UNITED STATES

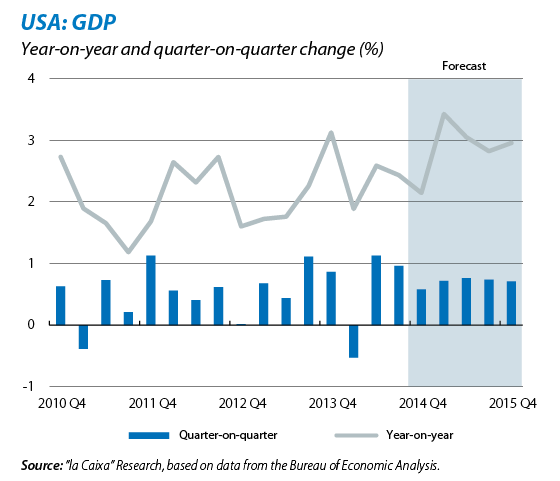

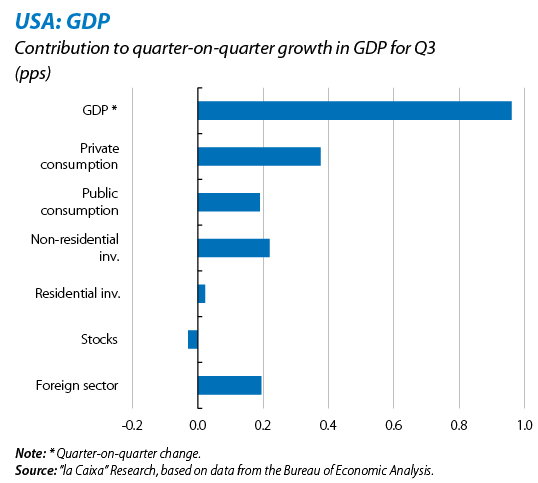

The US's GDP grew by a healthy 1.0% quarter-on-quarter in Q3. GDP increased more than initially calculated in Q3 according to the revised official figures (previously 0.9%). This figure brings year-on-year growth to 2.4% (previously 2.3%). The upward revision has once again come as a surprise and is mainly due to the improvement in non-residential investment and private consumption, tempering the concern we expressed the previous month regarding the moderation shown by both components of demand after the publication of the initial GDP figure. This improvement in growth also entails a slight rise in our growth forecast for 2014 to 2.3% (compared with 2.2% previously). In 2015, without the burden of the weak start to 2014, growth should reached 3.1%.

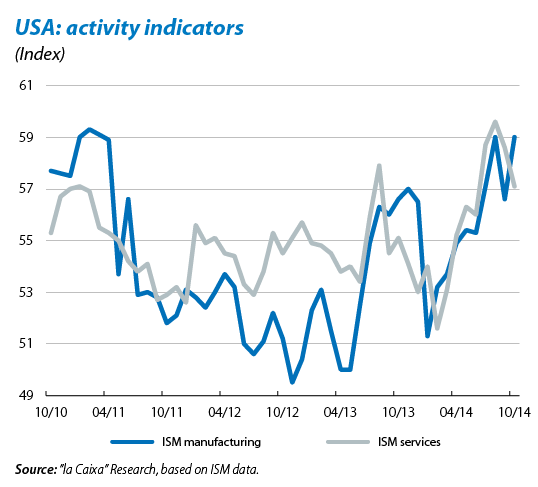

The latest data on activity confirm the expansion in the US. The business sentiment index (ISM) for manufacturing climbed to 59.0 points while the index for services stood at 57.1 points, both clearly above the 50 points that mark the expansionary zone. Along the same lines, the business sentiment index for small enterprises rose to 96.1 points in October (95.3 in September) and retail sales grew by a notable 0.3% month-on-month (2.8% year-on-year). On the other hand industrial production disappointed with a slight decline month-on-month of 0.1% (from 4.2% year-on-year in September to 4.0% in October). Falling oil prices continue to benefit the US economy (a net importer of crude oil) in external terms, although September's unexpected increase in the trade deficit for goods and services points to the external component making a lower contribution to growth in Q4.

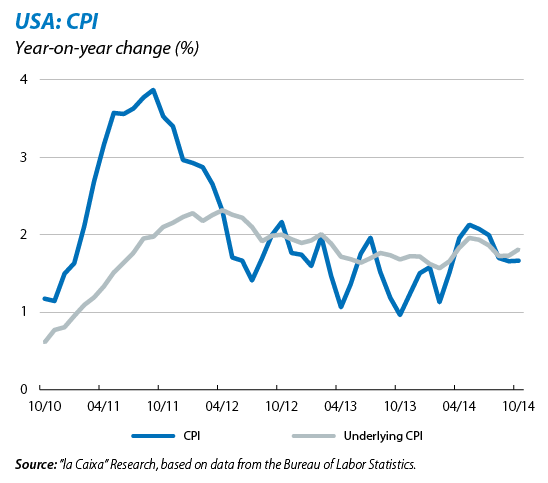

Prices are under control. October's CPI remained flat at 1.7% year-on-year. Once again, the sharp drop in energy prices offset the widespread increase in the rest of the components. Core inflation rose by 0.2% month-on-month, bringing year-on-year growth to 1.8%, 0.1 pps above September's figure. In spite of price stability, the minutes of the Federal Reserve's last meeting revealed that some members are concerned about for inflation, recommending that the trend in long-term inflation expectations should be closely monitored, given the risk entailed for economic growth.

