Market Overview

It is FOMC day and the markets are characteristically pensive as the market prepares for the Federal Reserve to deliver its latest monetary policy statement. There has been little real positioning ahead of the meeting, although the strong move higher in recent days on US Treasury yields just looks to be contained slightly ahead of the meeting. Interestingly the US dollar has just dipped back in the last couple of days (i.e. not followed the lead of Treasury yields) and this leaves the market somewhat mixed going into the meeting. There is no expectation of any rate hike, but there could be some minor tweaks to the FOMC statement. Perhaps amending or removing the focus of the international economic and financial issues would give the hawks some hope/expectation of June, but the US data in recent days/weeks has been somewhat mixed and will not help the prospects of a hike in the next meeting. There are also central bank announcements from the Reserve Bank of New Zealand (not expecting a second consecutive cut after last months unexpected cut) and the Bank of Japan (which could introduce further negative rates supposedly on bank loans).

Ahead of the FOMC, Wall Street closed again subdued last night with the S&P 500 up just +0.2% although it will be interesting to see the negative impact of Apple today with the shares down over 7% on weak earnings last night. Asian markets were mixed to slightly lower with the Nikkei 225 -0.4%. European markets have opened mixed to slightly lower too today. In forex markets we see very little movement across the major currencies, with the significant exception of the Aussie dollar which is sharply lower after Australian CPI cam e in sharply lower than expected and will now question the need for the RBA to cut rates. Gold is marginally higher but interestingly we have also started to see silver rallying back higher again (albeit less than a percent higher today). The oil price is around a percent higher in early moves, continuing yesterday’s gains.

