S&P 500 completed top intact to leave bearish risks

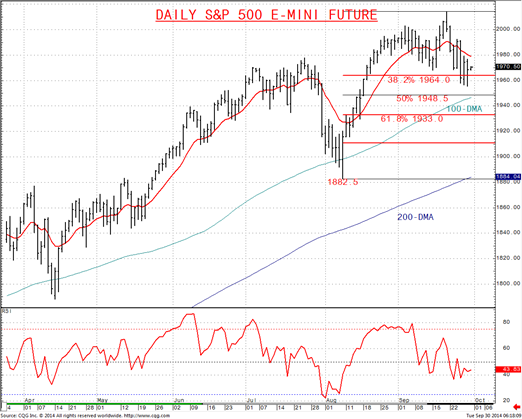

An erratic Monday session, but a lower low and lower high reinforces negative pressures from the Thursday plunge from ahead of a firm barrier at 1999.25 through 1968.0 and the 38.2% retrace of the rally from August in the ADC chart at 1964.0.

This activity completed a more notable topping structure, and still favours a deeper correction through month-end and targets chart/ retrace support at 1950.0/48.5 next

Overshoot threat is to the 100-day MA, currently 1946.25 and maybe the 61.8% retrace at 1933.0.

WHAT CHANGES THIS?

- Above 1979.25 eases bear risks; through 1992.5 signals a neutral tone, only shifting positive above 1999.25.

4 Hour S&P 500 E-mini December Future Chart

Daily S&P 500 Future Adjusted Continuation Chart

THERE IS SUBSTANTIAL RISK OF LOSS IN TRADING FUTURES, OPTIONS AND FX PRODUCTS. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 as US yields push lower

Gold price trades in positive territory above $2,310 in the American session on Monday. The benchmark 10-year US Treasury bond yield stays in the red below 4.5% after weaker-than-expected US employment data, helping XAU/USD hold its ground.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.