EUR/USD

4 hour

The EUR/USD showed a bullish bounce yesterday from the 138,2 support Fib but price is now at a resistance level (orange) of the downtrend channel. This is a break or bounce for the EURUSD. A bullish break could see price retrace higher as part of wave Y (blue).

1 hour

The EUR/USD upside could be the first part of a bullish momentum, which has for the moment been marked as a wave A (green). A break of the support trend line (green) could also indicate the continuation of the downtrend, although the wave B Fibs could be potential support levels.

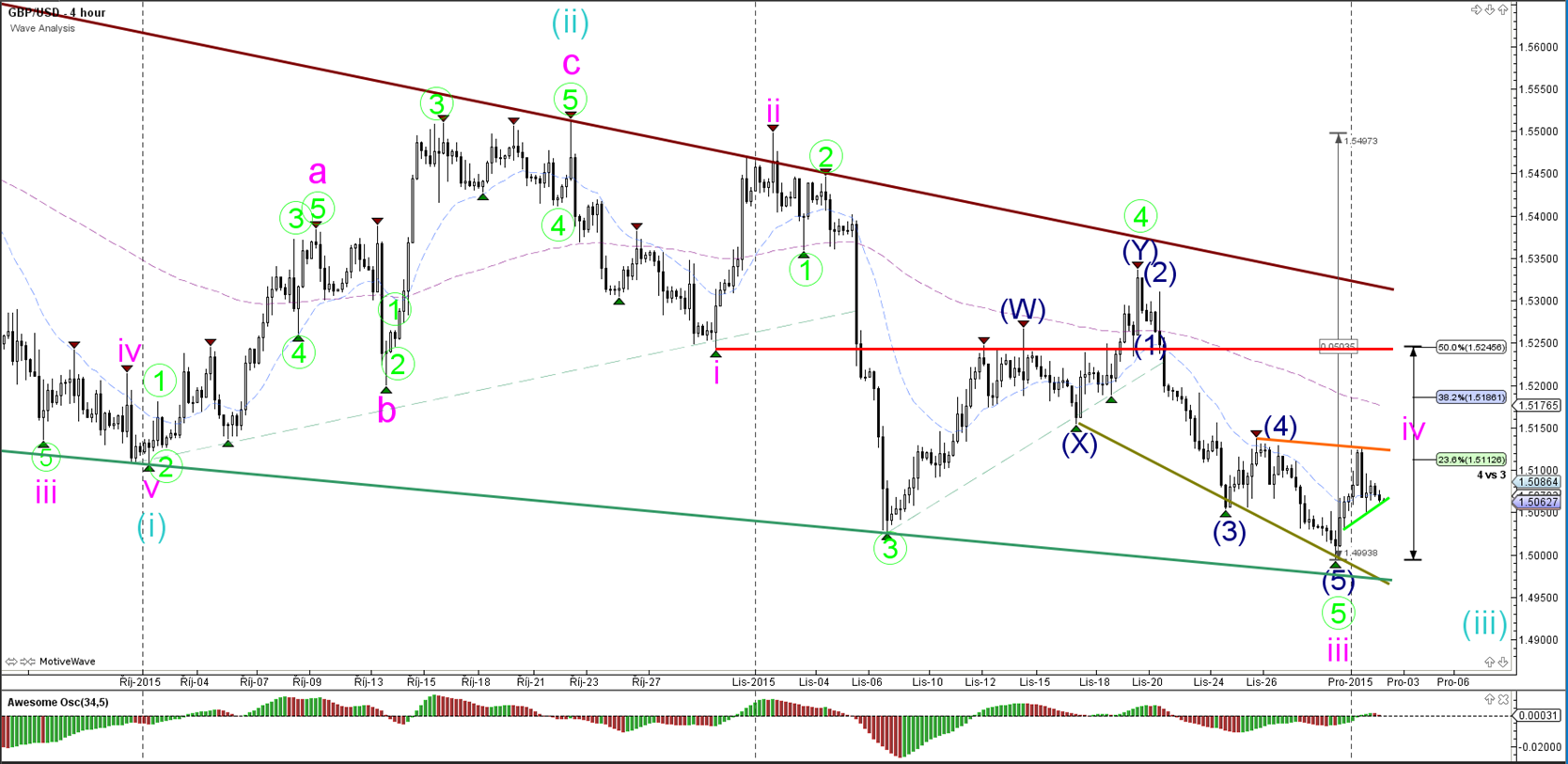

GBP/USD

4 hour

The GBP/USD has many support (greens) and resistance (reds) nearby. The invalidation level of the current wave 4 (pink) is marked by the horizontal red level.

