A poor run of European industrial production data and in-line-with expectations CPI figures in the Eurozone failed to trigger movements in the pair. On the other side of the Atlantic, FOMC minutes offered no surprises and confirmed the Federal Reserve will conclude its QE cycle in October if the US economy holds up as expected.

But on Thursday, fears Portuguese Banco Espiritu Santo troubles could spill into a banking crisis in the Eurozone hit the panic button, sparking risk aversion across markets and weighing on the EUR/USD, which erased previous weekly gains within a session.

Next week, from the Eurozone, the ZEW survey Tuesday and consumer price index Thursday will attract markets’ attention, while in the US retail sales, producer price index and the Reuters/Michigan consumer sentiment index will be the highlights.

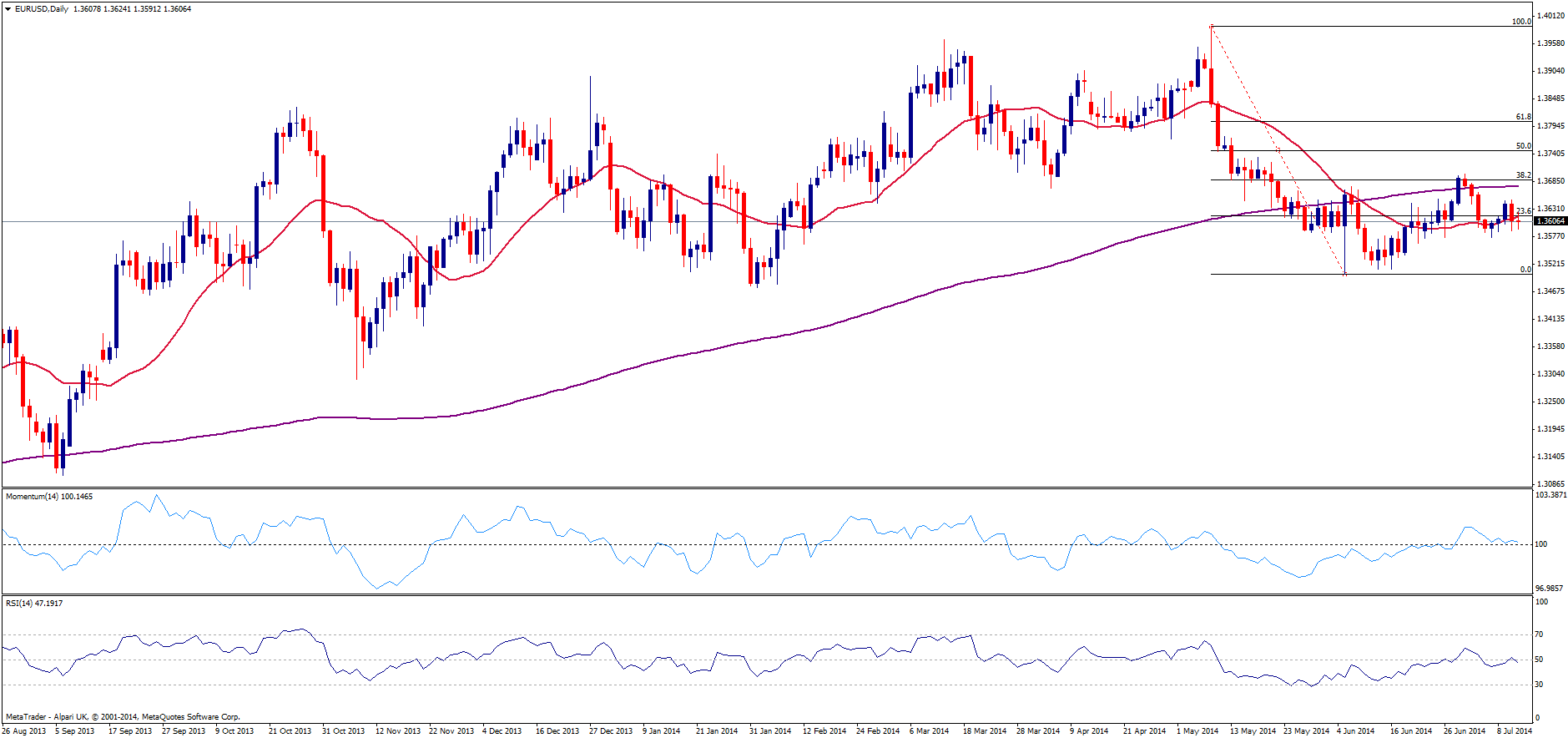

Technically speaking, the EUR/USD shows a more neutral tone in daily charts, after spending the week above the 1.3575 support zone. However, the bearish bias is still dominant after failing to break above 1.3650 and the 200-day SMA offering resistance at the 1.3575 area just before the 38.2% retracement of the 1.3993/1.3502 fall at 1.3688.

A loss of the 1.3575 area, could trigger more losses with the 1.3500/1.3475 area as next key support zone. Then, a break below this latter could pave the way to 1.3400.

View Live Chart for EUR/USD

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.