When the anticipated supply of something goes down, the price usually goes up. Such is the case with oil as a result of the attack over the weekend on Saudi Arabia’s largest faciality. Because of the attack, the anticipated supply of oil went down, causing prices to go up. If the price of oil is going up, the price of a currency of other oil exporting countries usually will go up as well.

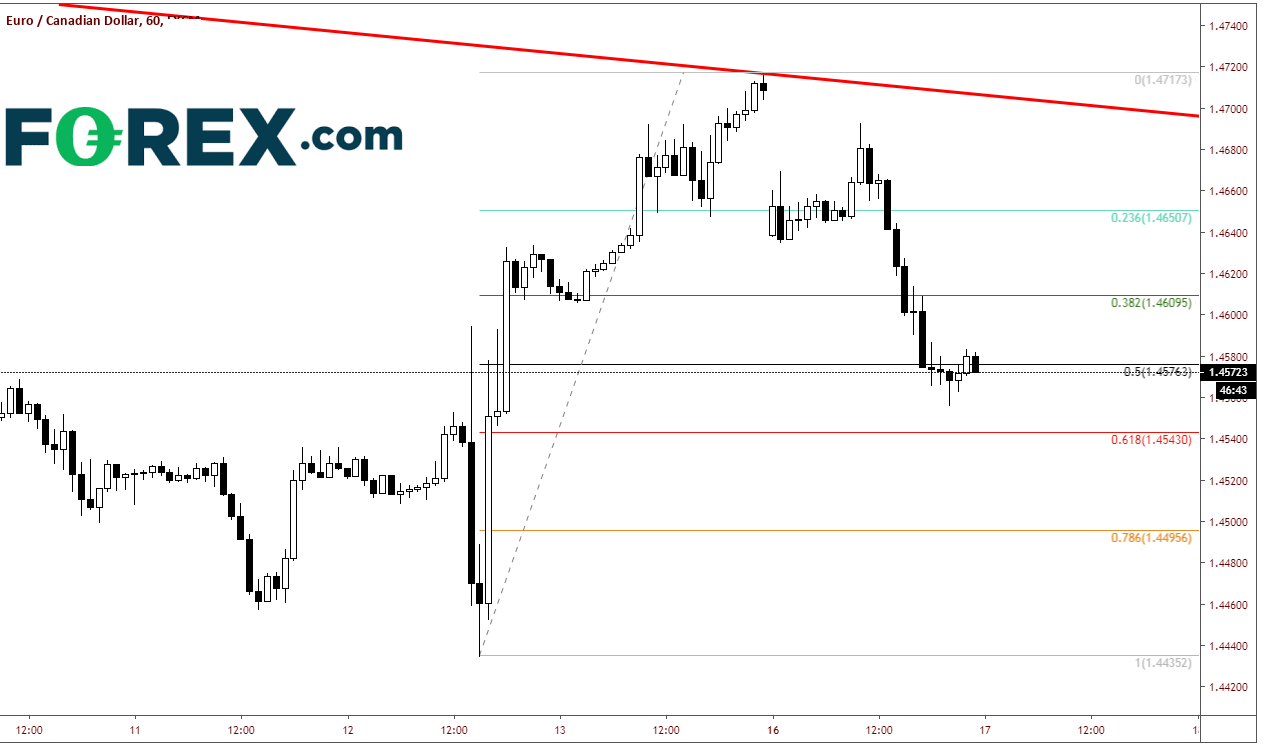

Canada is an oil export led economy. When the price of crude oil goes up, generally, the price of the Canadian Dollar will as well. Today, the Canadian Dollar was up against all major currencies across the board. However, it was up most vs the Euro, almost 1% with a low at 1.4555.

