German real estate prices have been rising rapidly since 2011.

To tackle rising rents, the government has introduced new rent controls in the major cities.

Several factors lie behind this trend, which is more of a normalisation of the real estate market (after a decade of stagnation) than a speculative bubble.

In Germany it would appear that the conditions are in place for the residential real estate market, whether rented or owned, to catch up after a lengthy period of stagnation. Recent survey data also point in this direction.

Creation of a speculative bubble?

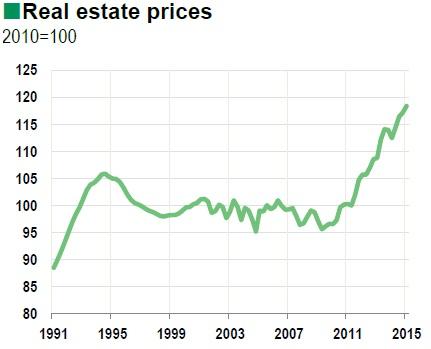

Following reunification1, it took several years to absorb the excess capacity that emerged in the real estate market, particularly in eastern regions. Prices started to rise again in 2011, particularly in the major cities (see Figure 1). In 2014, Berlin, Hamburg, Munich, Cologne and Frankfurt saw prices rise at twice the rate for the country as a whole (2.6% on average in 2014, from 5.2% in 2013). The rented market has not been left behind, particularly as most German households rent their homes (61%, compared for instance to 46% in France).

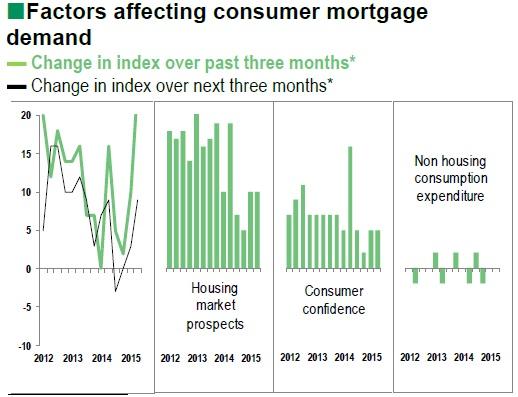

There are several factors that explain this renewed strength. First, the improved sentiment of German households, coupled with growth in disposable income, provides support, whether owned or rented (see Figure 2). According to the GfK survey, consumer confidence in May was at its highest level since October 2001, thanks to the rise in real disposable income. Indeed in the labour market, employment continues to rise and unemployment to fall. This trend is spread across all sectors of the economy. Demand for labour is rising in services benefiting from the upward dynamic in the industrial sector (German industry sector is the sole in the euro zone to operate above its pre-crisis levels). In addition, companies are recruiting to cope with the effects of early retirements on full pensions, which are available from the age of 63. Virtually full employment is helping drive rapid wage growth (in April the unemployment rate was stable at 6.4% for the second month in a row, at its lowest level since reunification). In 2014 wages rose by an average of 2.9%, following growth of 2.4% in 2013. In real terms, wages have at last returned to their level in 2000. The conclusion of wage negotiations between employers and unions in the metal working sector suggests that this upward trend will continue. The powerful IG-Metall union, representing 3.7 million workers, won a rise of 3.4% from April 2015 for a twelve-month period. Lastly, the absence of significant inflation (0.3% over the year to April), linked mainly to the fall in oil prices, has brought down both household heating costs and forecourt petrol prices, which has a positive effect on real disposable income.

