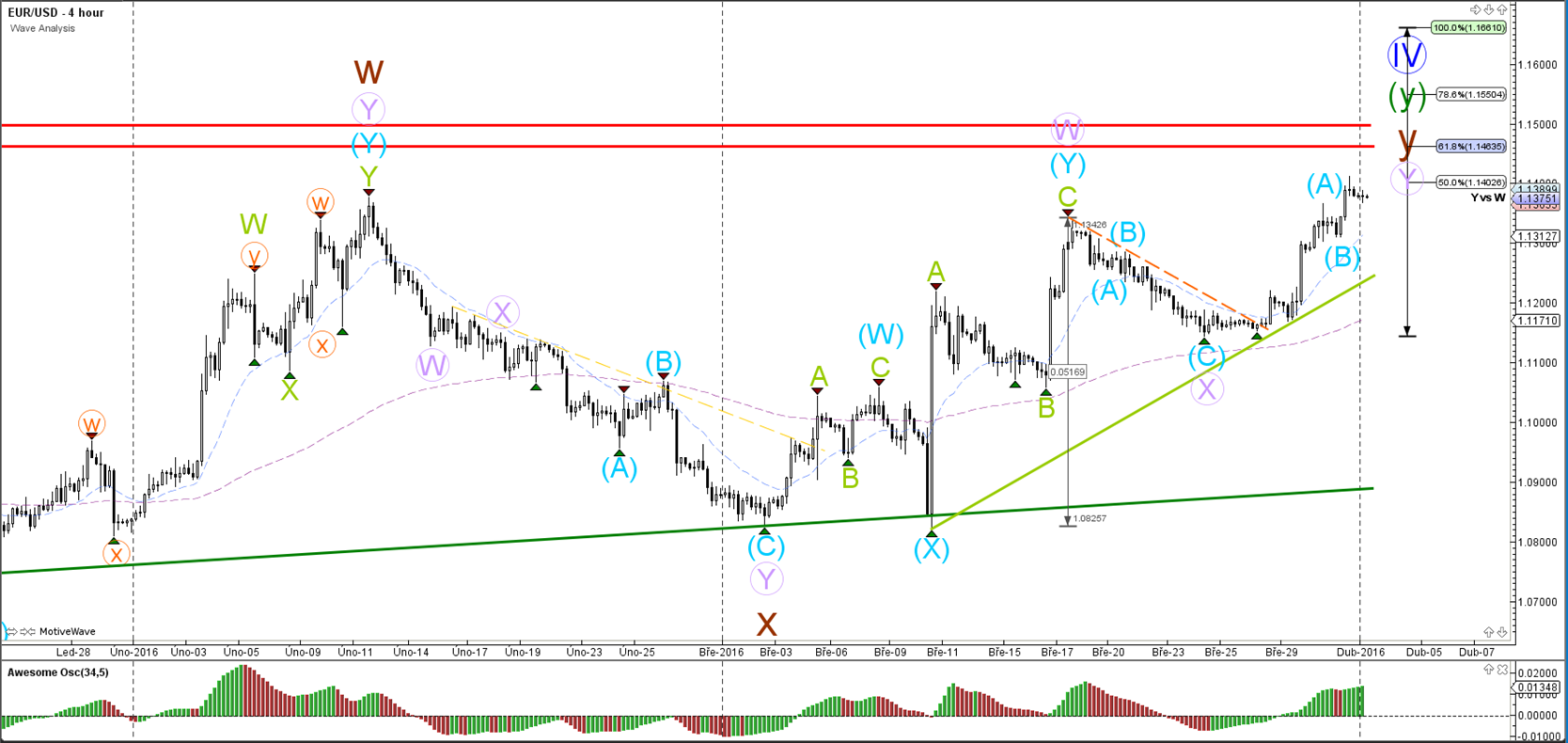

EUR/USD

4 hour

The EUR/USD showed more bullish momentum yesterday and has reached the 50% Fibonacci target. A bigger resistance zone could be at 1.15 where a 61.8% Fibonacci target and resistance trend lines are aligned.

