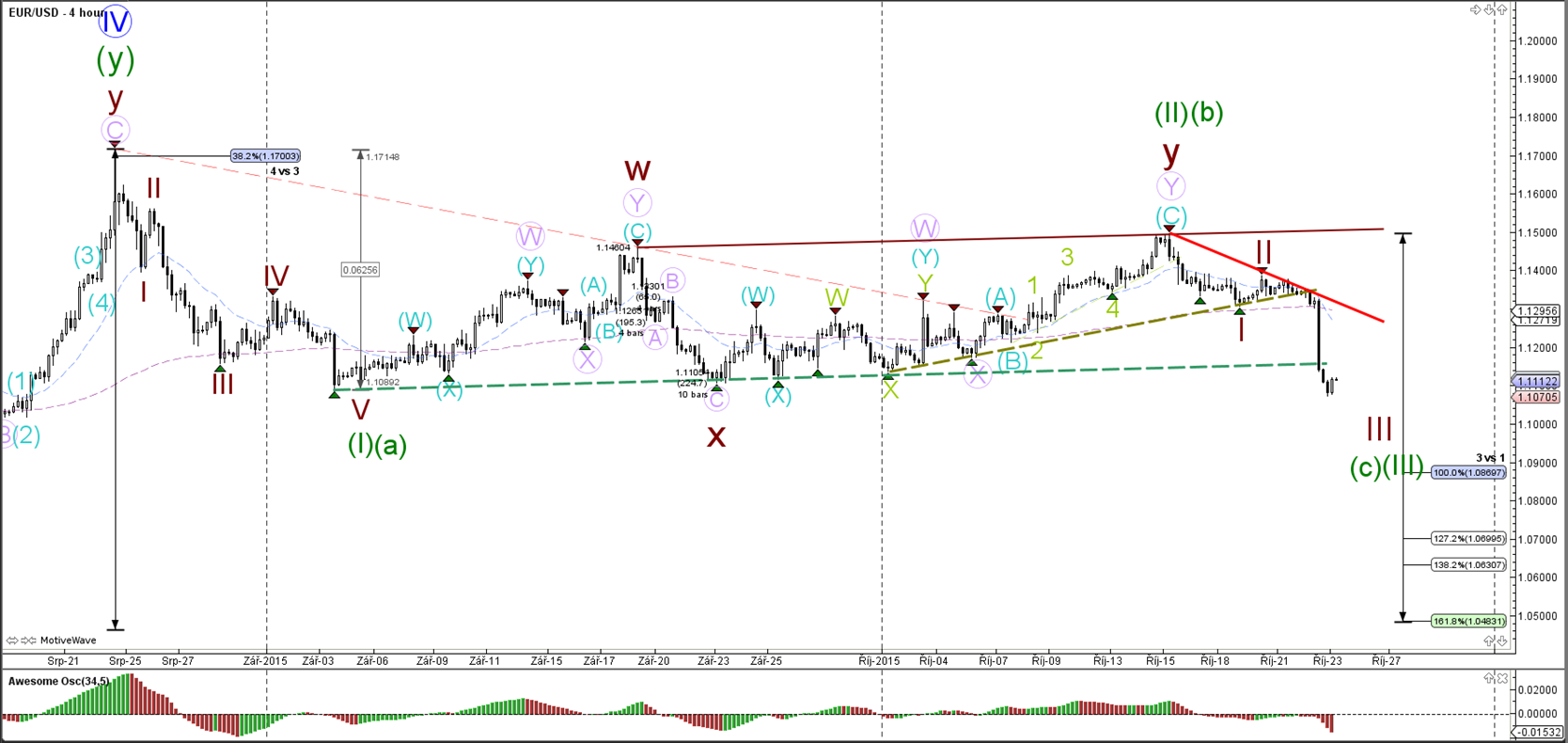

EUR/USD

4 hour

Yesterday’s news events connected to the Euro sparked the start of the wave 3 (dark red). Price broke below the various support levels (green) in a very impulsive fashion, which resembles the typical price action of a wave 3 of wave 3 (green/dark red).

1 hour

The wave 3 (dark red) has most likely not been completed and will see multiple continuations on lower time frames like the wave 3’s mentioned in the 1 hour chart. Whether wave 3 (green) has been completed remains to be seen but a pullback for wave 4 (green) will most likely find resistance at the 23.6-38.2 (max 50) Fibonacci levels.