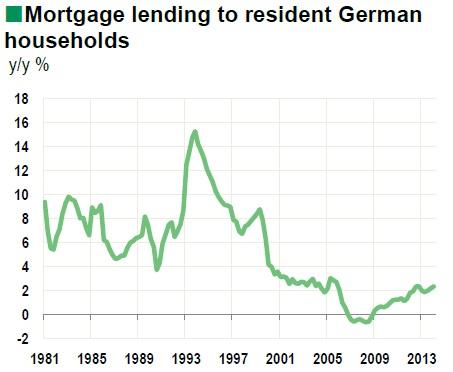

Monetary and financial conditions are very favourable as they are now. The Quantitative Easing conducted by the European Central Bank brought long and medium-term rates down; the stock market has recorded a huge rise (nearly 25%). However, although the resulting wealth effect is positive, it remains limited for German households. German savers have traditionally had a high level of risk aversion and still hold around 40% of their financial assets as cash and bank deposits (compared to 26.5% for French households). Meanwhile, equities make up only 10% of household portfolios (against around 20% in France according to OECD figures). However, we could see a partial reallocation of household savings towards real estate, given that alternative investment categories appear significantly less attractive. Rates on 10- year mortgages have fallen significantly, from 6.5% in 2000 to less than 2.5% in the fourth quarter of 2014. According to the Bundesbank’s latest qualitative survey on bank lending in Germany, demand for mortgages recovered significantly over the course of the fourth quarter of 2014. The index is thus six points above its long-term average. In addition, rental yields (at around 4%) look attractive given the continued slump in bond yields. For the time being, however, mortgage lending to households, which represents 40% of domestic lending by German banks, is growing at a very modest pace, well below the rapid growth of the 1990s (Figure 3). Moreover, according to the Bundesbank’s 2014 Financial Stability Review, mortgage lending is not overheating in those cities seeing the fastest increases in real estate prices. On this point, it is worth reminding ourselves that the indebtedness of German households remains limited. In 2012, mortgage debt represented around 45% of German GDP (against for instance more than 80% in the United Kingdom or around 108% in the Netherlands).

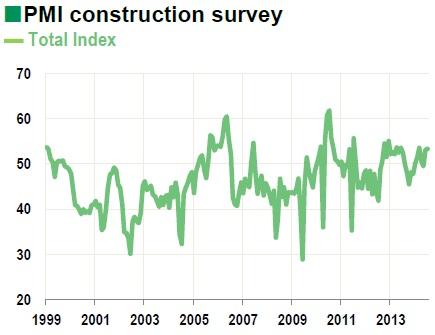

Lastly, current demographic trends are currently supporting the real estate market, even though in the longer term, the supply of housing appears sufficient given the expected decline in the population. On the one hand we are seeing a growing trend of migration towards the cities as the service sector grows. On the other, the number of one- and two-person households2 is growing. Between 2002 and 2012, the number of German households rose from 38.7 million to 40.3 million. According to the Federal Office of Statistics, there is likely to be a peak at 41.1 million households in 2025, despite the expected contraction in the population, which could to a degree support the rising trend in the real estate market. As a result, the Markit PMI index of residential building has been in expansionary territory for seven months, and in May was close to its highest level since 2012 (Figure 4).

Or normalisation of prices?

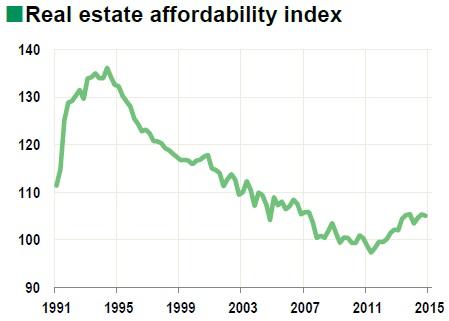

Rents and housing prices are thus rsing markedly but this evolution needs to be seen in perspective. First, the real estate affordability index we have calculated3 (Figure 5) is still well below its long-term average, despite the gap having closed since the third quarter of 2011. It has barely returned to its level before the economic and financial crisis of 2007. It suggests, amongst other things, a long-term undervaluation of the German real estate market of between 15% and 20%.

As far as the rental market is concerned, the prices per square metre observed in major urban centres remains well below those paid in other major European capitals. By way of comparison, in 2013 in Munich, the most expensive city in Germany, rental values were at EUR12 per square meter, compared to more than EUR 23 per square meter in Paris. Germany's federal nature, which creates numerous political and economic centres, explains part of this difference to the extent that it spreads tensions that can build up in the real estate market across the whole of the country. Moreover, rent controls are likely to limit rises.

From 1 June 2015, when a new lease is signed on an existing dwelling, the rent can not be set more than 10% above the average rent in the same district. This tightening of controls does not affect new, modernised or renovated properties, which are subject to a 20% limit for a three-year period. Each Land will be responsible for determining the urban areas to which these new rent controls will apply.

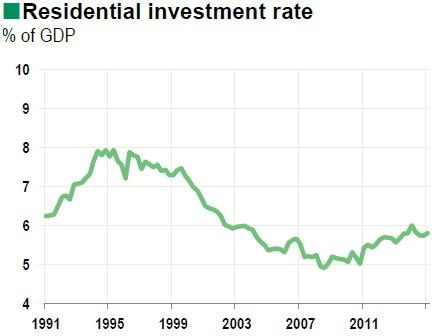

Lastly, although residential investment as a percentage of GDP has been rising since the third quarter of 2008, when it hit a record low of 4.9%, it remains below its long-term average. At 6% in the first quarter of 2015, it is well below the level reached after reunification (Figure 6).

All in all, several temporary factors (making up lost ground, portfolio arbitrage and short-term demographic trends) explain the rapid rise in real estate prices over the last few months. These do not, however, support the notion of a speculative bubble emerging in the German market; rather they suggest a normalisation of the market after a decade of stagnation.