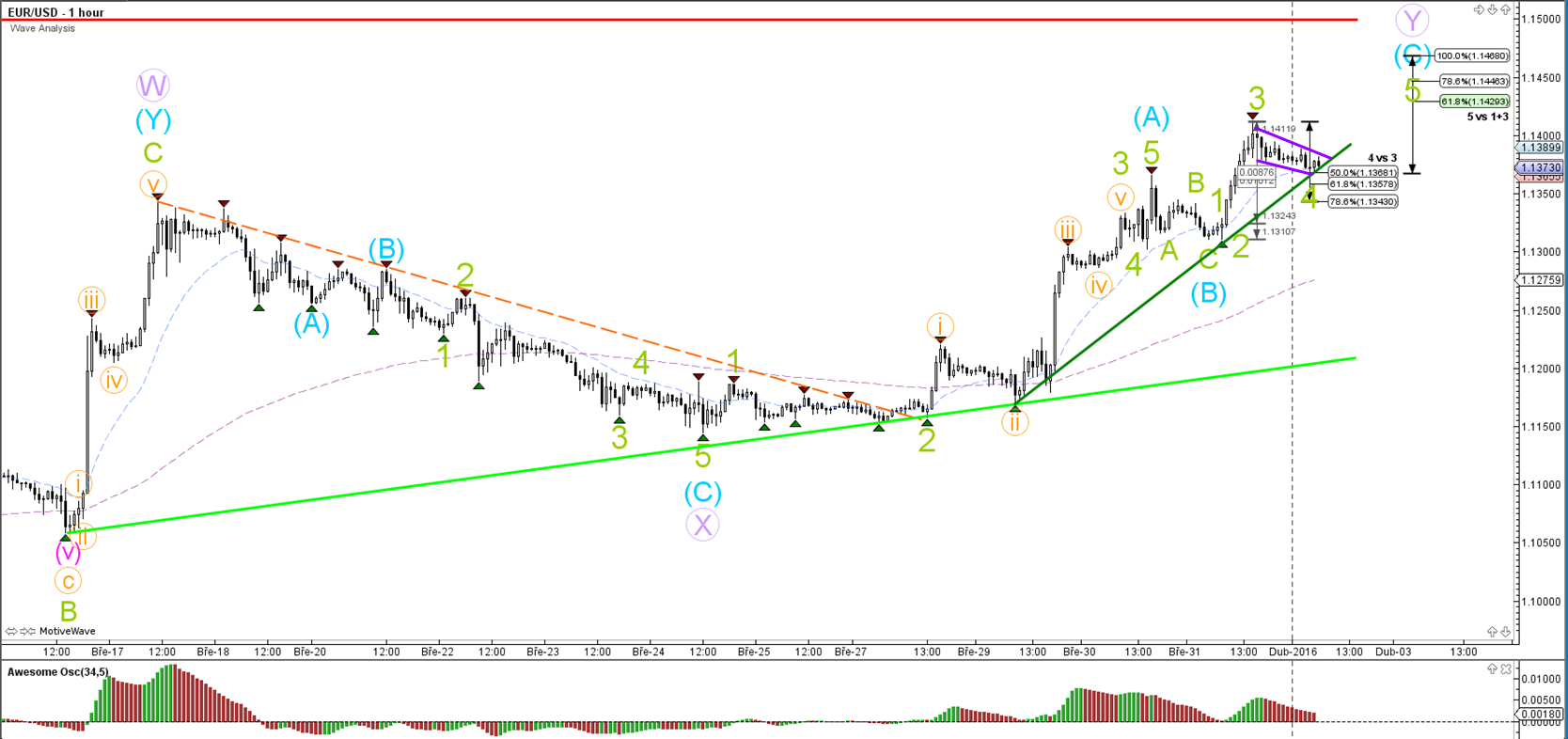

1 hour

The EUR/USD completed a shallow ABC bearish zigzag (green) within wave B (blue) after which price turned around to start the wave C (blue) continuation. For the moment it seems likely that price is in a bull flag (purple lines) chart pattern as part of a wave 4 (green). This is a major difference with the GBPUSD because price is making a bearish zigzag which is contrary to the EUR/USD’ bull flag.

