Highlights

-

Do the Draghi Drop

-

Volatility Slip

-

May the Force be With You

Please note: All data, figures & graphs below are valid as of October 21st. All trading carries risk. Only risk capital you are prepared to lose.

Overview

Stocks put up a rather lackluster trading day after Draghi's speech. European indexes were up about half a percent or less while the US ended their session slightly in the red.

Though we do have exciting moves in the currency markets, volatility is slipping once again with the VIX down to 13.25.

That's what he said

As expected the Eurozone interest rates were unchanged and there was no major policy changes. Draghi did re-affirm that low interest rates were good for the economy, though it's not clear how. Unemployment in the zone remains above 10%.

But it's what he didn't say that grabbed the market's attention. The decision whether or not to extend the QE asset purchase program beyond March will be tabled until December.

At this point it seems ‘extremely unlikely’ that the program will end and ‘slightly unlikely’ that the program will be reduced. Mario 'whatever it takes' Draghi, remains so committed to the ultra dovish loose money policy, that he's become famous for it and continues creating money in order to buy financial assets, until there's nothing left for the rest of the market.

That's what they did

The markets didn't wait long to start selling the Euro.

Here's we can see a chart of the Euro before and after the announcement...

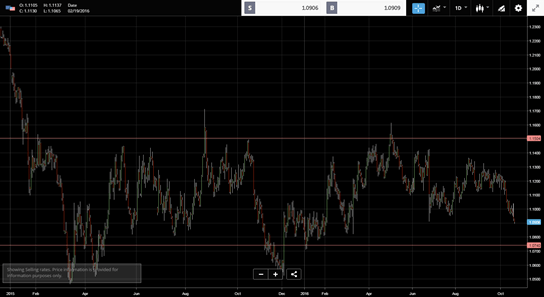

and here is a more long term outlook...

So the EUR/USD is now at its lowest point since March and well into the lower half of the trading range, which it's been at since the beginning of last year.

No doubt we'll get many range traders stepping in to buy the lows. However, now that it seems likely the QE program will continue, if we do push further down and start breaking support levels there's no reason we wouldn't see the pair at parity before too long.

May's Meeting

UK's recently appointed Prime Minister Theresa May had a meeting in Brussels last night that was certainly better than expected. May attempted to reassure Europe's leaders that England will be a strong trading partner.

The issue is that both Hollande and Merkel are salivating over the thought that London may no longer be the region's central financial hub for much longer. If they have any say in it, which they do. They're going to do the best they can to bag as much of that business as they can for Frankfurt and Paris. So in a way, May was attending a dinner with people who are eager to eat her lunch.

We're certainly in for some tough negotiations over the next 2.5 years with many more updates to come, but in the infamous words of the illusive Bob Dylan

"the lines have been drawn the curse it is cast, the slow one now will later be fast, as the present now will later be past, the order is rapidly fadin', and the first one now will later be last, for the times they are a changin'"

Trading in the Foreign Exchange market might carry potential rewards, but also potential risks. You must be aware of the risks and are willing to accept them in order to trade in the foreign exchange market. Don't trade with money you can't afford to lose.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.