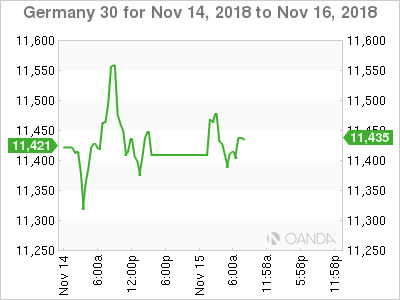

The DAX index is showing little movement in the Thursday session. Currently, the DAX is trading at 11,423, up 0.10% since the close on Wednesday. On the release front, the sole indicator is eurozone trade balance. The surplus dropped sharply to EUR 13.4 billion in September, down from EUR 16.6 billion in August. The weak reading was a result of a weakness in exports, which fell 1.0% in September, on an annualized basis. On Friday, the eurozone releases key CPI reports.

As the largest economy in the eurozone, Germany acts as a bellwether for the rest of the eurozone. Investors were in for a shock on Wednesday, on the news that the German economy contracted in the third quarter, for the first time since Q1 of 2015. German officials tried to put a brave spin on the numbers. Economic Minister Peter Altmaier said that a 0.2% decline “isn’t a catastrophe” and that the economy would rebound in the fourth quarter. The ministry blamed the contraction on weakness in the auto sector due to new pollution standards. However, it’s likely that the skid is also due to the global trade war, which has also resulted in U.S. tariffs on European products. Investor confidence remains very low, and that could be a harbinger of more trouble ahead in the fourth quarter. On Tuesday, the well-respected ZEW research institute said that investors did not expect a rapid recovery from the current weakness. German ZEW Economic Sentiment posted a second straight soft release for November, with a reading of -24.1 points. This points to deep pessimism on the part of institutional investors and analysts.

The crisis over the Italian budget continues, as Rome rejected a demand from the European Commission to revise its draft budget. The Italian government said it would stick to its deficit target of 2.4%, which is within EU fiscal rules. For its part, the EU argues that the deficit target could reach 3.1% in 2020, which would breach the rules. With the ball in the EU court, what happens next? The EU could respond with financial sanctions, known as an excessive deficit procedure, which would amount to billions of euros. As the third largest economy in the eurozone, Italy’s challenge to the EU could have repercussions for the entire bloc, as officials in Brussels scramble to respond to the salvo fired by Rome.

Aussie surges on strong jobs data

European update – The end of the road for May?

Looking for the elusive silver lining.

Economic Calendar

-

5:00 Eurozone Trade Balance. Estimate 16.4B. Actual 13.4B

-

2:00 German WPI. Estimate 0.2%

-

3:30 ECB President Draghi Speaks

-

5:00 Eurozone Final CPI. Estimate 2.2%

-

4:00 Eurozone Final Core CPI. Estimate 1.1%

-

8:00 German Buba President Weidmann Speaks

Open: 11,447 Low: 11,500 High: 11,376 Close: 11,423

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.