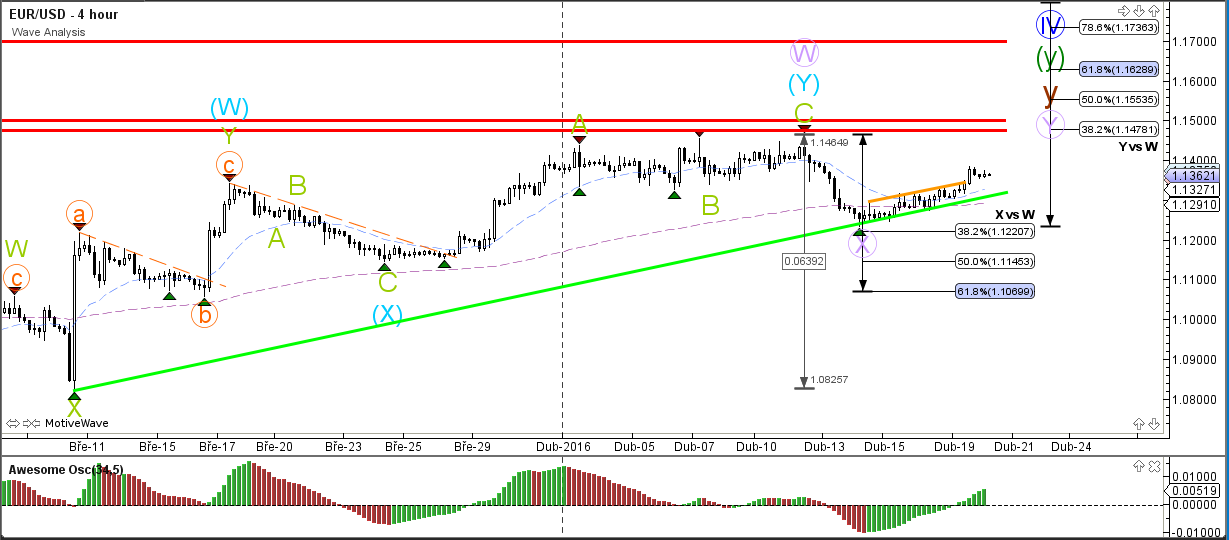

EUR/USD

4 hour

The EUR/USD did not break below support (green) and in fact broke the resistance line (dotted orange). This increases the chance that the bearish price action was a retracement for a wave X (purple) which respected the 38.2% Fibonacci level.

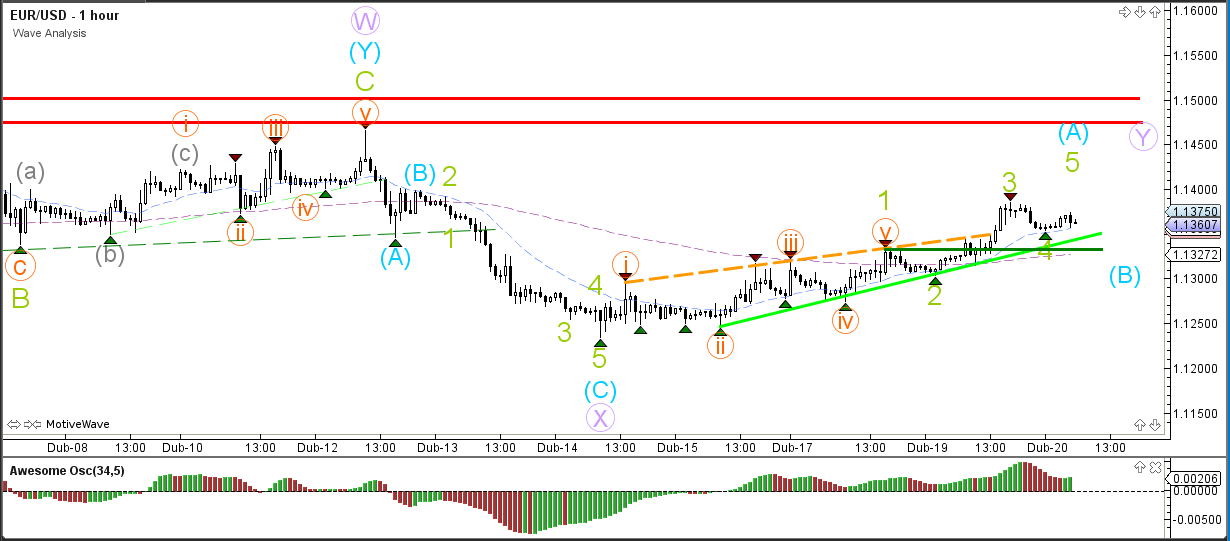

1 hour

The EUR/USD price action remains choppy and corrective. A break below the 2 support trend lines (green) invalidates the 4th wave (green).

