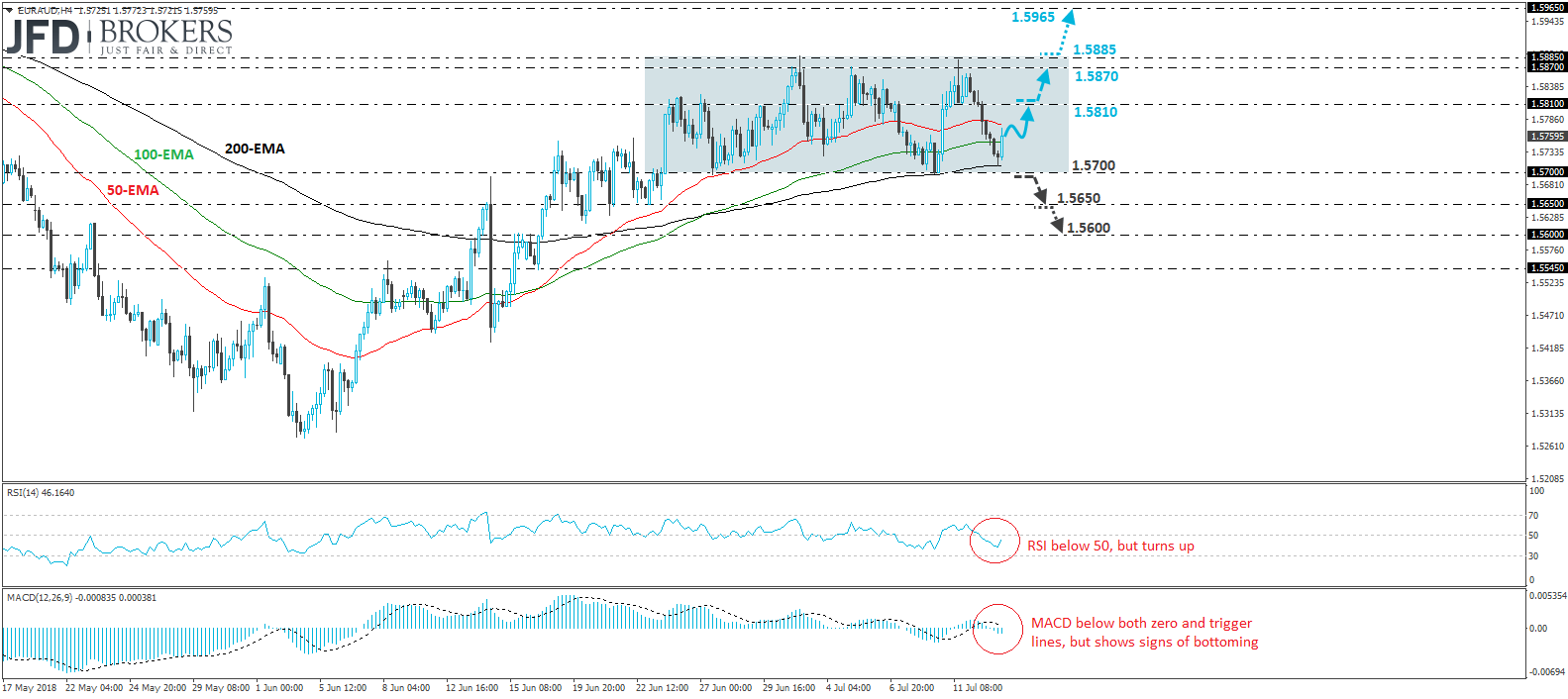

EUR/AUD traded higher during the European morning Friday after it hit support near 1.5700, the lower end of the sideways range that’s been containing the price action since the 25th of June. Bearing in mind that the rate continues to trade within that range, we would consider the short-term outlook to be neutral for now.

That said, given that the latest rebound came from near the lower bound of the range, we would expect the pair to continue trading higher for a while yet, perhaps for a test near the 1.5810 barrier. If that level fails to prevent the rate from rising further, then we may see extensions towards 1.5870 or the upper bound of the aforementioned range, at 1.5885.

We would like to see a clear and decisive break above 1.5885 before we start examining whether the outlook has turned back to positive. Such a break would confirm a higher high on both the 4-hour and daily charts and is possible to pave the way towards the 1.5965 zone, defined by the peak of the 9th of May.

Taking a look at our short-term oscillators, we see that the RSI, although below 50, has turned up. It could move back above 50 soon. The MACD lies below both its zero and trigger lines but shows signs of bottoming as well. These indicators corroborate our view that the pair could continue drifting higher, at least within the range.

On the downside, a clear break below 1.5700 could signal the downside exit off the sideways range and could initially aim for our next support of 1.5650. Another dip below that level could carry more bearish implications and could open the path towards the 1.5600 zone.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.