The labour market continues to improve while good news also comes from the real estate sector. 214,000 jobs were created in October, once again above the threshold of 200,000 that indicates a strong market. The unemployment rate also fell by 0.1 pps (5.8%). Such good news was somewhat spoilt by the participation rate (62.8%) which has hardly improved this year so far, indicating that the demotivating effect of the crisis has yet to be reversed. Demographic trends (with American baby boomers reaching retirement age) will not help this trend either. For its part, in the real estate sector the Case-Shiller price index that covers 20 metropolitan areas rose by 0.3% month-on-month in September after four consecutive months in decline. Along the same lines, sales of residential properties, both new and second hand, increased in October compared with the September figures (0.7% and 1.5%, respectively).

JAPAN

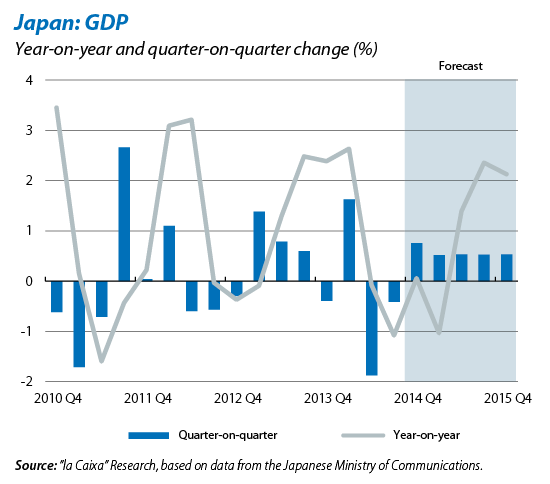

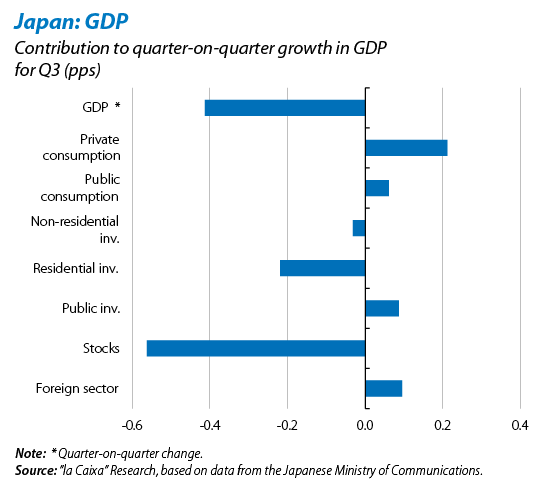

GDP falls in Q3, leaving Japan in a technical recession (two consecutive quarters of negative growth). The 0.4% drop quarter-on-quarter in Q3 (after decreasing by 1.9% in Q2) surprised even the most pessimistic, demonstrating that the consequences of April's VAT hike (from 5% to 8%) have been greater than expected. Although exports will pick up and a large part of this drop is due to an adjustment in stocks, the country's anaemic recovery and the lethargy of investors are of most concern. All this means that we have revised downwards our central scenario for growth in 2014 to 0.4% (previously 1.1%). With a view to 2015, and given the new expansionary economic policy measures, we have maintained our growth forecast at 1.2%. Given the bad figures, Japan's Prime Minister, Shimzo Abe, did not take long to announce that he would postpone the second VAT hike until April 2017 (previously planned for October 2015) and that general elections would be held on 14 December 2014. Abe hopes that these elections will provide him with a mandate for his economic initiatives (known as Abenomics and based on three basic pillars: monetary, fiscal and structural reforms) against rivals within his own party, the Liberal Democrats.