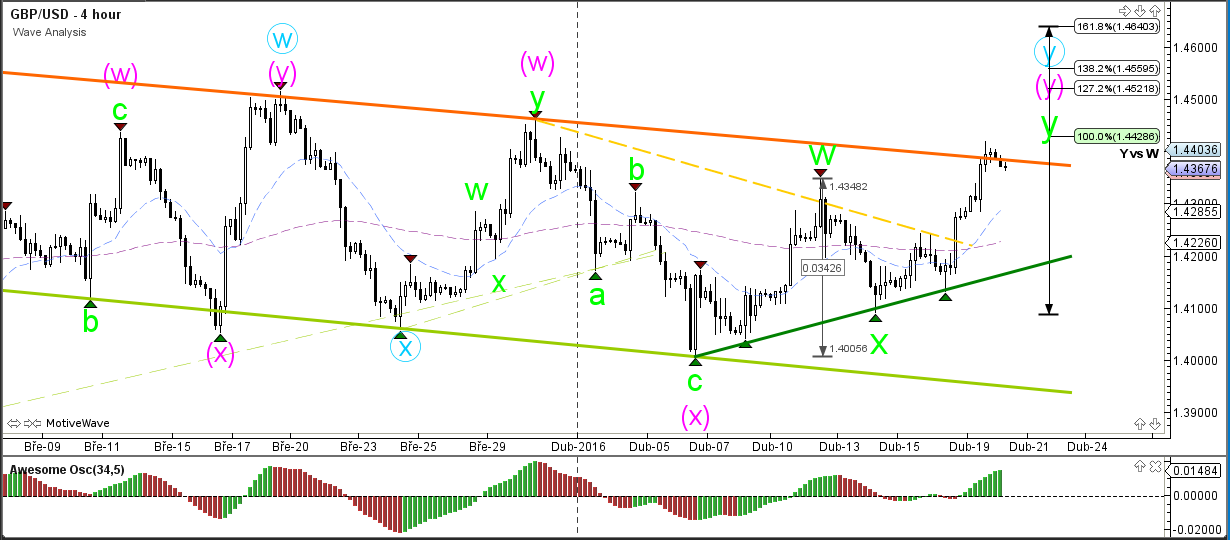

GBP/USD

4 hour

After making a bullish break above the contracting triangle (dotted yellow) chart pattern, the GBP/USD has reached the resistance trend line (orange) and 100% Fibonacci target, which could be a bounce or break spot.

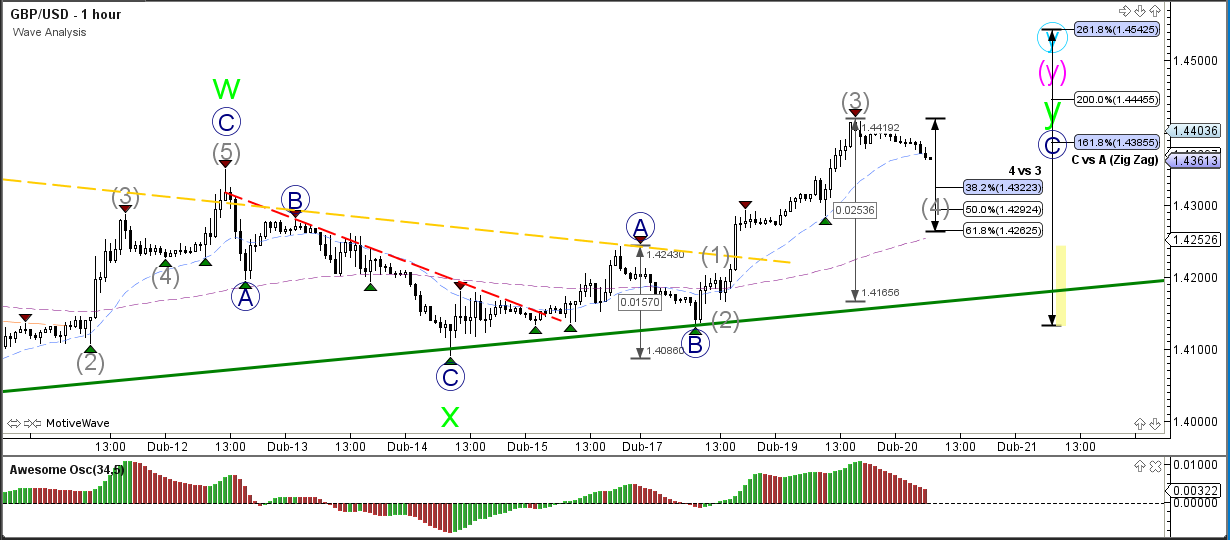

1 hour

When analyzing the lower time frames, the GBP/USD could have one more bullish push remaining via a wave 5 (grey). A break below the 50% or 61.8% Fibonacci retracement level would make such a wave 4 (grey) unlikely.

