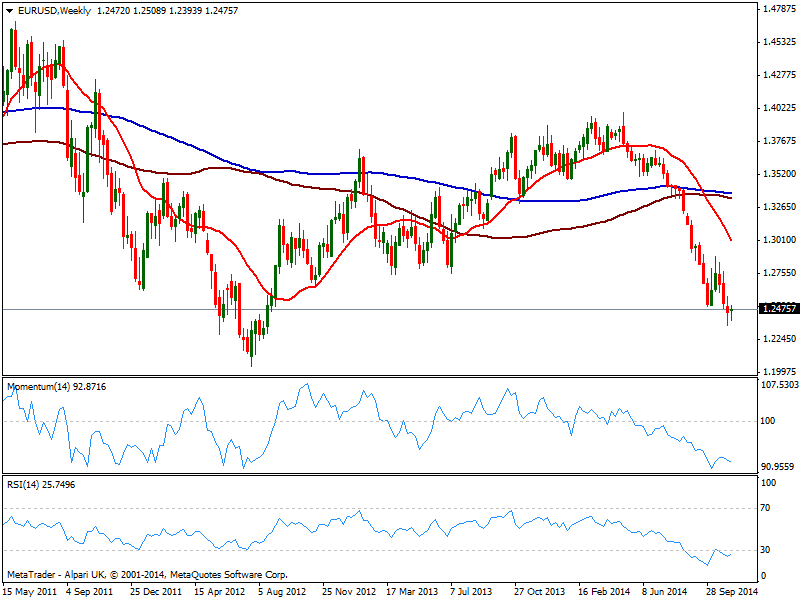

Technically, the weekly chart shows 20 SMA has extended its decline through larger ones, momentum maintaining its bearish slope and RSI still below 30, with sellers surging on advances towards the 1.2500 price zone.

Daily basis, 20 SMA offers dynamic resistance well above current price in the 1.2550 price zone, whilst indicators had erased oversold conditions but remain well into negative territory, and showing no aims to advance further. For the upcoming days, the year low of 1.2357 will be the critical support to follow, as it will take a break below to see the pair resuming the side, down to 1.2280/90 price zone, where the pair presents several weekly historical lows. If this last gives up, an approach to 1.2100 seems likely, opening also doors for a test of the long term key psychological level of 1.2000 in a longer term view.

Above afore mentioned 1.2550 the pair may correct higher, but the line in the sand remains at 1.2660, next resistance and probable top in case of a weekly recovery. In the unlikely case the pair manages to break above it, next target comes at 1.2750/70 price zone, albeit chances of such advance seem extremely poor at this point.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

TON crosses $200 million in Total Value Locked as its network integration continues to scale

In a recent development, the TON network surpassed $200 million in total value locked on Monday after seeing a major boost through The Open League reward program.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.