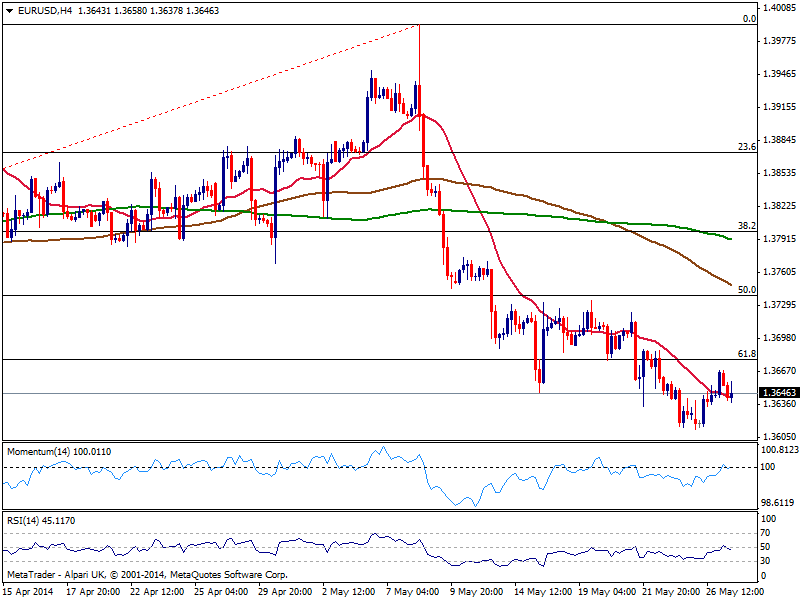

Technically, the timid advance is not enough according to the 4 hours chart, where indicators remain weak around their midlines, as price hovers right above a still bearish 20 SMA: price needs at least to establish itself above the 1.3680 Fibonacci level, 61.8% retracement of this year bullish run, to be able to continue advancing, eyeing then 1.3730/45 price zone. In the meantime, risk remains to the downside, with a break below 1.3610 pointing for a quick run towards 1.3570 first, and looking for lower lows later near the 1.3520 price zone.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD drops to 0.6650 on risk-off mood

AUD/USD has come under fresh selling pressure, dropping near 0.6650 amid broad risk-aversion-led US Dollar demand in Asian trades on Tuesday. The pair fails to find any inspiration from the RBA's hawkish Minutes. More Fedspeak awaited.

USD/JPY extends gains to near 156.50, tracking positive US yields

USD/JPY is extending previous gains to test 156.50, despite the comments from Japan's Finance Minister Shunichi Suzuki. The pair stays supported amid an uptick in the US Treasury bond yields and the US Dollar after Fed officials adopted a cautious stance on the inflation and policy outlook.

Gold price extends its upside as investors bet on rate cuts

Gold price extends the rally on Tuesday after retracing from a record high earlier. The renewed gold demand is bolstered by higher bets on interest rate cuts from the US Federal Reserve, ongoing geopolitical tensions, along with the strong demand stemming from central banks and Asian buyers.

New York Attorney General reaches $2 billion settlement with Genesis after claims of fraud

After a lawsuit filed by the New York Attorney General against crypto lender Genesis in late 2023, the company reached a settlement of $2 billion with the AG on Monday.

The market-moving data this week comes from everywhere other than the US

The market-moving data this week comes from everywhere other than the US. We get inflation from the UK, Canada, and Japan, possibly shifting central bank outlooks. The Fed releases FOMC minutes on Wednesday. And we get a slew of PMI’s on Thursday.