EUR/CHF – Looking for an upside move to sell into

I love it when the charts, baskets, timeframes line up. Correlation is king for me.

Going into the figures, the Euro basket looks like it has ample scope to move higher. I am looking at this as an opportunity to get short in EURCHF.

Let’s look at the charts.

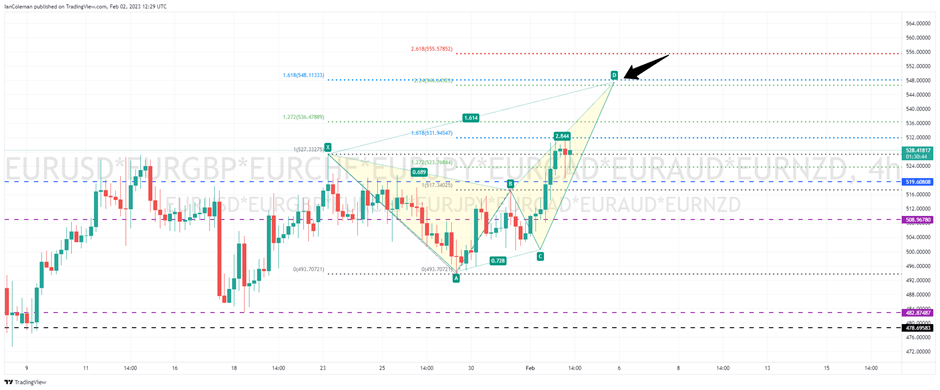

The Euro basket 4-hour looks to be forming a bearish Butterfly pattern. To complete, we would need to see an upside move towards the 1.618% and 2.24% confluence zone (black arrow). This is temporarily bullish for Euro.

The CHF basket 8-hour has ample scope to run up to the Gartley completion.

This gives us a bias to sell rallies in Euro and Buy CHF or sell EURCHF rallies.

EURCHF 8-hour chart and we have a double barrier at 1.0070. With a stop placed above the swing high, focusing on the Butterfly target of 0.9740, this gives a return rate of 8.68R.

Entering short 1.0070 Stop 1.1008 Target 0.9740.

The 0.9740 target gives us a pivot for the daily Bat (BC leg).

The daily Bat completion gives us a pivot for the BC leg of the weekly Gartley. This is perfect correlation and a very rare view.

Author

Ian Coleman

FXStreet

Ian started his financial career at the age of 18 working as a Junior Swiss Broker at Godsell Astley and Pearce (London). He quickly moved through the ranks and was Desk Manager at RP Martins at the age of 29.