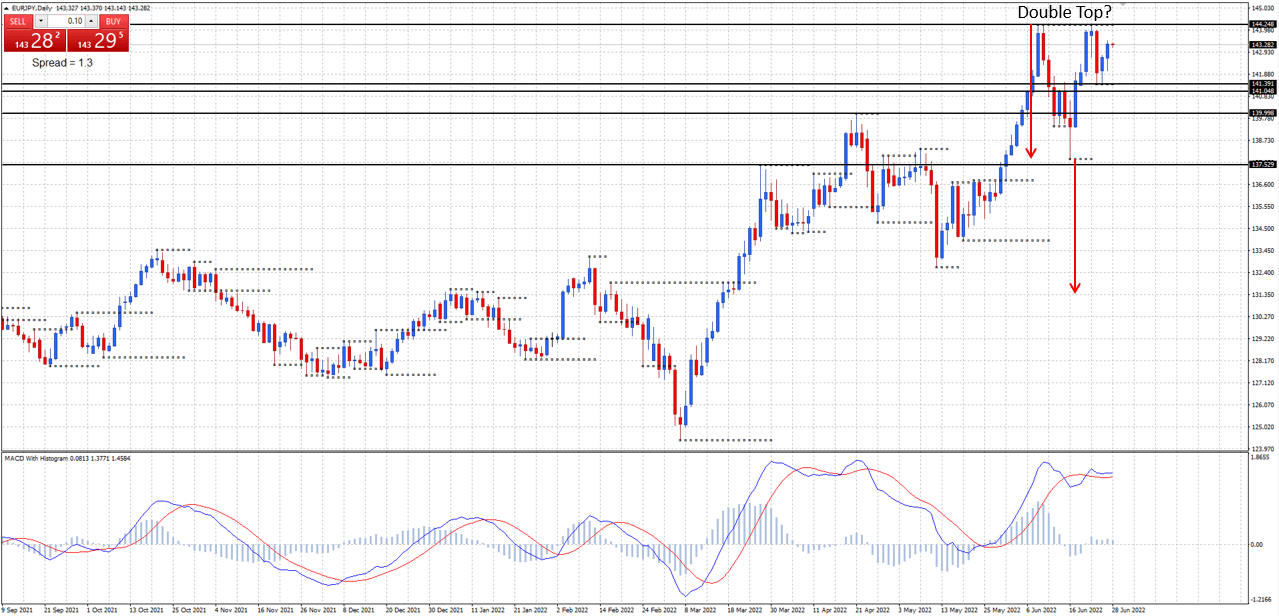

EUR/JPY double top forming at 144.24 weekly resistance level?

Overview

A complete top down analysis of the EURJPY.

EUR/JPY monthly

Monthly support at 141.04, resistance at 145.68.

Monthly chart is in an uptrend holding above the 141.04 monthly support level.

EUR/JPY weekly

Weekly support at 139.99 and 137.52, resistance at 144.24.

Weekly chart is in an uptrend, but price has been rejecting the 144.24 weekly resistance level. Will price hold or move above the 144.24 weekly resistance level?

EUR/JPY daily

Daily support at 141.39, resistance at 144.24.

A double top pattern may be forming at the 144.24 weekly resistance level. A break below 142.02 yesterday’s low would start to confirm the formation of a lower top following the double top pattern on the daily chart.

Short term target 141.04 monthly support. Medium term target 137.82 daily support. Double top price projection target 131.40.

Author

Duncan Cooper

ACY Securities

Duncan Cooper is a full-time trader and mentor. He has been actively trading the financial markets for more than 15 years and has traded stocks, options, futures, and the Forex Market since 2005.