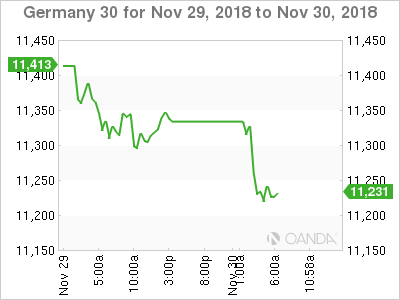

The DAX index has been under pressure throughout the week, and this is the story again in the Friday session. Currently, the DAX is trading at 11,241, down 0.62% on the day. Earlier on Friday, the index dipped to 11,224, its lowest level since November 21. On the release front, German retail sales fell to a 3-month low, with a reading of -0.3%. This was well off the estimate of 0.4%. In the eurozone, inflation levels dipped in November. CPI Flash Estimate dipped to 2.0%, shy of the estimate of 2.1%. Core CPI Flash Estimate followed the same trend, edging lower to 1.0%. This reading missed the forecast of 1.0%. The eurozone unemployment rate remained pegged at 8.1% for a third straight month, the lowest level since December 2008. This was above the estimate of 8.0%. Later in the day, the G-20 summit kicks off in Argentina.

Germany is the locomotive of the eurozone, and when the locomotive loses a gear, the entire train is in trouble. This has been the story in the third and fourth quarters, as weaker German growth has affected the rest of the eurozone. There was more grim economic news on Friday, as retail sales posted its first decline since July. Consumers are holding tighter to the purse strings, which is hurting economic growth. Unsurprisingly, consumer confidence softened in November – the reading of 10.4 points was its lowest level since May 2017.

The ongoing U.S-China trade war has dampened the German export sector, as German companies that export to both the U.S. and China are now facing higher tariffs. Germany’s economy posted a rare decline in the third quarter, with a contraction of 0.2%. Another problem is lower eurozone growth, as weak economic activity in the third quarter appears to have continued into in the fourth quarter. As well, the looming departure of Britain from the European Union and the crisis over the Italian budget have weighed on business and consumer confidence levels in Germany.

Next up, it’s a tête-à-tête between President Trump and Chinese President Xi Jinping in Buenos Aires. The two leaders will meet on the sidelines of the G-20 summit, with the two leaders sure to discuss the full-blown trade war between the world’s two largest economies. President Trump has taken a tough line ahead of the summit, threatening to raise the tariffs from 10 percent to 25 percent on $250 billion worth of Chinese goods. If Trump makes good on his threat, we could see a sharp downturn in the stock markets. However, the unpredictable Trump is known to prefer to reach a deal whenever possible, so his sharp rhetoric could be some grandstanding ahead of his crucial meeting with Xi. If the meeting goes well and the U.S. desists from further tariff action, risk appetite will improve and the stock markets would likely climb.

Economic Calendar

Friday (November 30)

-

Day 1 – G-20 Meetings

-

2:00 German Import Prices. Estimate 0.4%. Actual 1.0%

-

2:00 German Retail Sales. Estimate 0.4%. Actual -0.3%

-

2:45 French Preliminary CPI. Estimate -0.2%. Actual -0.2%

-

5:00 Eurozone CPI Flash Estimate. Estimate 2.1%

-

5:00 Eurozone Core CPI Flash Estimate. Estimate 1.1%

-

5:00 Eurozone Unemployment Rate. Estimate 8.0%

Saturday (December 1)

- Day 2 – G-20 Meetings

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.