DAILY GBP/USD TECHNICAL OUTLOOK

DAILY GBP/USD TECHNICAL OUTLOOK

Last Update At 14 Nov 2017 00:49GMT

Trend Daily Chart

Sideways

Daily Indicators

Neutral

21 HR EMA

1.3115

55 HR EMA

1.3127

Trend Hourly Chart

Sideways

Hourly Indicators

Turning up

13 HR RSI

52

14 HR DMI

+ve

Daily Analysis

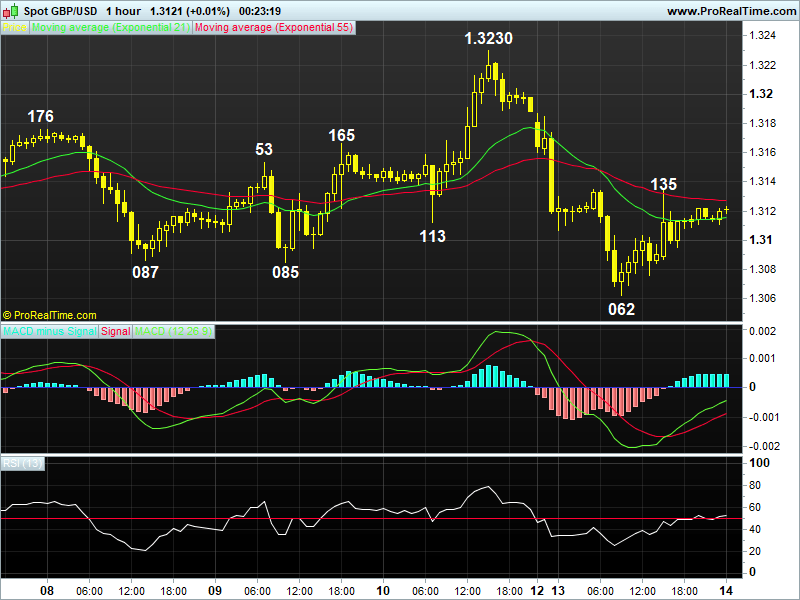

Consoldiation b4 one more fall

Resistance

1.3230 - Last Fri's high

1.3178 - Last Tue's high

1.3135 - Y'day's NY high

Support

1.3062 - Y'day's low

1.3040 - Nov 03 low

1.3027 - Oct's low (6th)

. GBP/USD - 1.3121.. Sterling took centre stage n came under heavy selling pressure after NZ open on Sun's news of challenge on May's leadership. Cable tan ked fm 1.3198 to 1.3108 in Asia, then 1.3062 (Europe) b4 rising to 1.3135 in NY.

. Looking at the bigger picture, cable's spectacular but erratic upmove after a 'flash crash' to 2016 31-year bottom of 1.1491 in Oct to 1.2775 (Dec), then strg gain to Sep's 14-month peak at 1.3659 confirms a major low is made. Having said that, sterling's selloff to 1.3027 in early Oct n then subsequent daily swings inside 1.3337-1.3040 range in next 4 weeks suggests further vola- tile consolidation would continue. As long as 1.3321 holds, downside bias re- mains, below 1.3040 would bring re-test of 1.3027, break would extend said fall fm 1.3659 to 1.2945/50, however, reckon 1.2774 (Aug low) should hold. Only abv 1.3337 risks stronger retracement twd 1.3418 (61.8% r of 1.3659-1.3027).

. Today, despite Mon's selloff to 1.3062, subsequent short-covering re- bound suggests further choppy trading abv Nov's trough at 1.3040 would continue, as long as 1.3135/40 holds, weakness twd 1.3040 is likely but key 1.3027 sup may hold. Only abv 1.3165 risks another rise to 1.3190/00 b4 another retreat.

Trendsetter does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Trendsetter does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Trendsetter shall not be responsible under any circumstances for the consequences of such activities. Trendsetter and its affiliates, in no event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.