The bearish long term dominant trend however, remains well in place in the EUR/USD pair that has been in a consolidative stage for most of this February around the 1.1300 figure. Last week, the number of shorts reduced according to the COT report, although remain at extreme highs. But both technical and fundamentally, the downside remains favored in the term. This does not mean an upward correction is impossible, but the pair will need to advance firmly above the 1.1440 price zone, to be able to extend its upward correction up to 1.1500 in the short term, with 1.1535 as a probable top. To the downside, the 1.1250 is still the key, as buyers have surged on approaches to it even since the month started.

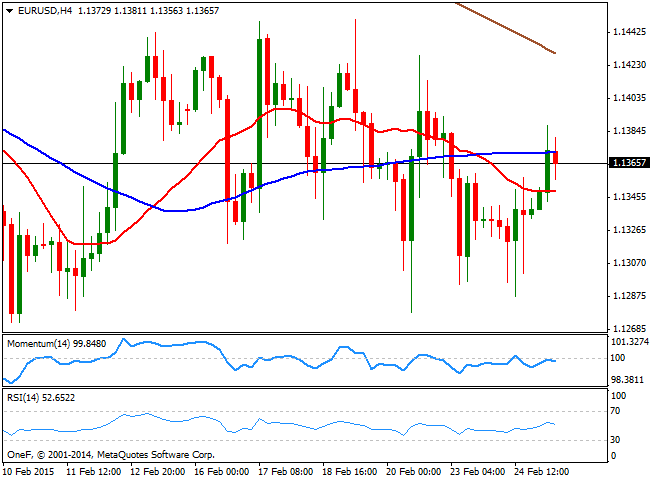

Intraday, the 4 hours chart maintains a quite neutral stance, as per indicators hovering flat around their midlines, and the price capped below an also flat 200 EMA around current levels. Anyway, upward movements are still seen as selling opportunities up to the mentioned 1.1530 price zone in the short term.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

How will US Dollar react to April jobs report? – LIVE

Following the Fed's policy announcements, market focus shifts to the April jobs report from the US. Nonfarm Payrolls are forecast to rise 238K. Investors will also pay close attention to revisions and wage inflation figures.

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.