- French composite output PMI fell to a 50-month low of 47.9 in January, indicating contraction of the economic activity.

- German manufacturing slips to contraction in January while the services sector increases.

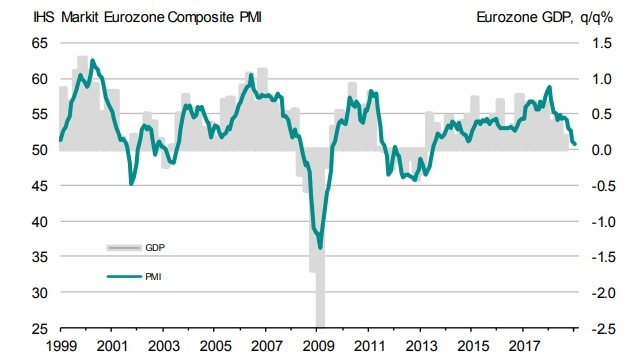

- The Eurozone composite PMI fell to a 66-month low of 50.7 in January indicating that the first quarter GDP is just 0.1%.

The economic activity in the Eurozone economy fell further in January approaching the stagnation territory with companies reporting the first drop in demand for over four years. The

Eurozone composite PMI in January fell to a 66-month low of 50.7 in January indicating that the first quarter GDP is just 0.1%. Apart from the yellow vest protest in France, the global demand deceleration stemming from ongoing trade tensions weighed on the activity.

The Eurozone manufacturing PMI fell to the lowest level in 50-month of 50.5 in January as German manufacturing PMI slipped to contraction territory of 49.9 for the first time in last 50-months.

French composite private sector activity fell to a 50-month low of 47.9 as the yellow vest protest led to the steepest decline in the economic activity in France since November 2014, consistent with GDP falling in the first quarter of 2019.

The services sector in France suffered a sharp deceleration to a 59-month low of 47.5 while manufacturing ticked up to 51.2 in January.

The services sector PMI in Germany rose to 53.1, but the manufacturing sector slipped to a 50-month low in contraction territory of 49.9 in January.

The slowdown of the Eurozoen economy continues and the ECB is likely to reflect it in its comments while the Governing Council is meeting today, following the International Monetary Fund (IMF) that lowered the global advanced economies growth projections mainly because of lower than expected growth in the Eurozone.

The Eurozone composite PMI

Source: IHS/Markit

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.