1 hour

The GBP/USD is building a correction within wave 4 (pink). Price has already retraced back to the 23,6 percent Fibonacci level, which together with the 38,2 Fib are typical Fibs for 4th waves.

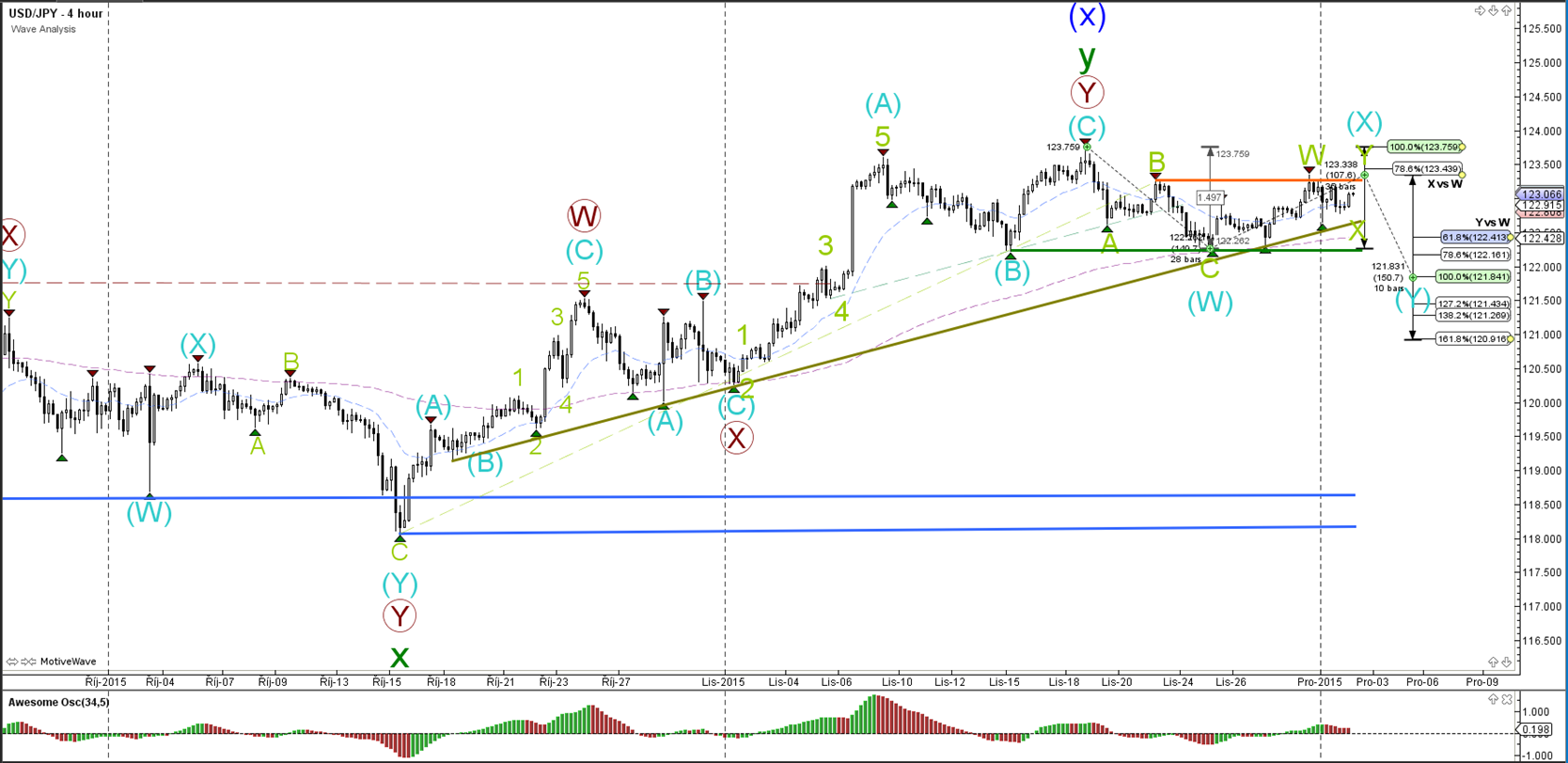

USD/JPY

4 hour

The USD/JPY is close to resistance levels, which offer a break or bounce zone. For the moment the wave count is indicating that price is in a wave X (blue) unless price manages to break above the 100 percent Fibonacci level.

