Signals Turn Bullish

The notion of a bullish turn in the market is being purported by the spot currency trading lower into a 4-year trend line. The ascending trendline – marked by 1.3926-1.5286 – serves as the major trendline support in the near term, coinciding with an oversold signal in technical oscillators. Incidentally, the current support figure is coinciding with a 61.8% fib support figure at 1.5690.

As a result, any upside potential in the GBPUSD, off of the support figure, would likely target the 1.5920 initial resistance figure.

Downside potential for the major pair remains in a break of the trendline, which would be considered widely bearish for the near term sterling outlook. The break would prompt an immediate test of 1.5443 support.

Fundamental Consideration

Even with the market remaining unconvinced of any interest rate reduction by the BOE in the near term, it seems that pessimistic economic fundamentals have helped in keeping any bullish GBPUSD momentum at bay in the short term. Specifically, with the UK GDP report showing less than exemplary growth in the economy last week.

However, with the global economy expected to stabilize and rebound this year, the market sentiment could change – making it likely that UK policymakers will refrain from doing anything to jeopardize the more bullish notion. This more than solidifies the notion that the BOE will remain in a wait and see approach as fundamentals hopefully improve over the next six months.

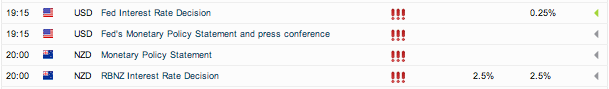

Expect any movement in the underlying spot to reflect this notion ahead of the Federal Reserve meeting on Wednesday (January 30th), as well as the RBNZ meeting shortly after.

Source: FXStreet.com

Source: FXStreet.com

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.