BNP Paribas is regulated by the FSA for the conduct of its designated investment business in the UK and is a member of the London Stock Exchange. The information and opinions contained in this report have been obtained from public sources believed to be reliable, but no representation or warranty, express or implied, is made that such information is accurate or complete and it should not be relied upon as such. This report does not constitute a prospectus or other offering document or an offer or solicitation to buy any securities or other investment. Information and opinions contained in the report are published for the assistance of recipients, but are not to be relied upon as authoritative or taken in substitution for the exercise of judgement by any recipient, they are subject to change without notice and not intended to provide the sole basis of any evaluation of the instruments discussed herein. Any reference to past performance should not be taken as an indication of future performance. No BNP Paribas Group Company accepts any liability whatsoever for any direct or consequential loss arising from any use of material contained in this report. All estimates and opinions included in this report constitute our judgements as of the date of this report. BNP Paribas and their affiliates ("collectively "BNP Paribas") may make a market in, or may, as principal or agent, buy or sell securities of the issuers mentioned in this report or derivatives thereon. BNP Paribas may have a financial interest in the issuers mentioned in this report, including a long or short position in their securities, and or options, futures or other derivative instruments based thereon. BNP Paribas, including its officers and employees may serve or have served as an officer, director or in an advisory capacity for any issuer mentioned in this report. BNP Paribas may, from time to time, solicit, perform or have performed investment banking, underwriting or other services (including acting as adviser, manager, underwriter or lender) within the last 12 months for any issuer referred to in this report. BNP Paribas, may to the extent permitted by law, have acted upon or used the information contained herein, or the research or analysis on which it was based, before its publication. BNP Paribas may receive or intend to seek compensation for investment banking services in the next three months from an issuer mentioned in this report. Any issuer mentioned in this report may have been provided with sections of this report prior to its publication in order to verify its factual accuracy. This report was produced by a BNP Paribas Group Company. This report is for the use of intended recipients and may not be reproduced (in whole or in part) or delivered or transmitted to any other person without the prior written consent of BNP Paribas. By accepting this document you agree to be bound by the foregoing limitations. Analyst Certification Each analyst responsible for the preparation of this report certifies that (i) all views expressed in this report accurately reflect the analyst's personal views about any and all of the issuers and securities named in this report, and (ii) no part of the analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed herein. United States: This report is being distributed to US persons by BNP Paribas Securities Corp., or by a subsidiary or affiliate of BNP Paribas that is not registered as a US broker-dealer, to US major institutional investors only. BNP Paribas Securities Corp., a subsidiary of BNP Paribas, is a broker-dealer registered with the Securities and Exchange Commission and is a member of the National Association of Securities Dealers, Inc. BNP Paribas Securities Corp. accepts responsibility for the content of a report prepared by another non-US affiliate only when distributed to US persons by BNP Paribas Securities Corp. United Kingdom: This report has been approved for publication in the United Kingdom by BNP Paribas London Branch, a branch of BNP Paribas whose head office is in Paris, France. BNP Paribas London Branch is regulated by the Financial Services Authority ("FSA") for the conduct of its designated investment business in the United Kingdom and is a member of the London Stock Exchange. This report is prepared for professional investors and is not intended for Private Customers in the United Kingdom as defined in FSA rules and should not be passed on to any such persons. Japan: This report is being distributed to Japanese based firms by BNP Paribas Securities (Japan) Limited, Tokyo Branch, or by a subsidiary or affiliate of BNP Paribas not registered as a financial instruments firm in Japan, to certain financial institutions permitted by regulation. BNP Paribas Securities (Japan) Limited, Tokyo Branch, a subsidiary of BNP Paribas, is a financial instruments firm registered according to the Financial Instruments and Exchange Law of Japan and a member of the Japan Securities Dealers Association. BNP Paribas Securities (Japan) Limited, Tokyo Branch accepts responsibility for the content of a report prepared by another non-Japan affiliate only when distributed to Japanese based firms by BNP Paribas Securities (Japan) Limited, Tokyo Branch. Hong Kong: This report is being distributed in Hong Kong by BNP Paribas Hong Kong Branch, a branch of BNP Paribas whose head office is in Paris, France. BNP Paribas Hong Kong Branch is regulated as a Licensed Bank by the Hong Kong Monetary Authority and is deemed as a Registered Institution by the Securities and Futures Commission for the conduct of Advising on Securities [Regulated Activity Type 4] under the Securities and Futures Ordinance Transitional Arrangements. Singapore: This report is being distributed in Singapore by BNP Paribas Singapore Branch, a branch of BNP Paribas whose head office is in Paris, France. BNP Paribas Singapore is a licensed bank regulated by the Monetary Authority of Singapore is exempted from holding the required licenses to conduct regulated activities and provide financial advisory services under the Securities and Futures Act and the Financial Advisors Act. © BNP Paribas (2011). All rights reserved.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.