- The EUR/USD trades below 1.1400 once again, unable to recover.

- Worries about Italy and Germany are balanced by some risk-on mood.

- The technical picture is mixed for the pair.

The EUR/USD is trading below 1.1400 but refraining from the cycle lows of 1.1335. Italy's economy stagnated in the third quarter of 2018, worse than 0.1% expected. Year over year, the economy decelerated from 1.2% to 0.8%. The weak data also has implications for the clash over the budget deficit.

Italy remains in the limelight as the clash between the European Commission and the nation continues. The government led by Matteo Salvini and Luigi di Maio is set to submit the budget to parliament today despite the Commission's explicit rejection. As Italy has a high-debt-to-GDP ratio of around 130%, the EC wants a limit of 2%. Italy will raise money today in bond markets.

German Chancellor Angela Merkel announced she would not be contesting the leadership of her party in December but that she will remain at her post until the next elections, due in 2021 but may come earlier.

The EUR/USD initially dropped but stabilized on the announcement that followed the very disappointing election results in Hesse, a region that is home to Frankfurt.

While concerns about Italian and German politics weigh on the common currency, it receives support from a better market mood after US President Donald Trump expressed optimism about reaching a "great deal" with Chinese President Xi Jinping at the G-20 Summit in Buenos Aires in November. The rise in stocks pushes the greenback and the yen down against all other currencies.

The optimism followed reports that the US will present fresh tariffs on around $257 billion of Chinese goods in early December. These will include all remaining products that were not subject to duties in the previous round. The report sent stocks plunging, and Trump's interview with Fox News sent equities back up.

French GDP came out at 0.4% within expectations and the euro-zone figure is projected to stand at the same quarterly rate.

Germany's states publish their preliminary Consumer Price Index measures throughout the morning with the all-German number due at 13:00 GMT. In the US, the Conference Board's Consumer Confidence for October will be of interest at 14:00. The gauge hit the highest levels in 18 years back in September.

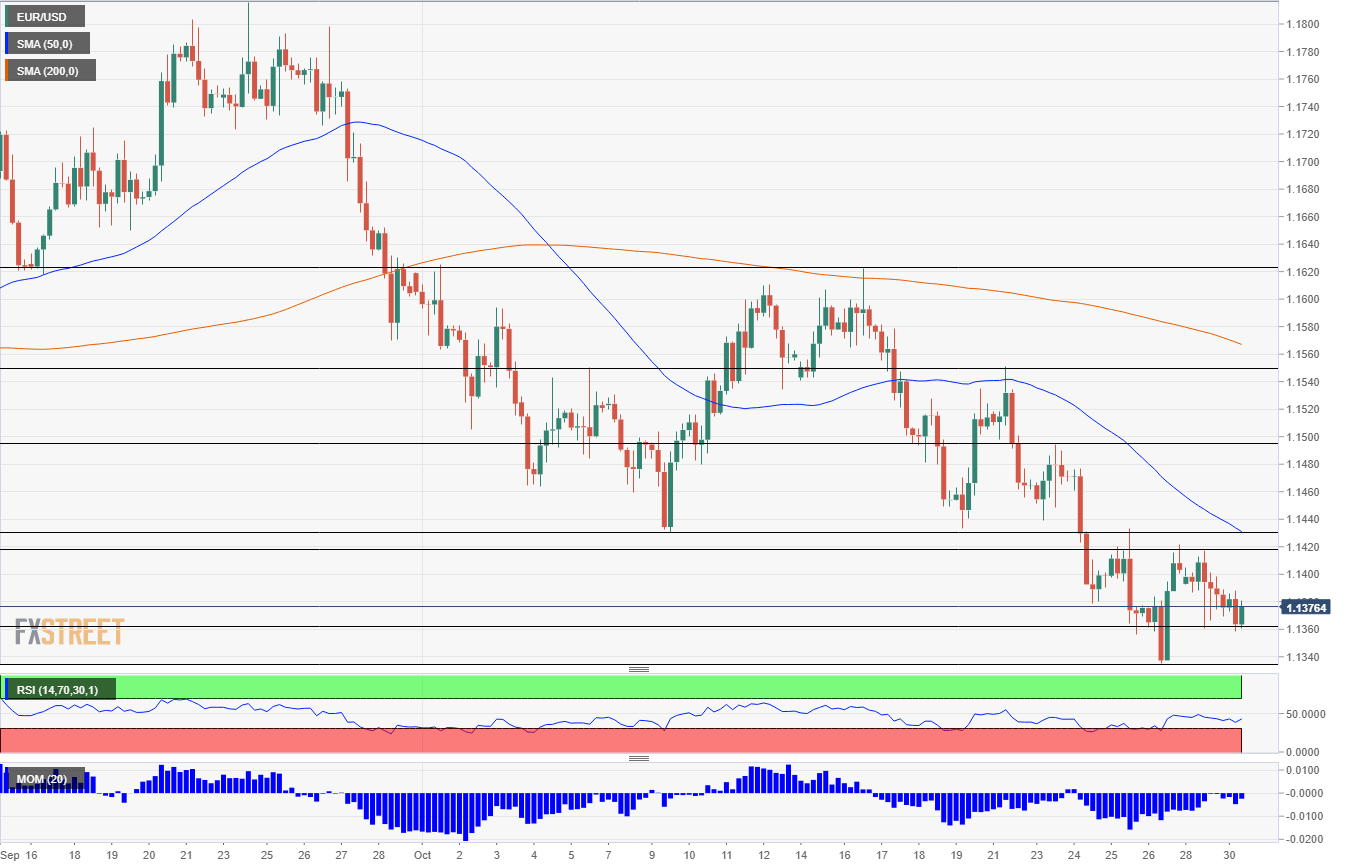

EUR/USD Technical Analysis

The EUR/USD suffers from downside Momentum and trades below the 50 and 200 Simple Moving Averages on the four-hour chart. These are all bearish signs. The Relative Strength Index does not point to any imminent move.

1.1360 was the low point in recent hours and provides initial support. Further down, 1.1335 was the swing low last week and is a significant support line. 1.1300 is not only a round number but also the 2018 low. Further down, 1.1220 and 1.1100 are notable.

1.1415 was the high point in recent days, and it is very close to the double bottom of 1.1430 that was visited twice in October. 1.1495 capped a recovery attempt in mid-October and 1.1550 was a swing high around the same time.

All in all, recovery attempts are being thwarted and follow the "dead cat bounce" pattern. The trend remains to the downside.

More: EUR/USD faces a hard-cap at 1.1390 on any recovery attempt – Confluence Detector

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.