EUR/USD

4 hour

The EUR/USD respected the 78.6% Fibonacci level after price broke the resistance at around 1.1325. The invalidation level of the wave 1-2 (brown) is the purple line. A break below support most likely confirms the development of the wave 3 or C (green).

1 hour

The latest bullish price action could have completed wave C (blue) or there could more upside remaining as price makes a wave 3 and 4 (green) within C.

GBP/USD

4 hour

The GBP/USD is currently showing a bullish retracement as part of the wave 2 (orange). Price stopped at the 50% Fibonacci retracement level but could go to a higher Fib if price does continue with an ABC zigzag (green).

1 hour

The GBP/USD seems to be building a bearish ABC correction (blue) within the wave B (green).

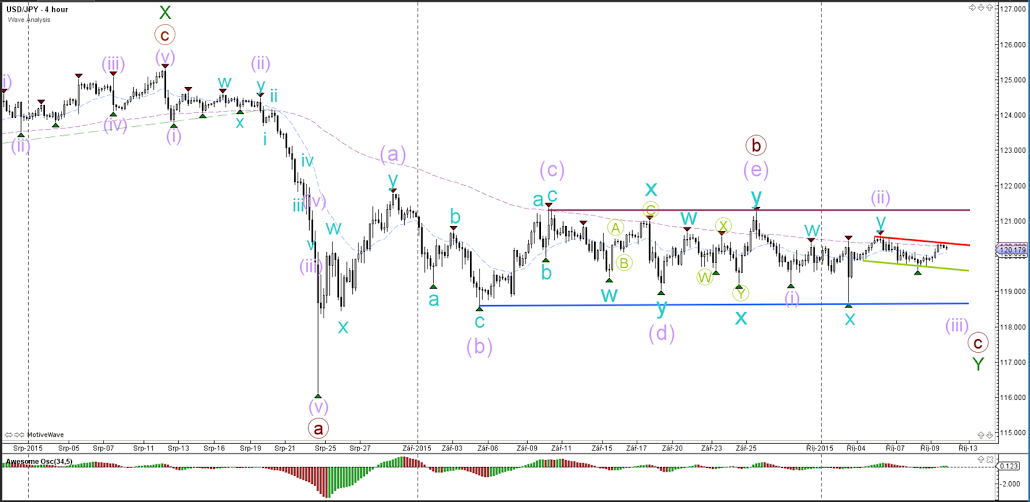

USD/JPY

4 hour

The USD/JPY remains secured in a consolidation (red/green) within a sideways range (purple/blue). The wave count is favoring a bearish structure with a wave B and C (brown) due to strong bearish momentum in August (wave A).

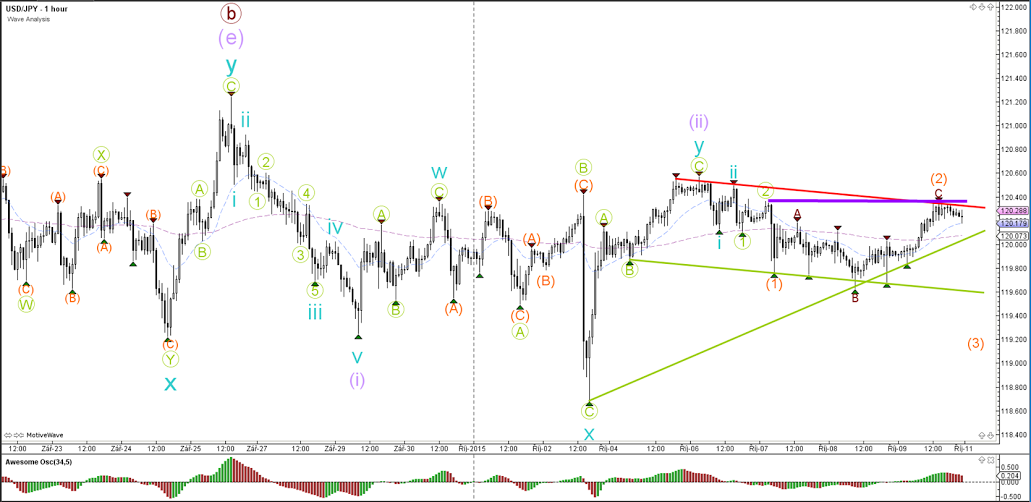

1 hour

A USD/JPY break above resistance (red/purple) invalidates the current 1-2 wave structure and could indicate, for instance, a deeper wave 2 (purple) retracement.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.