The uneventful European Central Bank meeting cemented the euro’s position as an attractive funding currency. Those looking and/or hoping for signs of more imminent ECB policy normalisation were clearly disappointed. A stable EUR/USD converging towards the 1.1000 level is likely in the coming weeks and months

Uneventful ECB meeting and little sign of a policy shift

The euro modestly weakened in response to the fairly uneventful ECB meeting . While no new news has been revealed (in fact, President Christine Lagarde noted that incoming data points to some stabilisation in growth dynamics and mentioned indications of a moderate increase in underlying inflation), those who were looking for a more meaningful and imminent shift towards a less dovish policy stance have been disappointed. Although both the eurozone economic and inflation outlooks have been stabilising, such a path has always been the ECB base case. This suggests no urgent need to change the ECB policy stance despite some modestly better news. Hence, the modest dip in EUR/USD (in line with its compressed volatility of past quarters).

Euro’s attractive funding characteristics intact

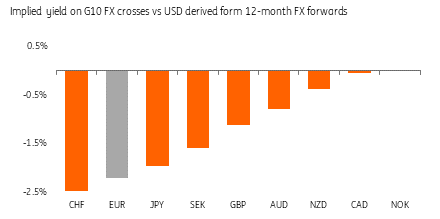

With few signs of an ECB policy reversal and deeply negative rates, the euro’s attractive funding characteristics remain in place, with the euro to remain the funding currency of choice throughout 2020. Like the dollar, the euro is also highly liquid but unlike the dollar, it's cheap to sell it. As Figure 1 shows, the euro suffers from the second lowest / second most negative implied yield in the G10 FX space.

Figure 1: Euro operating with a deeply negative yield

Source: ING, Bloomberg

Flat EUR/USD profile

We continue to see a fairly high hurdle for a EUR/USD rally. The eurozone economic recovery will be very gradual and if it reaps some benefits from stabilising global growth (due in part to the US-China trade war truce) this will also have implications for the Federal Reserve (in the same way the Fed’s easing last year did not occur in isolation). If downside risks evaporate and global trade picks up, the single Fed rate cut currently priced in by the market for 2020 is likely to be priced out. This would, in turn, benefit the dollar and limit the EUR/USD upside. We look for a fairly flat EUR/USD throughout this year. Our three-month forecast is 1.1000.

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.