- EUR/USD has been recovering as the Biden transition gets underway.

- Economic data is gaining traction but still competes with coronavirus.

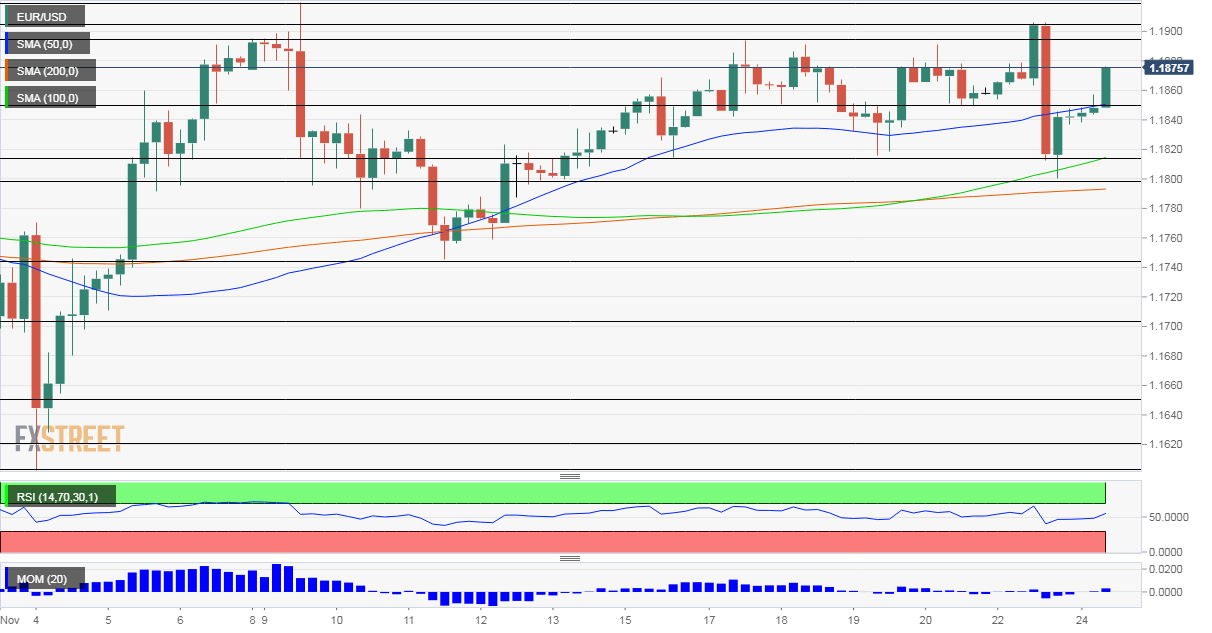

- Tuesday's four-hour chart is painting a bullish picture.

Upbeat US data, stronger dollar – this basic logic seemed to disappear and is now making a comeback, triggering a pullback in EUR/USD on Monday. However, the battle continues with politics still playing a role.

The safe-haven dollar is on the back foot once again after President Donald Trump authorized the General Services Administration to facilitate the transition to President-elect Joe Biden. The outgoing Commander-In-Chief made his move after Michigan's certified his loss and amid growing pressure from fellow Republicans. A smoother transition reduces the already low risk that Trump clings to power and also allows Biden and his team to have better chances of boosting the economy.

Janet Yellen, former Chair of the Federal Reserve, is set to lead these efforts as the new Treasury Secretary. Markets cheered the news of her nomination, also adding to pressure on the greenback. Yellen will likely push for more fiscal stimulus yet without advocating for left-leaning policies. She is a proponent of free trade.

Investors also seem calmer about an upcoming COVID-19 vaccine. AstraZeneca and the University of Oxford reported interim results for their immunization candidate, adding to hopes but also causing confusion. While the average efficacy came out at 70%, a lower dosage regimen pointed to 90% success. The partial figures were criticized. However, now the dust has settled and markets are waiting for fresh figures.

