Member states often budget a larger fiscal adjustment than they end up carrying out in reality. As shown by an EC study,1 between 1999 and 2014 the budgetary adjustment approved was 0.4 pps more than the adjustment actually carried out one year later, on average. This difference increases to 0.8 pps for adjustments planned two years ahead. This gap is largely because actual expenditure ends up being larger than planned.

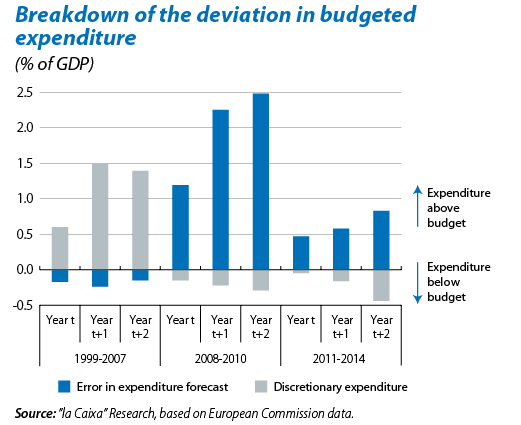

Such deviation in budgeted spending is due both to errors in expenditure forecasts and also to discretionary spending incurred during the budget period. A breakdown of the deviation in various countries shows that, before 2008, most of the increase in unbudgeted spending was due to discretionary measures. However, as from 2008, the reason for such deviations is greater spending than forecasted, in particular an increase in unbudgeted social expenditure.

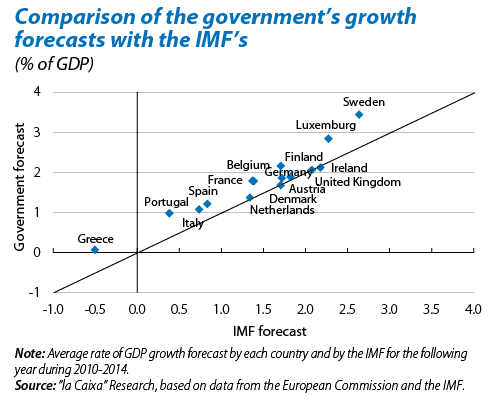

This unplanned increase in expenditure is not entirely innocent: many countries repeatedly overestimate their growth estimate when drawing up budgets. Growth forecasts for the year following the year in which public budgets are presented to the EC are, on average, 0.3 pps higher than the growth forecasts provided by other organisations such as the IMF for the same period.

Thorough budget planning is therefore seen as essential in order to improve public finances. Independent fiscal institutions, established several years ago in some countries in Northern Europe but only recently set up in Spain can be of some assistance in this task. Among other issues, these institutions analyse the macroeconomic forecasts of public budgets, the fiscal policies adopted and the cost of implementing the measures included, and they also attempt to monitor compliance of budget stability on the part of public administrations. One important aspect of their work is to make public accounts more transparent, as well as to offer recommendations regarding any possible problems, although the public administrations are ultimately responsible for taking any measures to resolve such difficulties.

Consequently, at the end of the day the public authorities are responsible for ensuring budgets are met as far as possible, and strong political commitment is required to implement the necessary changes in order to restore the state of public finances. This is the huge task facing European countries after several years of crisis.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.