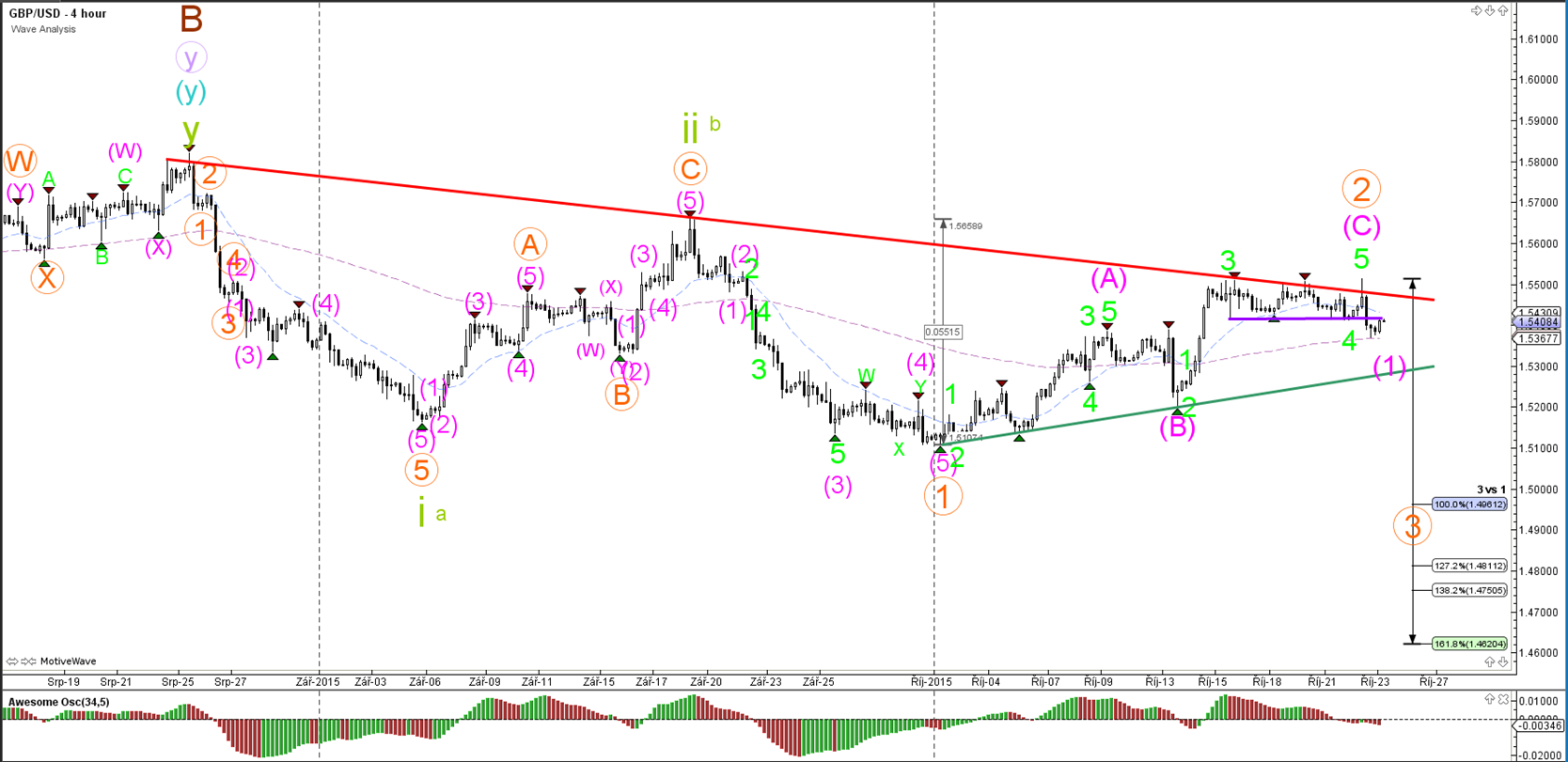

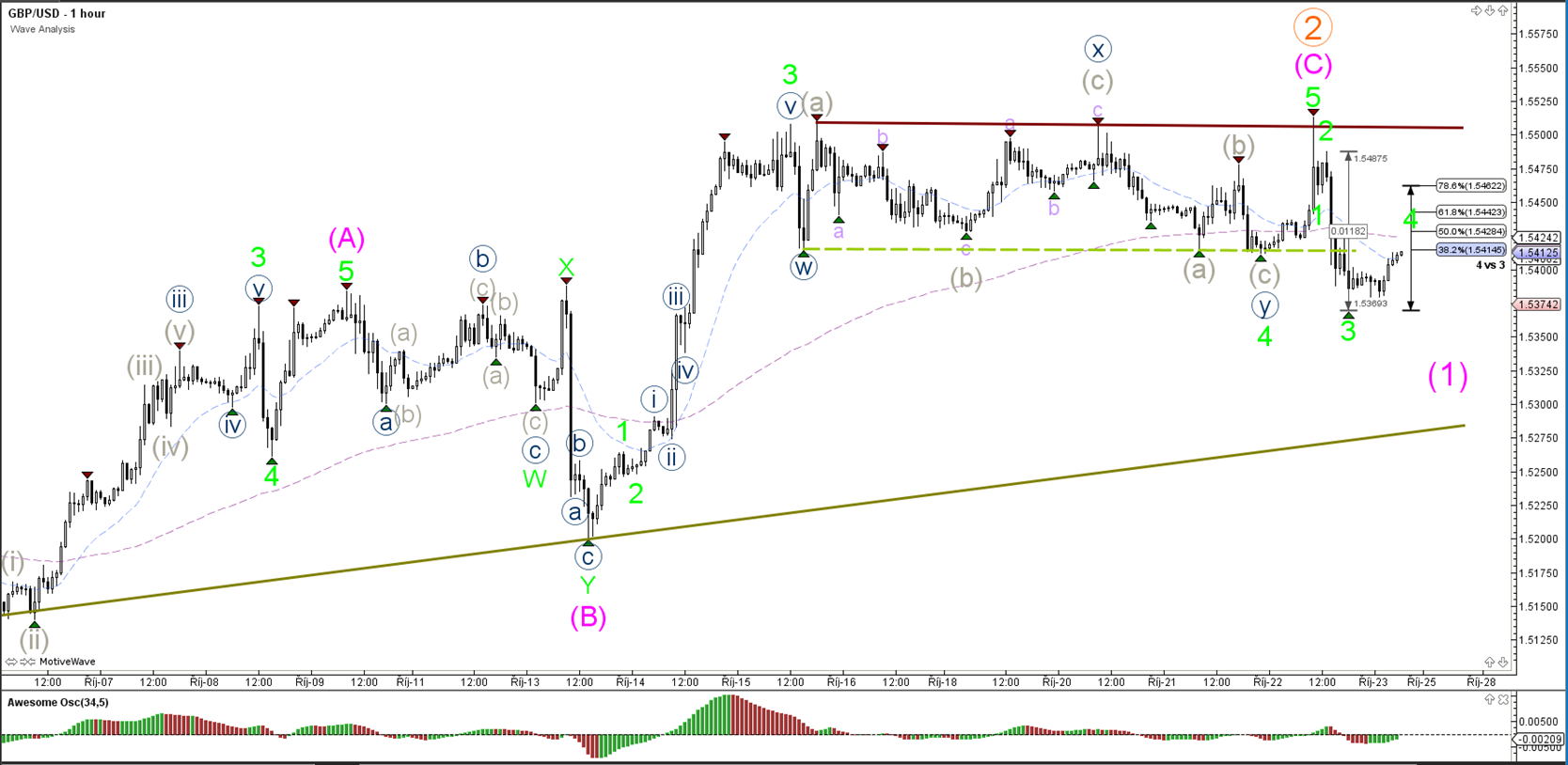

GBP/USD

4 hour

The GBP/USD broke below support (purple) after struggling at the resistance trend line (red) for quite a while. For the moment I have marked the wave 2 (orange) as completed and am anticipating a bearish turnaround on the GBPUSD.

1 hour

The GBP/USD could be building a bearish 5 wave (green) with price retracing for wave 4 and then following once more for wave 5. Price is still above the support level (green) which could be a level that supports the completion of a wave 1 (pink).