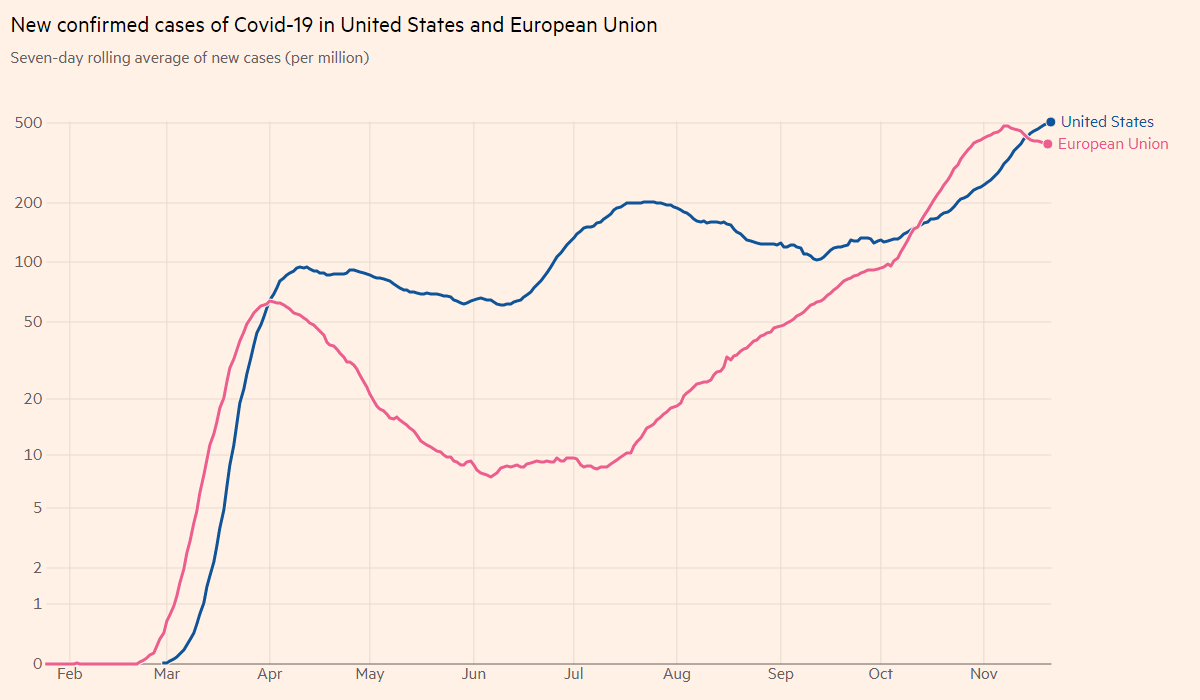

In the meantime, the old continent's coronavirus cases continue their gradual decline, contrary to the increase in the US, a factor underpinning the common currency.

Source: FT

As mentioned earlier, the only significant factor boosting the greenback was robust data. Markit's preliminary Purchasing Managers' Indexes for November beat estimates and pointed to strong growth. As the firm's PMIs tend to be disregarded by markets, their impact may be pointing to the comeback of statistics as substantial market movers.

Tuesday's calendar kicked off with an upgrade to Germany's Gross Domestic Product figures for the third quarter, 8.5% compared with 8.2% originally reported. Another release from Europe's largest economy is eyed – the IFO Business Climate for November, which is set to point to a decline in sentiment amid lockdowns.

Across the pond, US housing figures are of interest, as house prices are on the rise – partially a result of fiscal stimulus. The most significant publication is the Conference Board's Consumer Confidence measure for November, which could follow the parallel release from the University of Michigan with a drop.

Overall, the broader market sentiment favors appreciation in EUR/USD, yet data is gaining more traction and could trigger volatility in both directions.

EUR/USD Technical Analysis

Euro/dollar has recaptured the 50 Simple Moving Average on the four-hour chart and benefits from minimal upside momentum. Bulls have an advantage, but are not in full control.

Some resistance awaits at 1.1895, which capped the pair last week, followed by 1.1905, Monday's high. It is followed by 1.1920 and 1.2010.

The first cushion is at 1.1850, which held EUR/USD up last week, followed by 1.1815 and 1.18, , the latter being Monday's low point.

More When the market shivers, the Fed delivers? Where next for markets

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.