper trade integration could more than compensate for those losses. Acknowledging the inherent uncertainty of such projections, Lagarde stressed the ECB’s readiness to protect price stability. She also praised Germany’s newly announced spending initiatives, despite the upward pressure on bond yields.

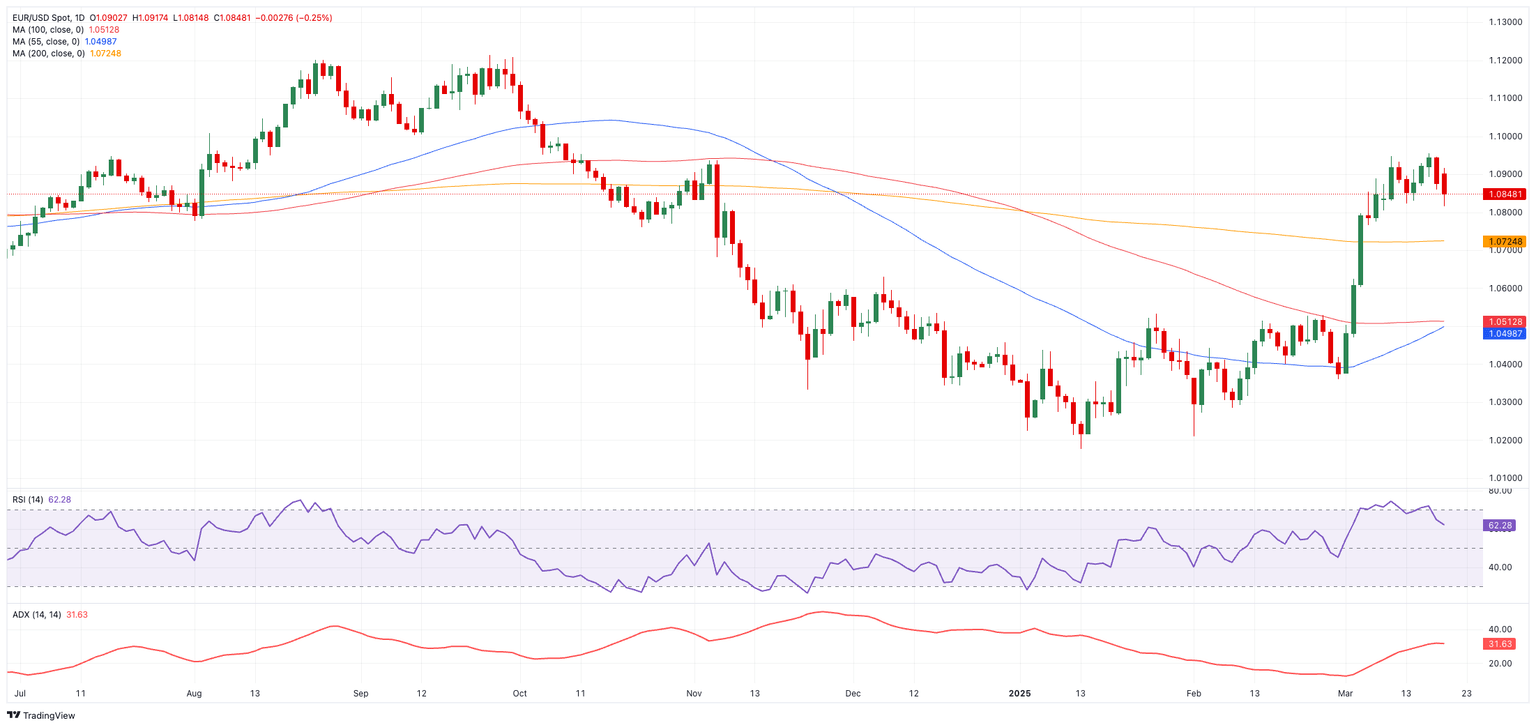

EUR/USD technical outlook

Immediate resistance lies at the YTD high of 1.0954 (March 18). A firm break above that level would target 1.0969 (the 23.6% Fibonacci retracement) and could pave the way for a test of the psychological 1.1000 barrier.

On the downside, the 200-day Simple Moving Average (SMA) at 1.0728 acts as initial support, followed by the provisional 100-day SMA at 1.0522 and the 55-day SMA at 1.0498. Below these levels are 1.0359 (the February 28 low), 1.0282 (the February 10 low), 1.0209 (the February 3 low), and the 2025 bottom of1.0176 (January 13).

Momentum signals remain somewhat bullish, with the Relative Strength Index (RSI) sitting around 62, and the Average Directional Index (ADX) near 32 indicating a strengthening uptrend.

EUR/USD daily chart

What to Watch Next

EUR/USD is likely to remain sensitive to trade-related headlines, central bank developments, and the broader Eurozone growth narrative—particularly as Germany ramps up fiscal spending. Progress in Russia-Ukraine peace efforts could also shift market sentiment rapidly. Traders should stay alert to both geopolitical news and major economic releases, which could redefine near-term direction for the pair.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.