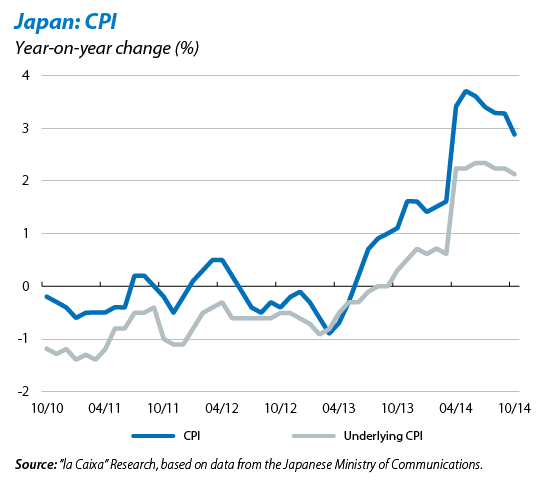

Inflation disappoints in October and moves away from the target set by the Bank of Japan (BoJ). October's CPI rose by 2.9% year-on-year (3.3% in September) although, discounting the effect of VAT, it remained at a moderate 0.9%, far from the 2.0% intended by the BoJ. The BoJ's decision to increase its rate of asset purchases last 31 October already hinted at a certain concern for inflation, which the data have since confirmed. Nonetheless, to date the greatest success of Abenomics has been precisely in the monetary area, as it has managed to put an end to a problem of deflation which had affected the Japanese economy for the last 15 years.

EMERGING ECONOMIES

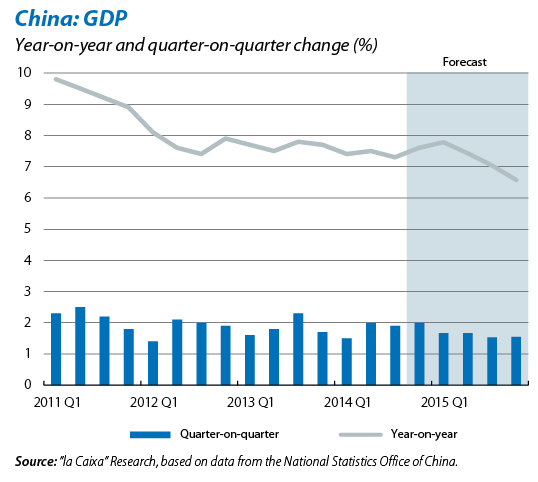

China's business indicators slow down slightly in October although they still show significant growth. Specifically, industrial production was up 7.7% year-on-year (8.0% in September), retail sales grew by 11.5% (11.6% in September) and investment by 15.9% from January to October. Regarding foreign trade, Chinese exports continued to improve in October, growing by a strong 11.6% year-on-year, in line with the strength shown over the last few months. All this occurred in an environment of moderate prices (inflation stood at 1.6% in October). Although China's activity figures are still reasonable, we have revised downwards our growth forecast for 2015 (from 7.4% to 7.2%), encouraged by the words of the President, Xi Jinping, who believes a 7% growth target is feasible for 2015, suggesting that the government will tolerate a greater slowdown before implementing any more measures of support. The unexpected cut in the official interest rate (by 40 bps to 5.6%) by the country's central bank, the first in over two years, is yet another factor supporting this downward revision. This movement is interpreted as acknowledgement on the part of the Chinese authorities that the slowdown is taking place and a sign of their commitment to this process being gradual.

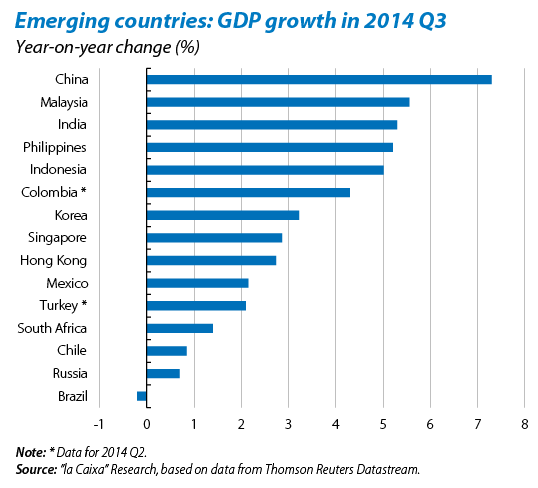

Disparities have increased in the rest of the emerging countries, with marked contrast between the relative stability of India and Mexico and the uncertainty presented by Russia and Brazil (with very little margin for expansionary policies). India remains on track with 5.3% GDP growth year-on-year in Q3, above consensus expectations. In addition to its good GDP figure, falling oil prices have also increased the government's room to manoeuvre in order to moderate inflation and the country's trade deficit. For its part Mexico picked up moderately in Q3 (2.3% year-on-year compared with 1.6% previously). The risks are greater in Brazil, whose inflation leaves no room to manoeuvre, although GDP improved in Q3 (–0.2% year-on-year compared with –0.9% in Q2) thanks to better performance by public consumption and investment. Along the same lines, Russia's figures came as a pleasant surprise with its GDP growing by 0.7% year-on-year in Q3, although we believe that the negative impact of falling oil prices will be felt in Q4.

Recommended Content

Editors’ Picks

How will US Dollar react to April jobs report? – LIVE

Following the Fed's policy announcements, market focus shifts to the April jobs report from the US. Nonfarm Payrolls are forecast to rise 238K. Investors will also pay close attention to revisions and wage inflation figures.

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.