EUR/GBP

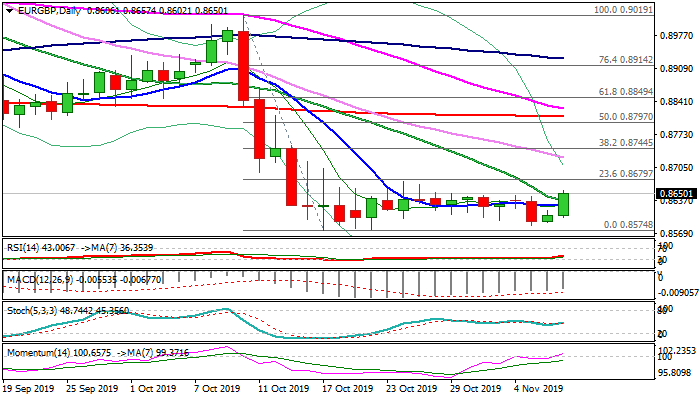

The cross retested highs of past few days at 0.8646 (reinforced by falling 20DMA) on fresh bullish acceleration on surprise BoE MPC split vote (7-2 vs 9-0 f/c) on previous policy meeting, report showed today. Sterling came under fresh pressure on announcement and fell against its major counterparts, as the first non-unanimous interest rate vote in more than one year signals different views of UK policymakers and signals that more MPC members may join in rate vote for rate cut in 19 Dec BoE's next policy meeting. Fresh advance brings the cross' price in the upper part of 0.8574/0.8675, three-week congestion, which was so far capped by rising 200WMA (0.8658). Rising bullish momentum and north-heading stochastic on daily chart support recovery which needs to break above 200WMA and congestion top to signal base formation and expose next pivotal barriers at 0.8745/69 (Fibo 38.2% of 0.9019/0.8574/falling 10WMA). Caution on conflicting weekly studies (rising bearish momentum/stochastics' bullish divergence) which may limit recovery on lack of clearer signals.

Res: 0.8658; 0.8679; 0.8725; 0.8744

Sup: 0.8628; 0.8602; 0.8585; 0.8574

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.