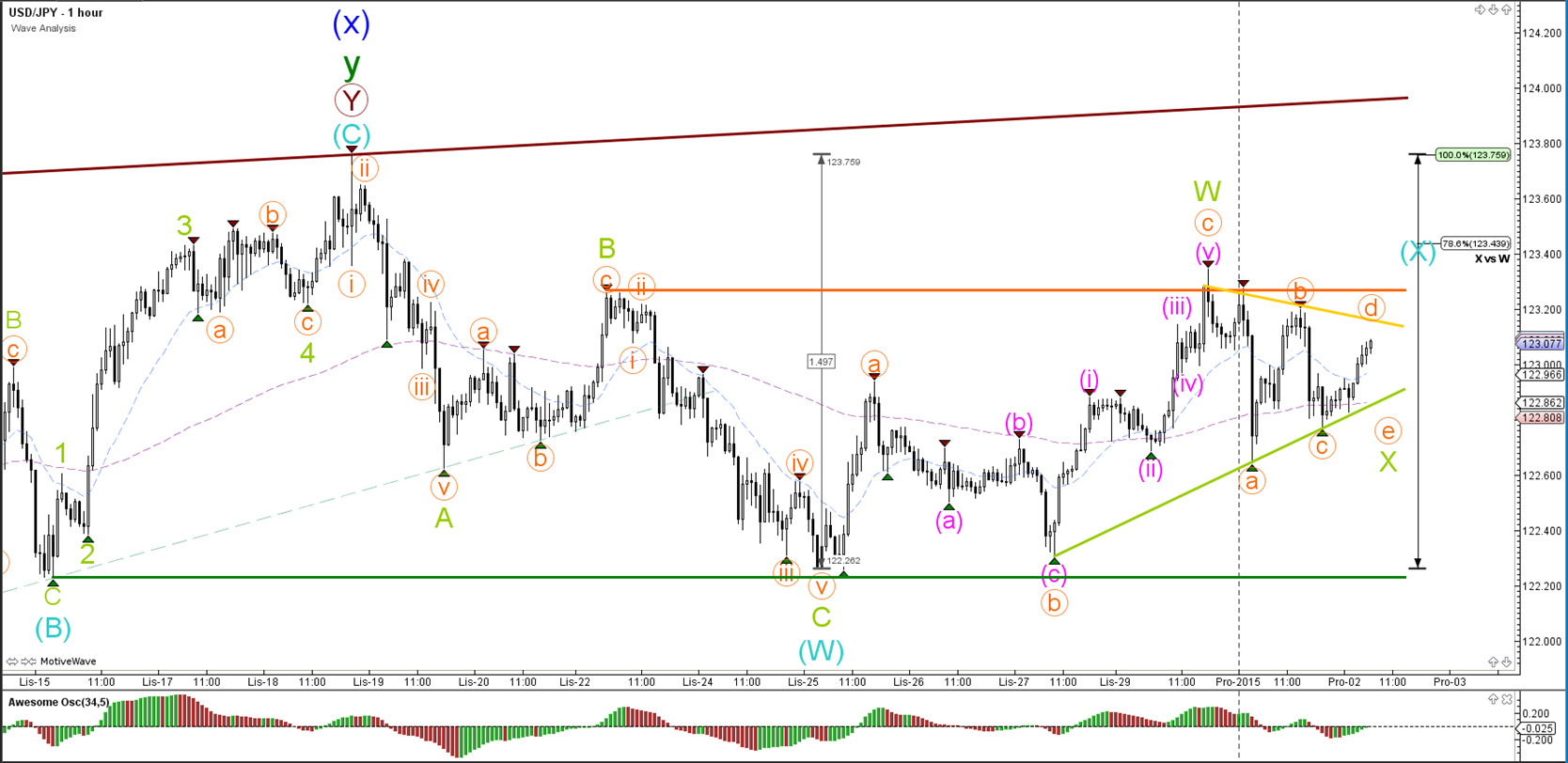

1 hour

The USD/JPY failed to show to a bearish 5 wave pattern and price has been building a contracting triangle pattern instead. The wave count reflects the triangle pattern and indicates that price could potentially make at least 1 more lower high and higher low.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.