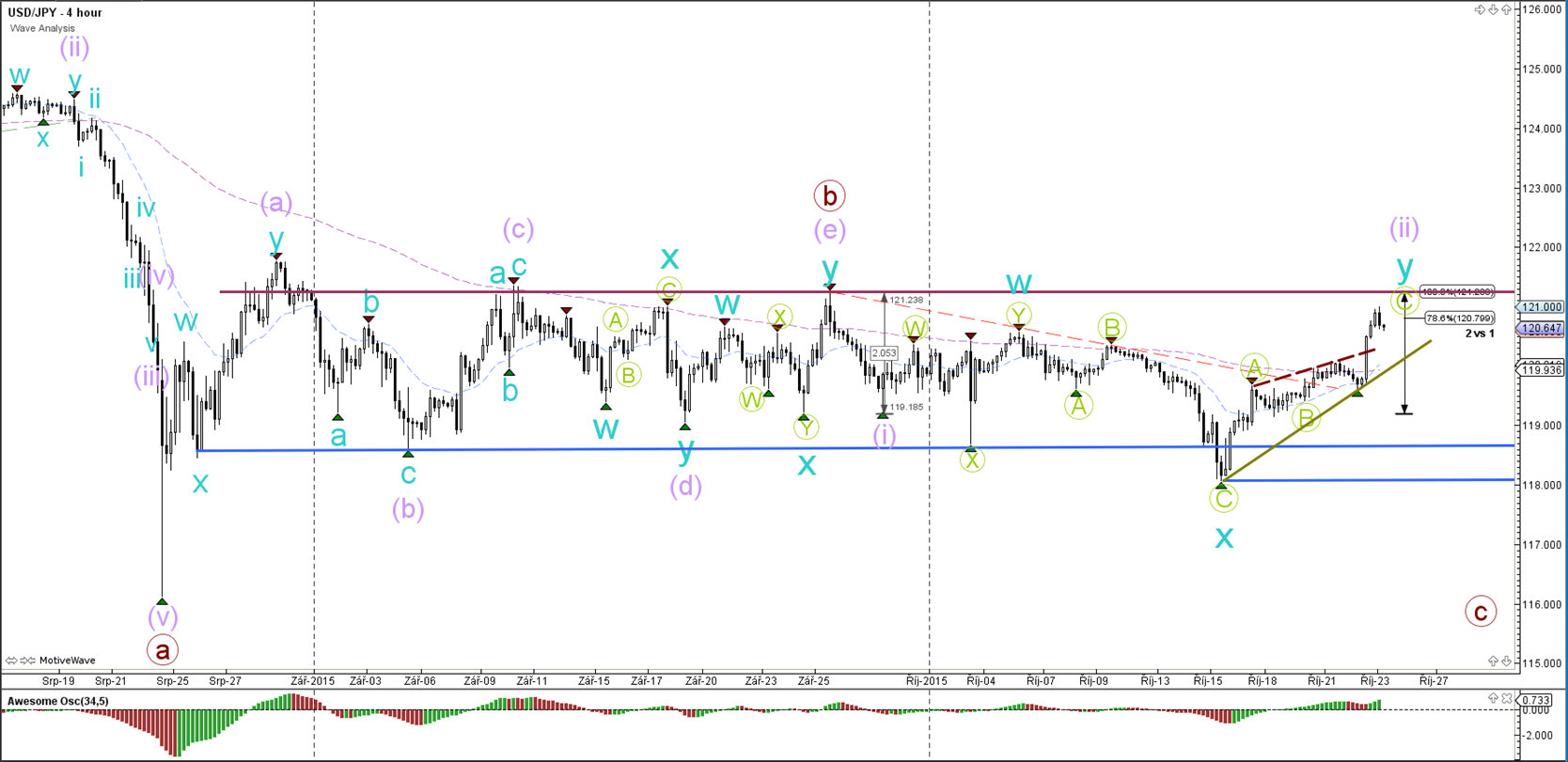

USD/JPY

4 hour

The USD/JPY is testing the top of the consolidation zoned (purple/blue) lines. The current wave 2 (purple) is invalided in case price is able to break above the resistance (purple) and origin of wave 1 (100% Fib). At the moment price could still subscribe to the ABC zigzag formation (green).

