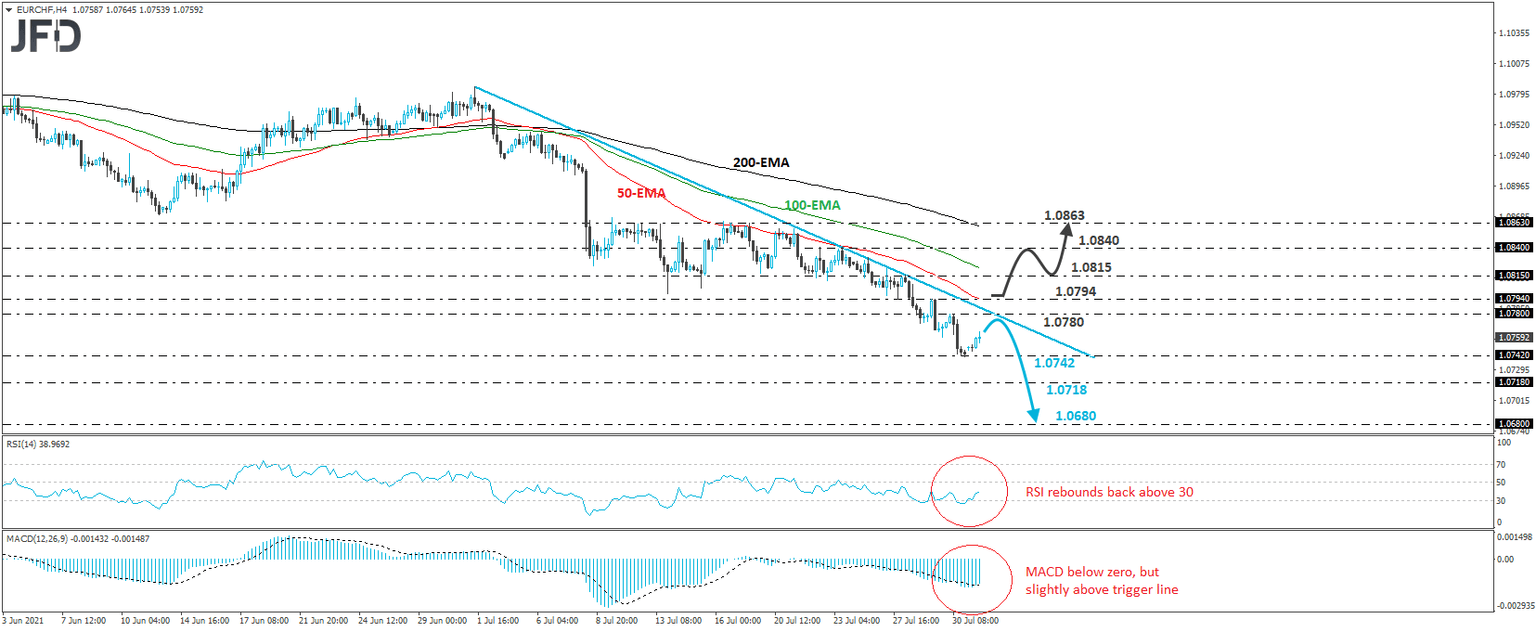

EUR/CHF rebounds but stays in a downtrend

EUR/CHF traded higher on Monday, after it hit support near 1.0742 on Friday. Overall though, the pair continues to trade below the downside line drawn from the high of July 1st, and thus, we would treat today’s recover as a corrective bounce before the next leg south.

The current bounce may continue for a while more, but we see decent chances for the bears to jump back into the action from near the aforementioned downside line and Friday’s high, at 1.0780. They cold then push the action down for another test near 1.0742, the break of which would confirm a forthcoming lower low and perhaps initially target the 1.0718 level, which stopped the price from moving higher on October 28th, November 3rd, and November 5th. That said, if the bears ignore that inside swing barrier, we could see them aiming for the low of November 9th, at around 1.0680.

Shifting attention to our short-term oscillators, we see that the RSI rebounded back above its 30 line, while the MACD, although negative, has just poked its nose above its trigger lines. Both indicators detect slowing downside speed and support the notion for some further recovery before the next leg south.

Now, in order to start examining a bullish reversal, we would like to see the recovery extending, not only above the pre-mentioned downside line, but also above the 1.0794 level, marked by Thursday’s high. This could firstly target the 1.0815 barrier, the break of which could allow advances towards the 1.0840 barrier, which provided resistance on July 23rd. Another break, above 1.0840 may see scope fore extensions towards the 1.0863 zone, which acted as a temporary ceiling between July 9th and 19th.

Author

JFD Team

JFD