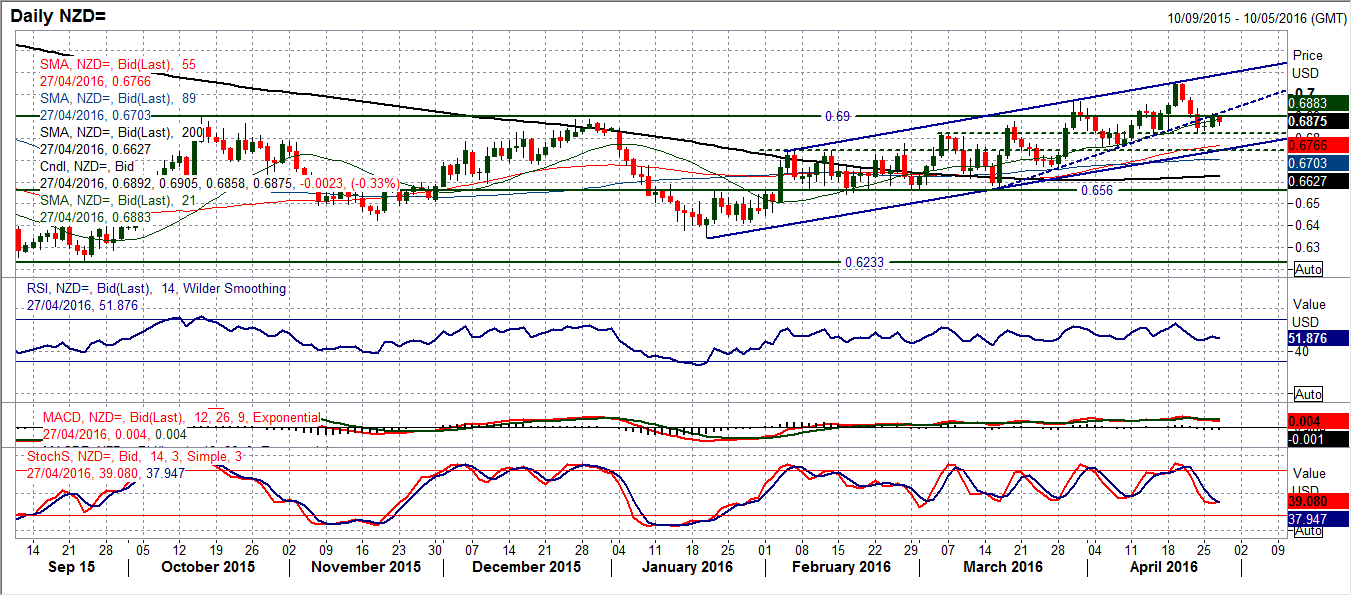

Chart of the Day – NZD/USD

With both central banks reporting monetary policy decisions tonight, it would be interesting to see what the technicals on the Kiwi/Dollar are suggesting. Both central banks are expected to stand pat (although the Fed could give a hawkish hint in its statement whilst the RBNZ has a slight possibility of a second consecutive rate cut, albeit unlikely). On a technical basis, the recent correction back from the $0.7055 high was sharp, forming three strongly bearish candles. This move has now seriously tested the bullish medium term outlook and the pair seems to be at a bit of a crossroads ahead of the central bank decisions. An uptrend intact since the March low of $0.6575 has been broken by the recent correction, and this broken uptrend is now becoming a basis of resistance. This could now mean a move back towards the support of the three and a half month uptrend channel, currently around $0.6750. The recent dip has bounced off the old pivot again at $0.6820, but this now opens the prospect of a near term head & shoulders top pattern which would complete on a close below $0.6820 and imply around 230 pips of downside. The bulls would point to the daily momentum indicators which have consistently retained a positive configuration in the past three months with the RSI bouncing from 45/50 and the Stochastics turning positive again around 40. Corrections have tended to be seen as a chance to buy, but the early weakness today is beginning to question this and support needs to be held at $0.6820 otherwise a deeper correction could set in. Above yesterday’s high at $0.6910 the initial resistance is in the band $0.6950/$0.6965.

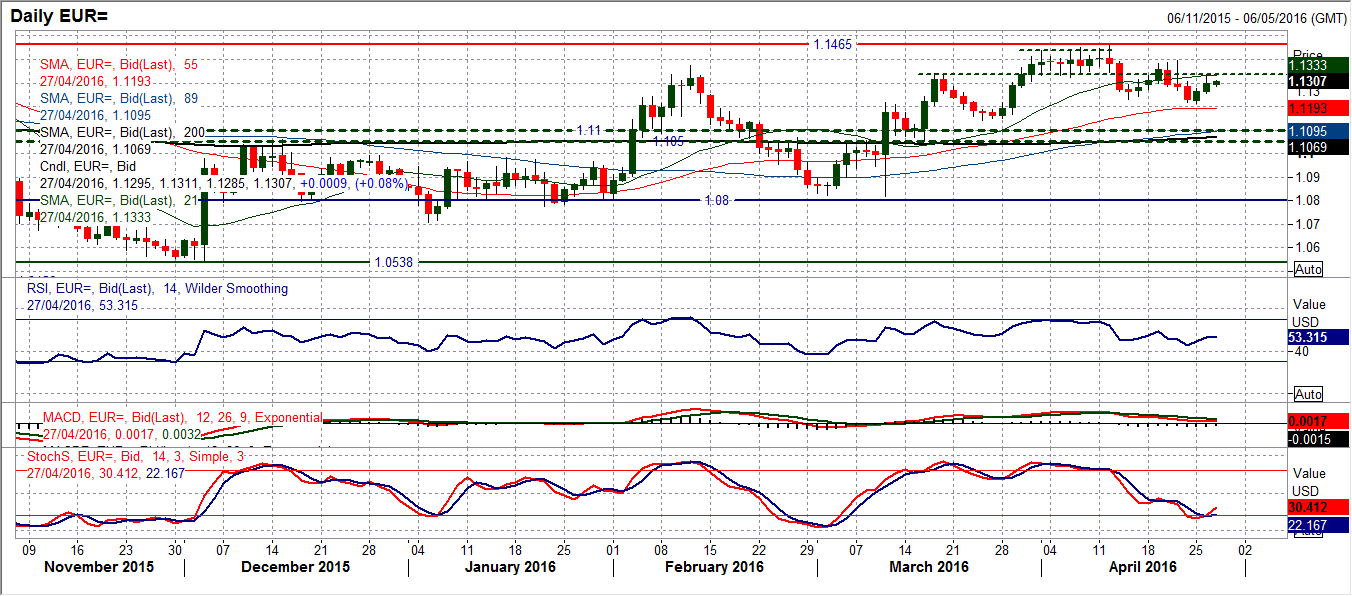

EUR/USD

The euro has now rallied for the past two days and posted couple of reasonably positive candles. However, I see the corrective configuration on the medium term technical indicators and this looks to be another rally that is likely to come as a chance to sell. The rally yesterday hit the old pivot line around $1.1330 and then fell back and there is a chance that this will prove to be another lower high under the $1.1395 posted last week. The main caveat today is that tonight we have the FOMC meeting which is likely to mean limited direction in front of the announcement and subsequently after 1900BST we will see some direction. On technicals alone I am still looking at the pair to come back into the support band $1.1100/$1.1200 before the likely next buy signal, however a dovish Fed tonight is the big risk to this as it would send EUR/USD higher. The long term resistance remains $1.1465.