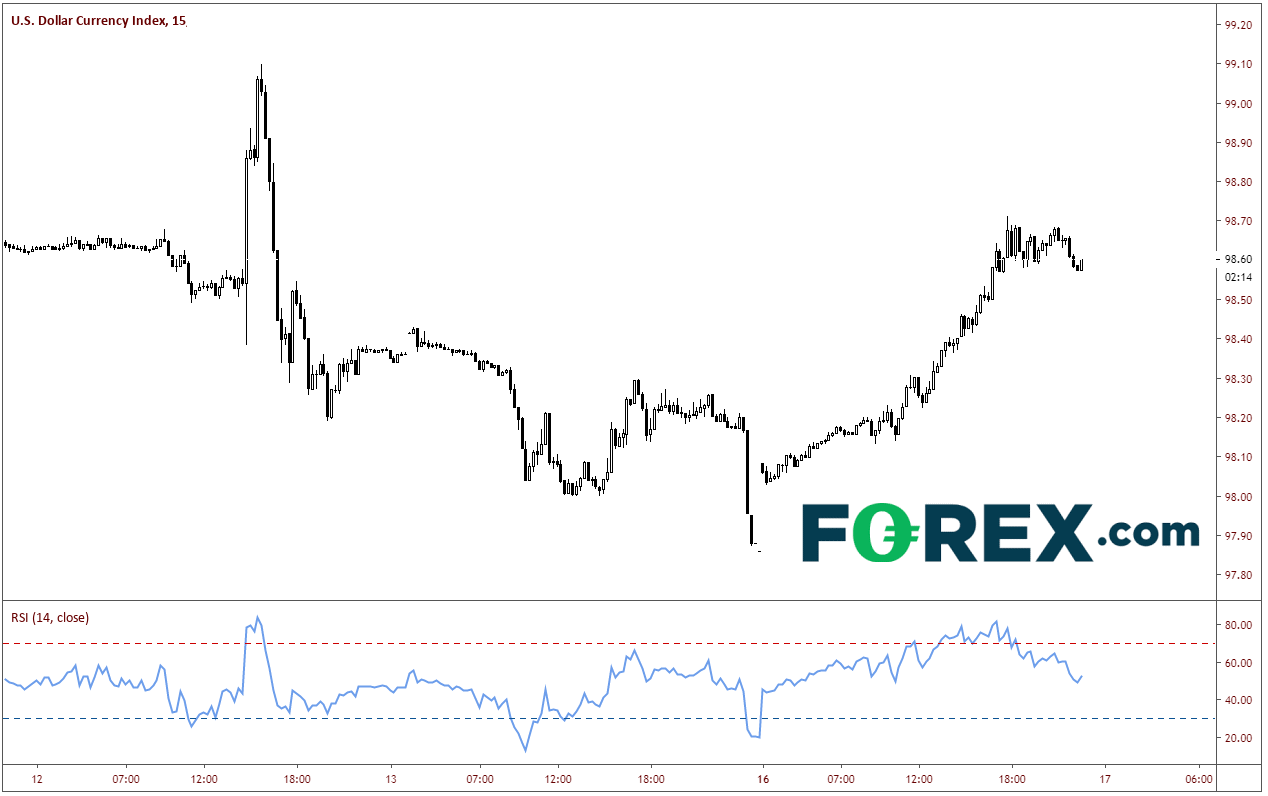

Why so weak vs the the Euro? Mainly because DXY was bid all day. Over 60% of the US Dollar Index is made up of the Euro. So often, when the DXY goes higher, the Euro will go lower.