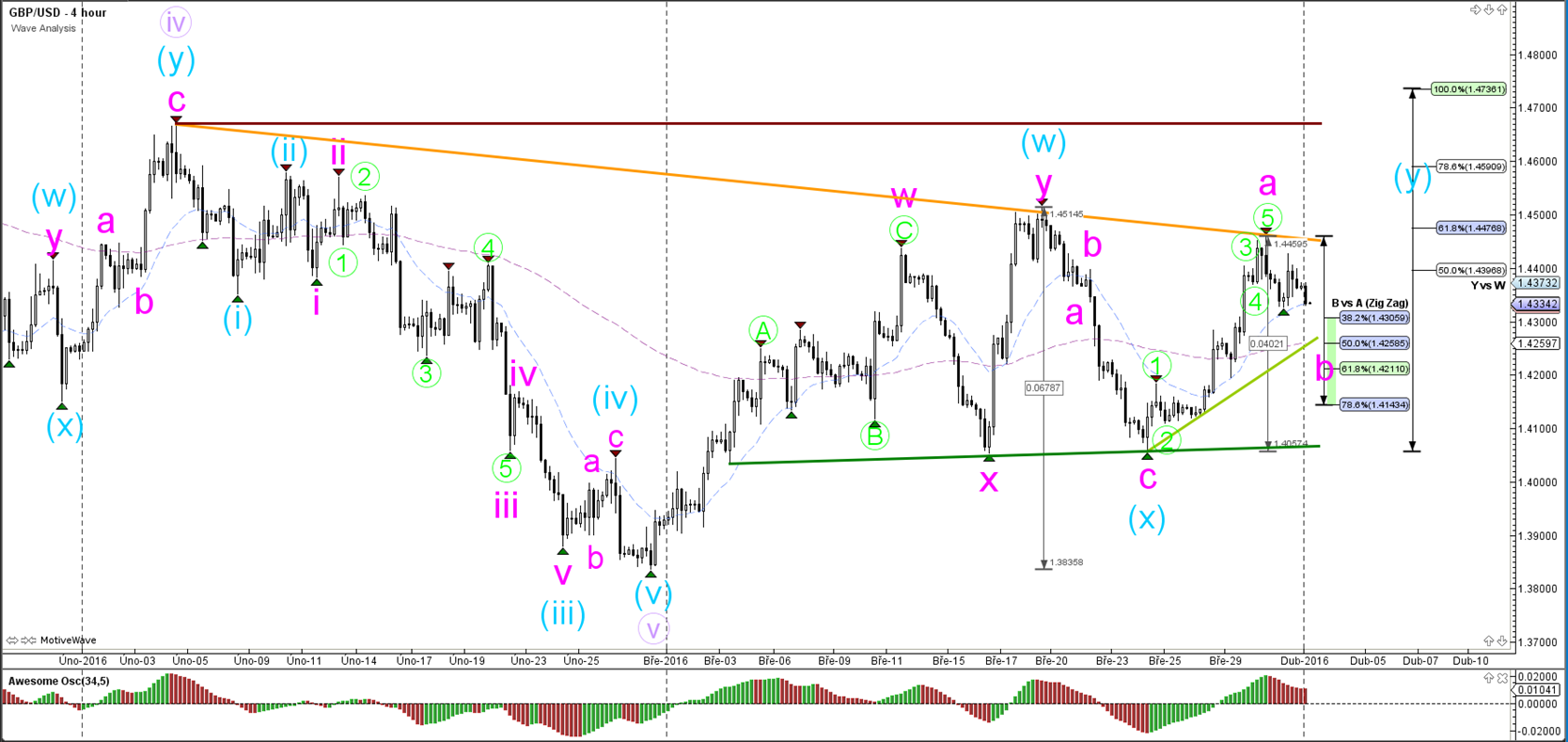

GBP/USD

4 hour

The GBP/USD has bounced at the 38.2% Fibonacci level of wave B (pink) but the rally was not able to break above the resistance trend line (orange) and price is expanding the bearish correction.