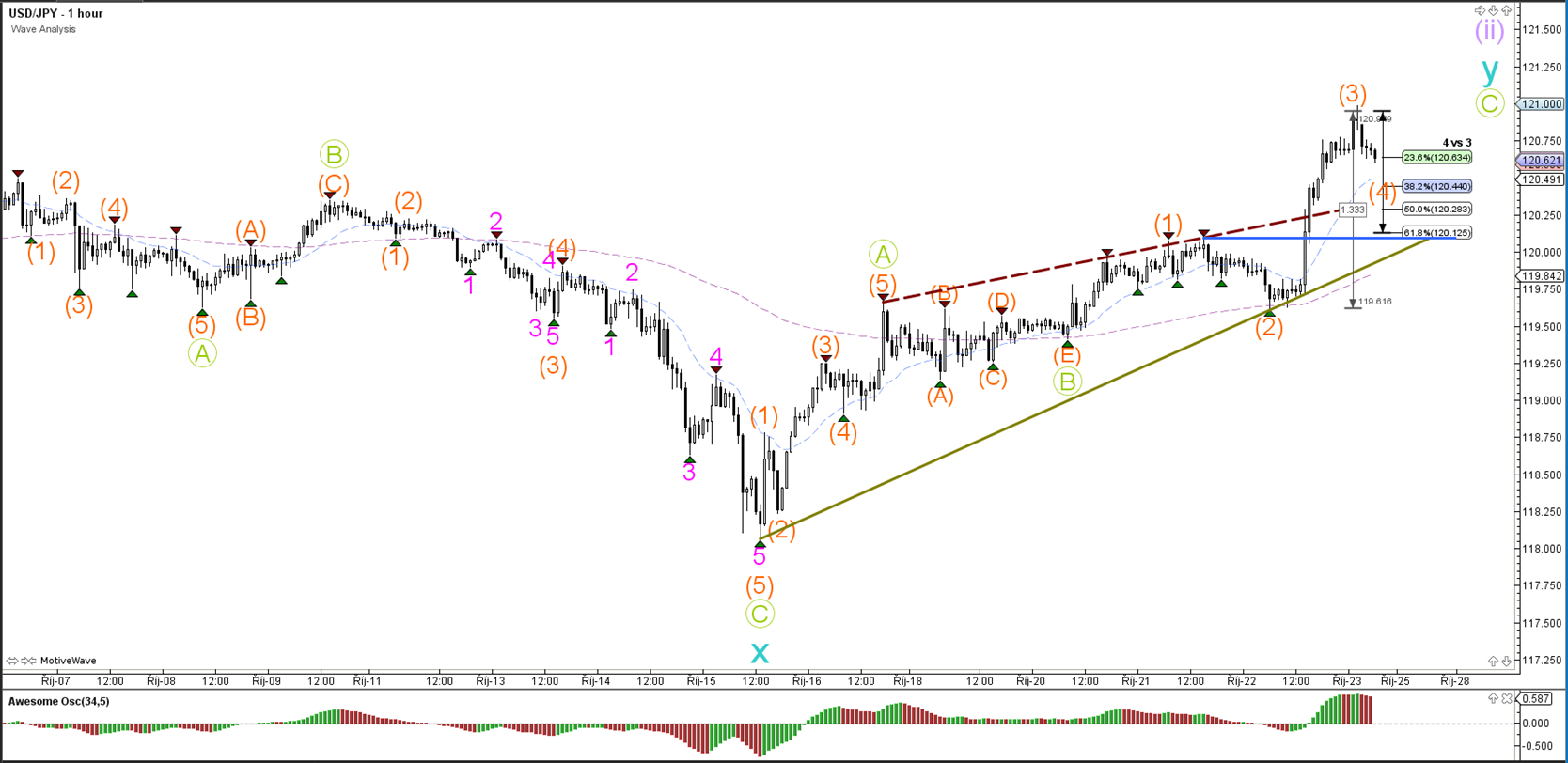

1 hour

The USD/JPY broke the rising wedge chart pattern when it broke above the resistance trend line (dotted dark red). The bullish impulse could be a wave 3 (orange), which means that the current retracement is a potential wave 4 (orange). A bearish break below the origin of wave 1 (blue) and support (green) changes the wave count.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.