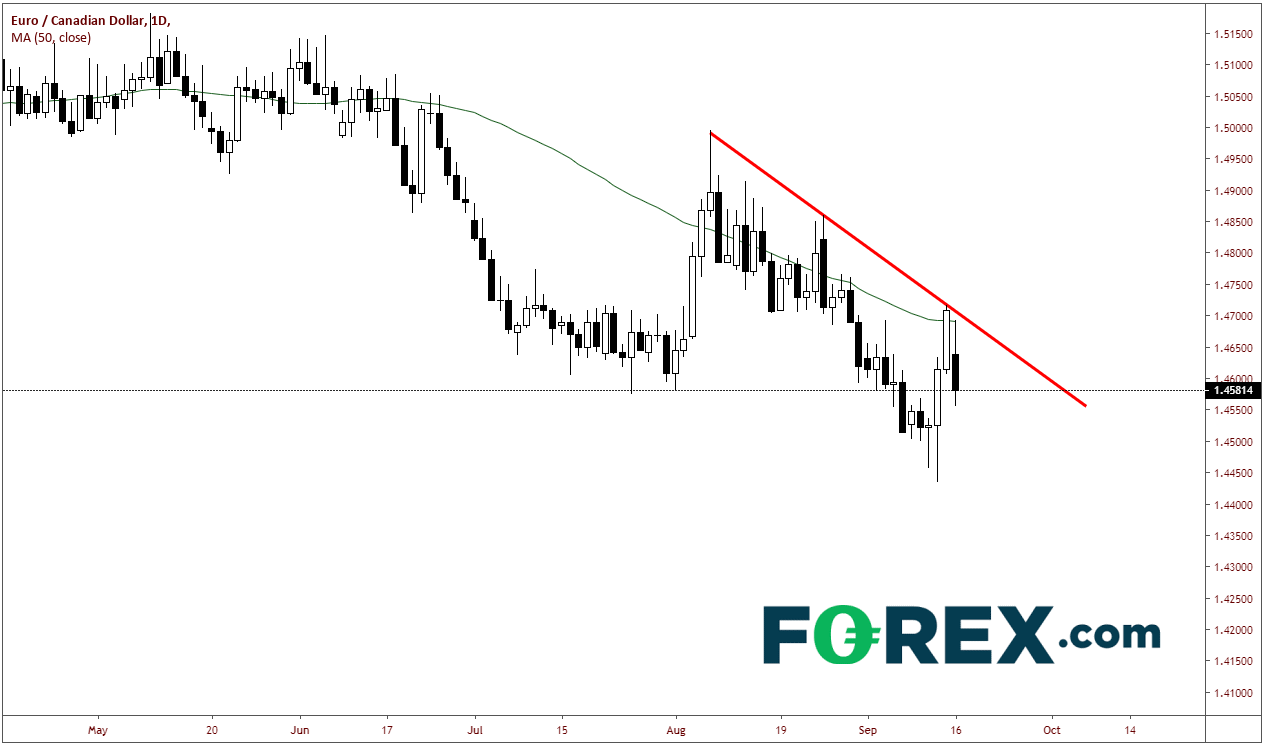

Also, EUR/CAD closed at trendline resistance and the 50 Day Moving Average on Friday. After the gap lower on the opening earlier, the pair was never able to recover to fill the gap because of strength of the US Dollar and Canadian Dollar.

Where can EUR/CAD go from here? If news continues indicate that Iran is to blame for the attacks, the price of crude is likely to rise, and therefore, the price if EUR/CAD is likely to continue to decline. Support comes in at 1.4543, which is the 61.8% retracement level for Thursday’s/Friday’s range. Below that, support comes in at Thursday’s lows of 1.4435. Resistance doesn’t come in until the gap fil near 1.4700, which is also the descending trendline and the 50-day moving average.

Risk Warning Notice Foreign Exchange and CFD trading are high risk and not suitable for everyone. You should carefully consider your investment objectives, level of experience and risk appetite before making a decision to trade with us. Most importantly, do not invest money you cannot afford to lose. There is considerable exposure to risk in any off-exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of the markets that you are trading. Margin and leverage To open a leveraged CFD or forex trade you will need to deposit money with us as margin. Margin is typically a relatively small proportion of the overall contract value. For example a contract trading on leverage of 100:1 will require margin of just 1% of the contract value. This means that a small price movement in the underlying will result in large movement in the value of your trade – this can work in your favour, or result in substantial losses. Your may lose your initial deposit and be required to deposit additional margin in order to maintain your position. If you fail to meet any margin requirement your position will be liquidated and you will be responsible for any resulting losses.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.