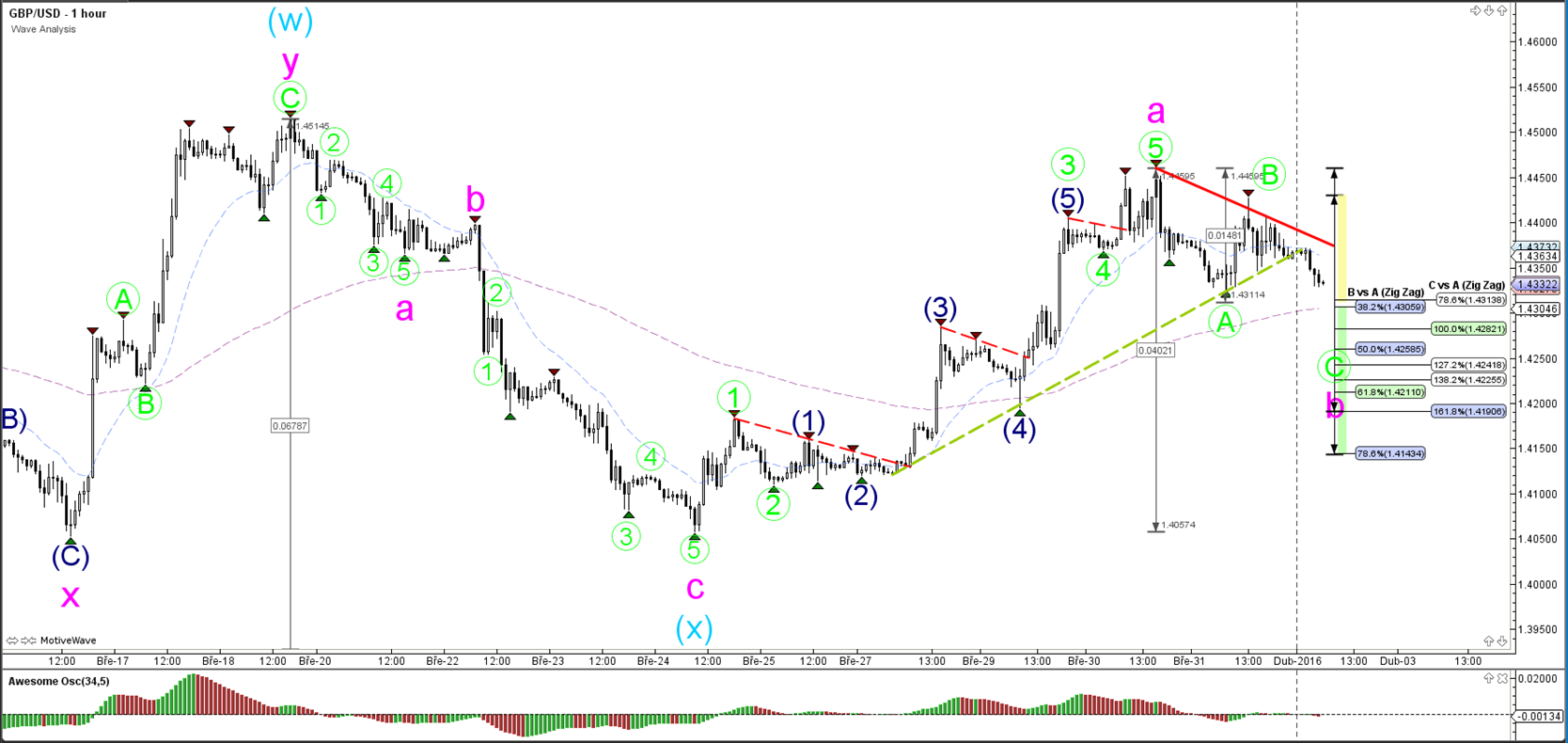

1 hour

The GBP/USD broke above below the support (dotted green) trend line, which makes it likely that a wave C (green) has started. A bearish ABC zigzag (green) could be underway now within potential wave B (pink). The wave B is vulnerable to change if price were to gain strong bearish momentum followed by a sideways correction.

