The euro had a deceptively active week, where it lost over 200 pips. We say it’s “deceptive” because, while it looks like an impulsive decline, it’s actually much more likely to be a correction, particularly since it’s yet to reach our invalidation point.

Over the weekend, we had a chance to review our counts and make minor modifications to some of the wave labels. This doesn’t affect our outlook or previous expectations in any way — it just provides a more fitting count for the wave subdivisions.

We’re updating our counts to reflect the most recent price action and to present tighter targets and invalidation points.

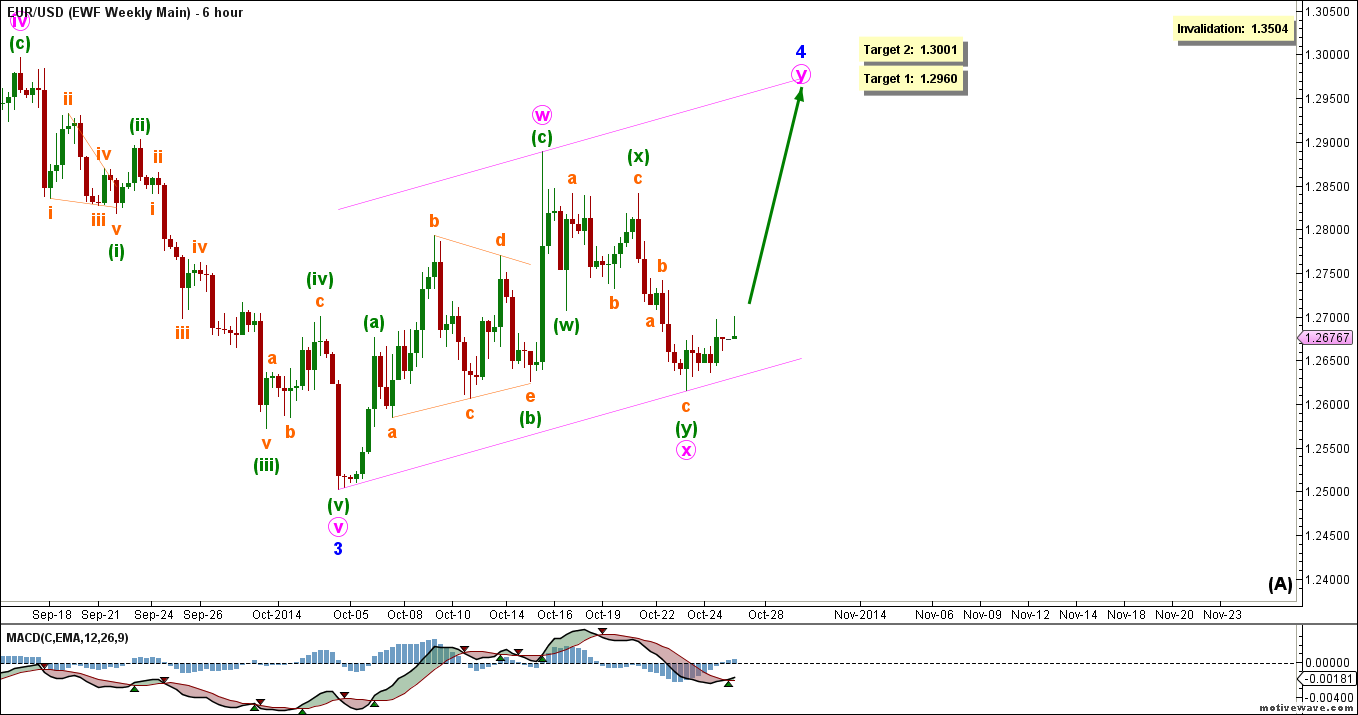

6-Hour Main Count

– Invalidation Point: 1.3504

– Confirmation Point: –

– Upwards Target : 1.2960 – 1.3001

– Wave number: Minute y

– Wave structure: Corrective

– Wave pattern: Zigzag or Flat

Main 6-Hour Wave Count

The bigger picture sees the euro moving downwards in intermediate wave (A), which is forming an impulse labeled minor waves 1 through 5.

Minor wave 3 formed an impulse labeled minute wave i through v, and has reached nearly 261.8% the length of minor wave 1.

Within it, minute wave v unfolded as an impulse labeled minuette waves (i) through (v), well exceeding 100% the length of minute wave i, and coming close to reaching 100% the length of minute wave iii.

Within it, minuette wave (i) formed a leading diagonal labeled subminuette waves i through v.

Minuette wave (iii) formed an impulse labeled subminuette waves i through v, exceeding 161.8% the length of minuette wave (i).

Minuette wave (iv) retraced 38.2% of minuette wave (iii).

Minuette wave (v) has reached 100% the length of minuette wave (i), driving minor wave 3 to come very close to reaching 261.8% the length of minor wave 1.

Minor wave 4 is probably unfolding as a double combination labeled minute waves w, x and y.

Minute wave w formed a zigzag labeled minuette waves (a), (b) and (c), where minuette wave (b) formed a running triangle labeled subminuette waves a through e, and minuette wave (c) reaching 161.8% the length of minuette wave (a).

Minute wave x formed a double zigzag labeled minuette waves (w), (x) and (y), retracing over 61.8% of minute wave w.

This count expects the euro to make one more upwards push in minute wave y to complete minor wave 4.

The MACD indicator supports this count by showing a bullish crossover.

At 1.2960 minor wave 4 would retrace 38.2% of minor wave 3, then at 1.3001 minute wave y would reach 100% the length of minute wave w.

This wave count is invalidated by movement above 1.3504 as minor wave 4 within this impulse may not enter the price territory of minor wave 1. No invalidation point may be placed at the lower end at this point, as the pattern may unfolded as an expanded flat or more complex formation.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.