Decoding the US economy: Unpacking financial market data

The focus of this month’s article will be on the US economy. One of the first major data points contributing to the November 1st rate decision by the Federal Reserve, will be the US unemployment report, set to be released this Friday, Oct. 6th. The market expectations is for the September unemployment rate to come in at 3.7%, down from 3.8%, in August, while Non-Farm Payrolls are expecting to be in the 150,000 – 170,000 range, representing a slight reduction from August’s 187,000.

Earlier this year, as the US continued its rate hike policy to combat inflation pressures, the big concern with this vigilant approach to rate hikes, was an eventual recession resulting in a “harder landing”. The market consensus began shifting to a “softer landing” in Q2, as the effectiveness of the rate hikes were showing reduced inflation data, supporting this sentiment. Now, with recent developments around energy prices rising, the UAW strike (which got resolved last week), a last minute agreement to avoid a government shutdown, while longer term Treasury yields have been on the rise (specifically 10-year US Treasury Yields reaching the highest levels since 2007 as of this writing), we are witnessing a lot more uncertainty in the direction of the US economy. This has resulted in a methodical decline in the US equity markets over the past 2 months. The Fed’s current monetary policy campaign, of tightening financial conditions, is still working its way through the US economy. The consumer spending data points need to show signs of slowing down, before the Fed will start shifting gears away from the its current stance. With the pending November policy meeting, there is a divided opinion on whether the Fed will resume rate hikes or suggest that they’re done with this current policy. The recent comments from the Fed, about a prolonged period of rates remain at current levels, has also negatively weighed on equities, while also seeing US Dollar appreciation.

As we’ve witnessed throughout 2023, economic conditions that global economies are experiencing, are dramatically different, from fighting inflation to stagflation/recession. Regarding economic slowdowns, the central banks of the Eurozone (ECB) and the UK (Bank of England) are a few months ahead of the US economy, in terms of the shifting focus from fighting inflation to an economic slowdown. The rate hike monetary policies of both the ECB and Bank of England, with an overall bias to tightening monetary policy, is now showing its impact on business and consumers. With higher financing costs, we’re seeing slowdowns in the housing markets and overall consumer spending.

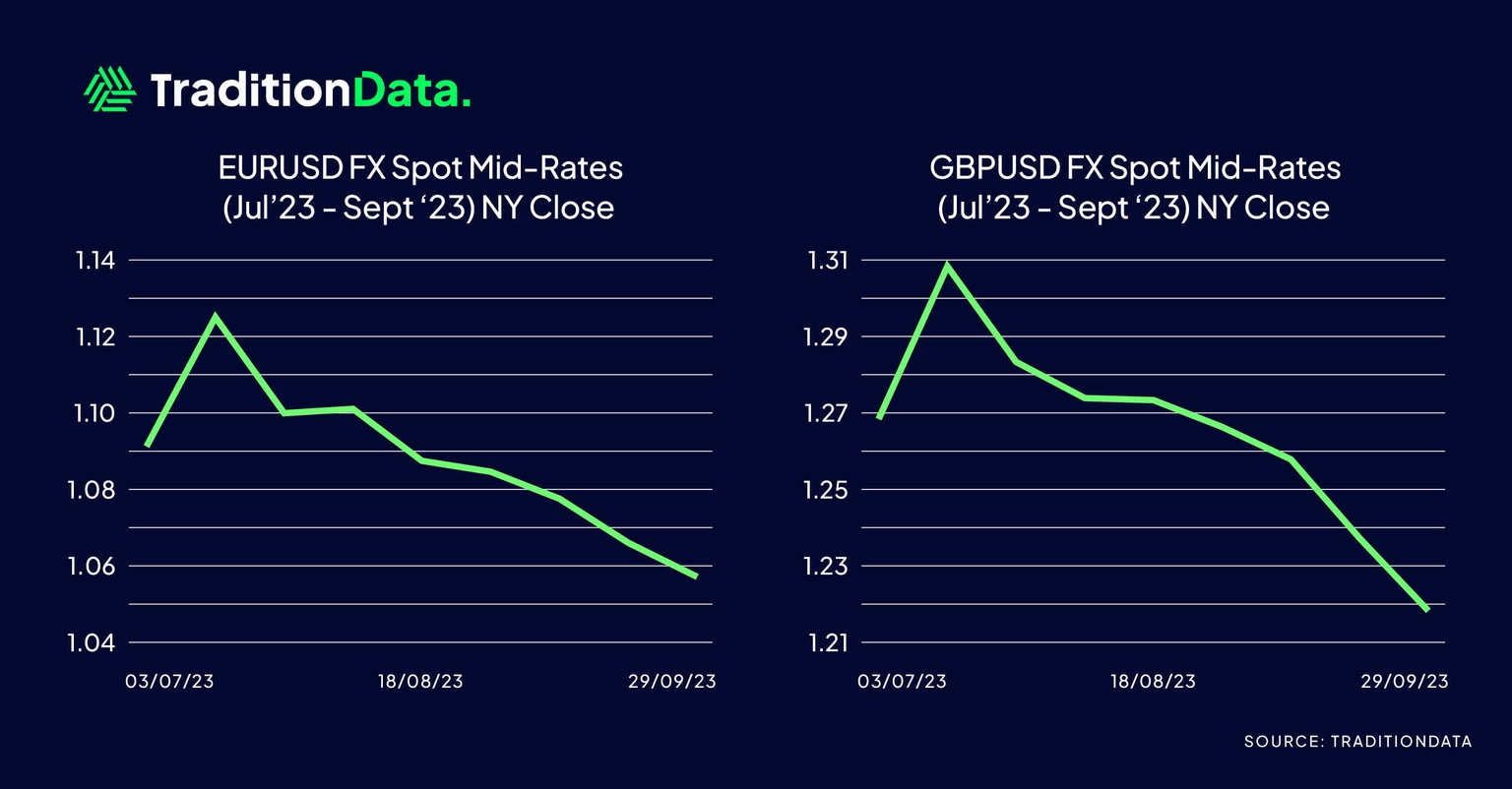

The US Dollar appreciation over the past 3-month period (July – Sept) against the Eurodollar (EUR) and the British Pound (GBP), is reflected in the charts below. This illustrates the impact that a prolonged Fed policy of keeping US rates elevated, at current levels, compared to the Eurozone and UK economies. These regions have entered economic slowdowns, which implies an ECB and Bank of England shift of monetary policies, to rate reductions, are imminent. In conclusion, as is always the case during these shifting tides, each of the global central banks will rely on the economic data to determine their next policy decision.

At TraditionData, we pride ourselves on our global footprint with local market expertise through our relationship with Tradition’s experienced broking business. We offer extensive coverage across Dollar, GBP and Euro-based products covering, FX spot/forwards, interest rate derivatives and inflation markets. Get in touch to find out how our OTC market data products can power your business, trading and risk decisions.

Author

Sal Provenzano

TraditionData

Sal Provenzano Is the FX Product Manager for the TraditionData business and has been tasked with shaping the future of the FX product range.