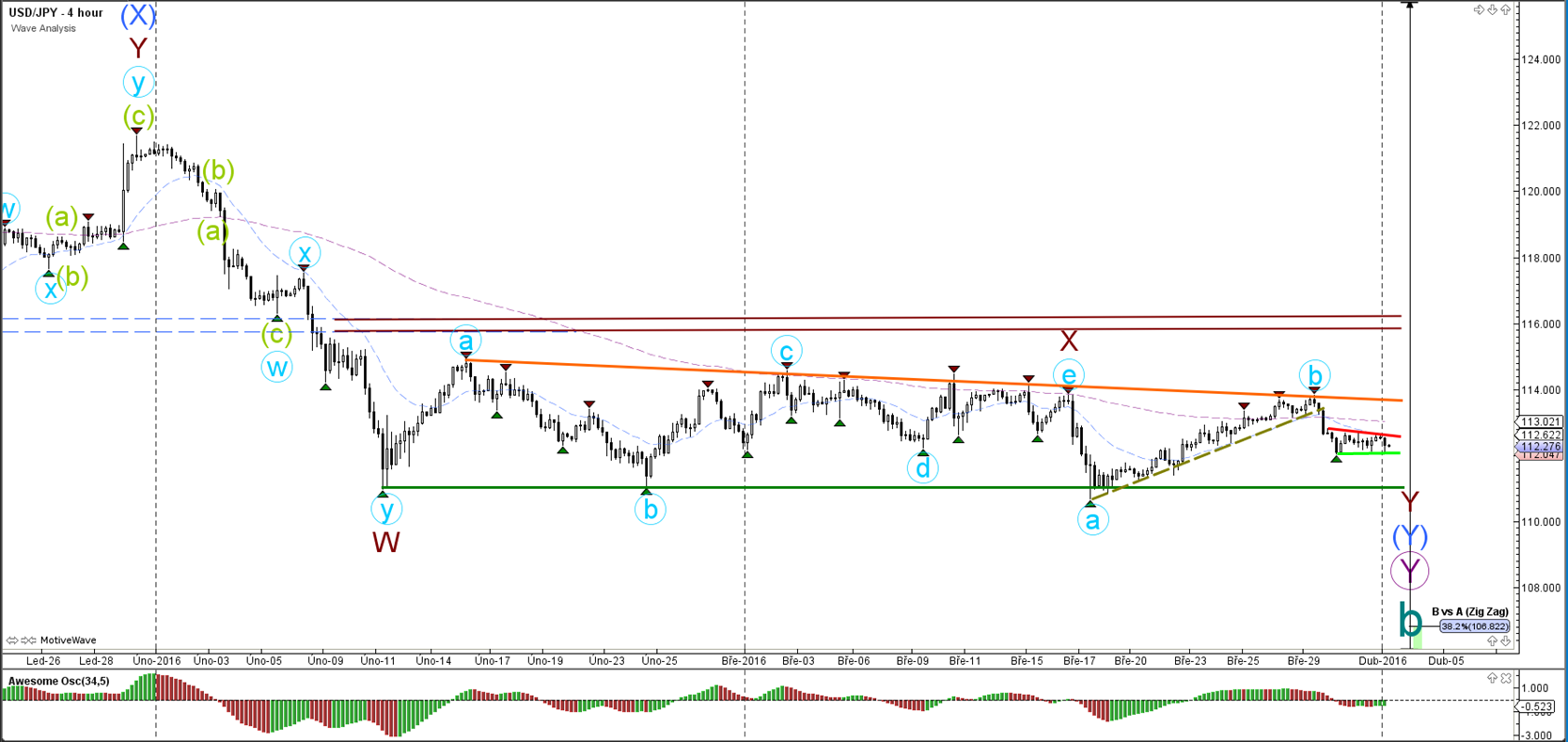

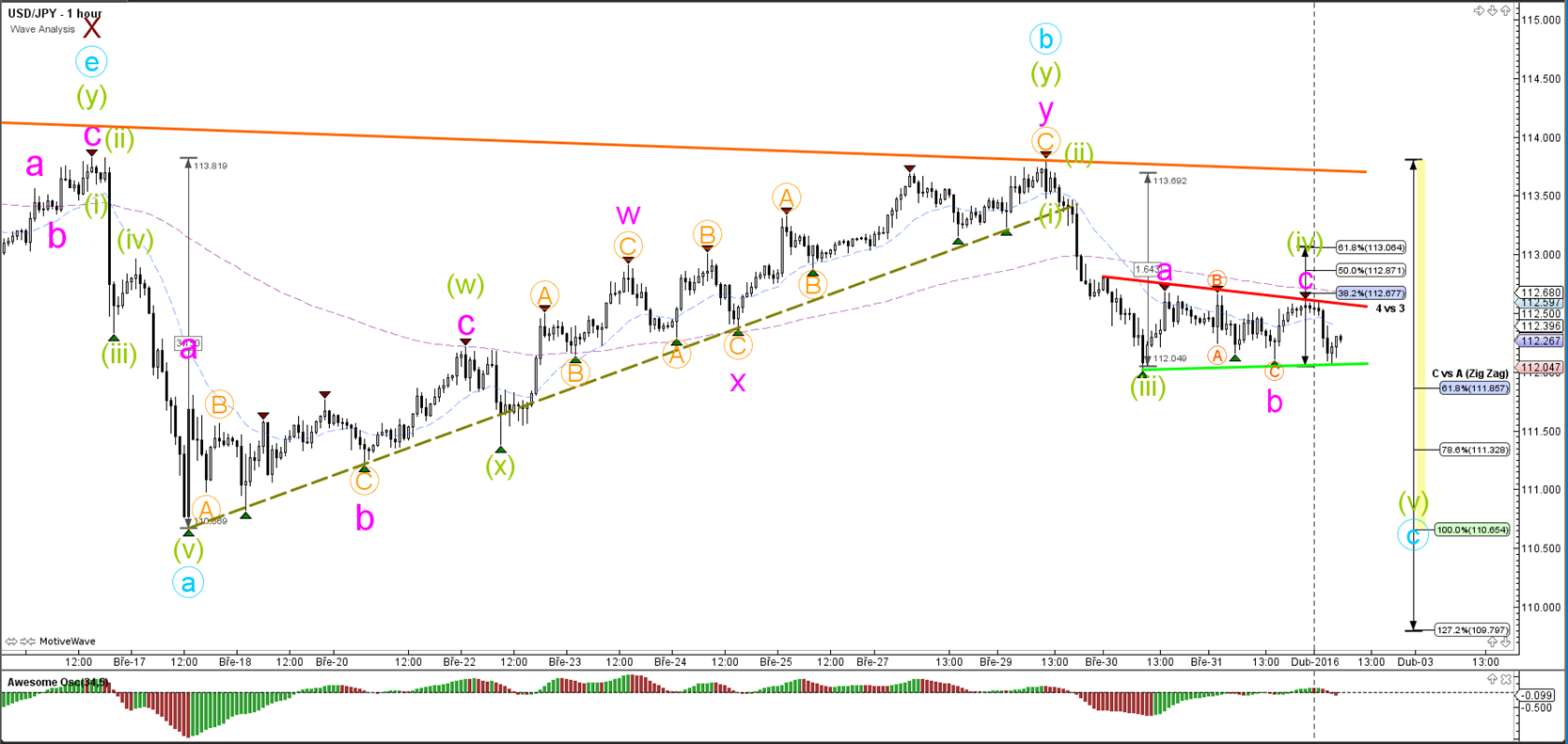

USD/JPY

4 hour

The USD/JPY continues with building a smaller contracting triangle below the broken bullish channel (dotted green). A bearish break could see price fall down to retest the double bottom (green).

1 hour

The USD/JPY has been testing the support and resistance lines of the contracting triangle. A bullish break of the triangle could see price retest higher Fibonacci levels or even the trend line (orange). A break above the top at wave B (blue) would however invalidate the bearish wave C (blue). A bearish break could see price fall down to retest the Fibonacci levels.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.