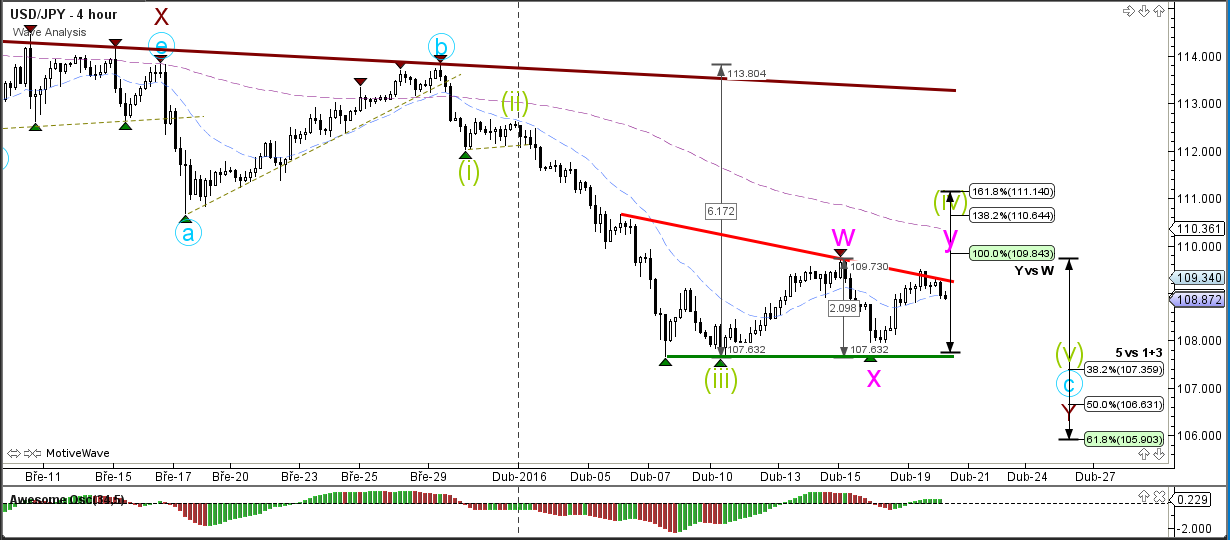

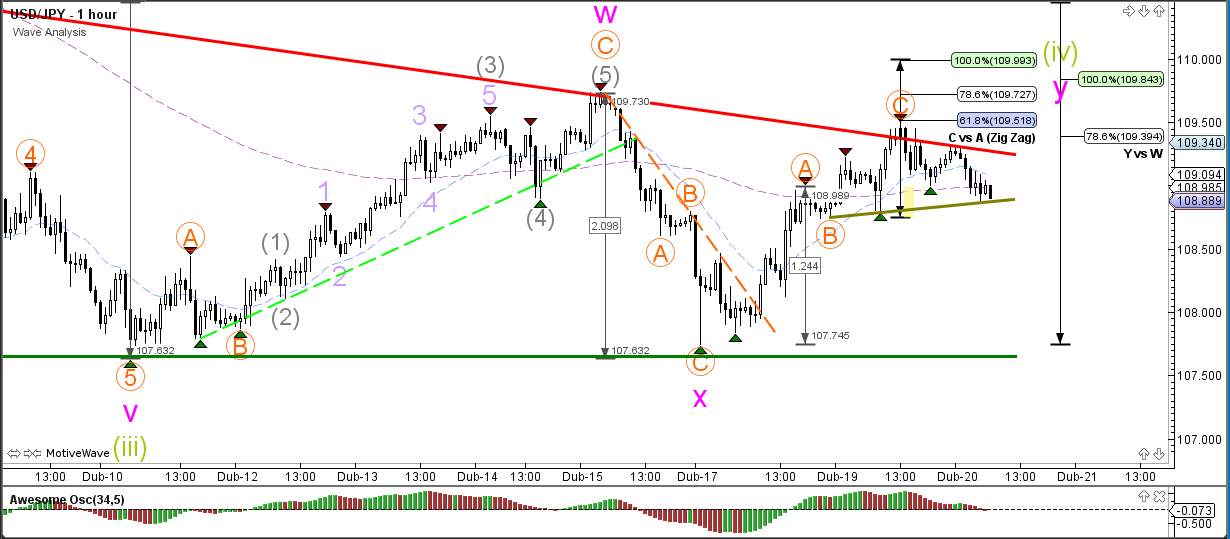

USD/JPY

4 hour

The USD/JPY has reached resistance (red) but is unable to break above it. A bearish turn could confirm the expansion of a wave 4 (green) correction via WXY (pink).

1 hour

The USD/JPY is building a mini triangle at the resistance trend line (red). A break below the support (green) of the triangle could indicate the completion of the bullish ABC (orange) zigzag.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.