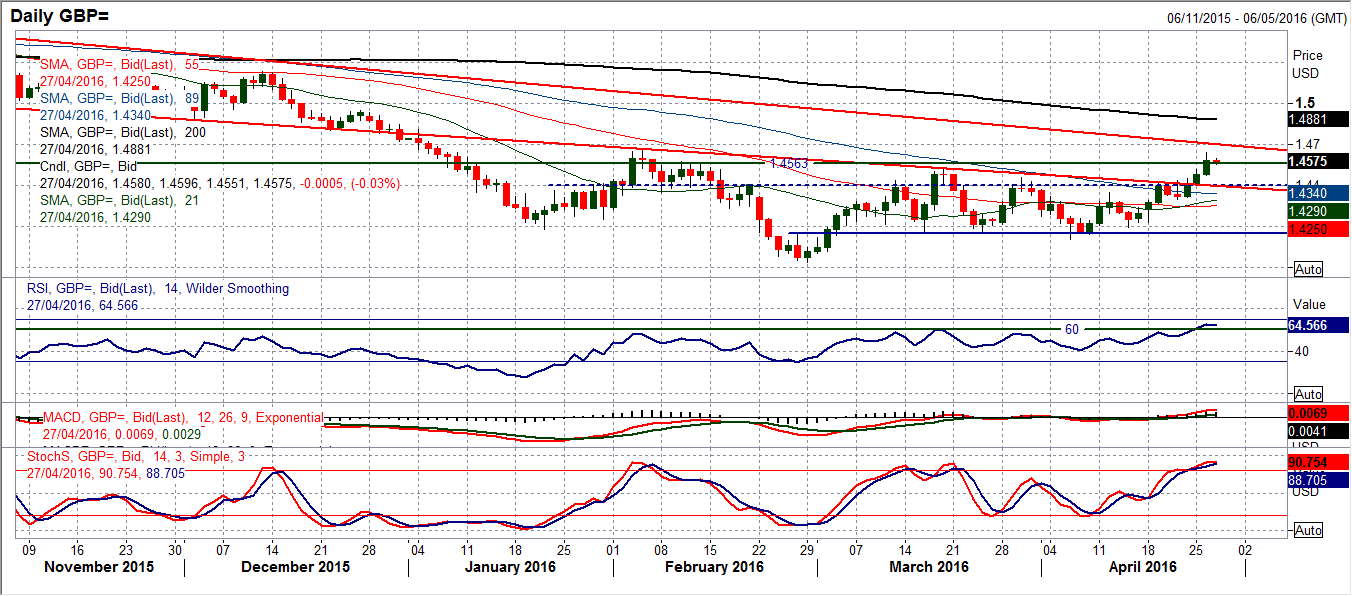

GBP/USD

Cable continues its strong run higher and is now up to testing some key medium to longer term resistance. Between $1.4563 and $1.4670 there a band of just over 100 pips of significant resistance that formed from the key low from 2015 and the reaction high of February. It would be a key move if sterling managed to breach this band. I continue to focus on the RSI moving decisively above 60 as a signal that the bulls are gaining in confidence, whilst the Stochastics are strong and the MACD lines are ever improving too. The bulls will be looking for another higher low to provide a foothold for the developing bull trend. This is the day of the FOMC and there could be some interesting volatility, which could also mean some trading opportunities arise. The hourly chart shows consistent gains and strong near term momentum too. Near term corrections have been using previous breakout levels as the basis of support for the past 6 days now and this means that there is support at $1.4470, $1.4440 and $1.4400, whilst the key near term reaction low comes in at $1.4300.

USD/JPY

Despite shaping up for a correction back in the past couple of days the pair has continued to find support around the old 111.00 floor again. Intraday dips below 111.00 have failed to be confirmed by a closing move and the support remains in place. It would seem as though this is the stage set moving into the FOMC meeting tonight and subsequently the BoJ meeting early tomorrow. Volatility in front of these two key events is understandably muted and by this time tomorrow morning we could have some tone of direction that is set for the coming days/weeks. Momentum signals are tailing off in their decisiveness with the RSI flattening just above 50, the MACD lines also shallowing their unwind and the Stochastics rolling over. Traders look to be unwilling to take a view ahead of such key events. Near term resistance is at 111.90, but until 113.70 there is nothing notable on a technical basis that would really change the outlook. Initial support is around 109.75 with the key support at 107.60.

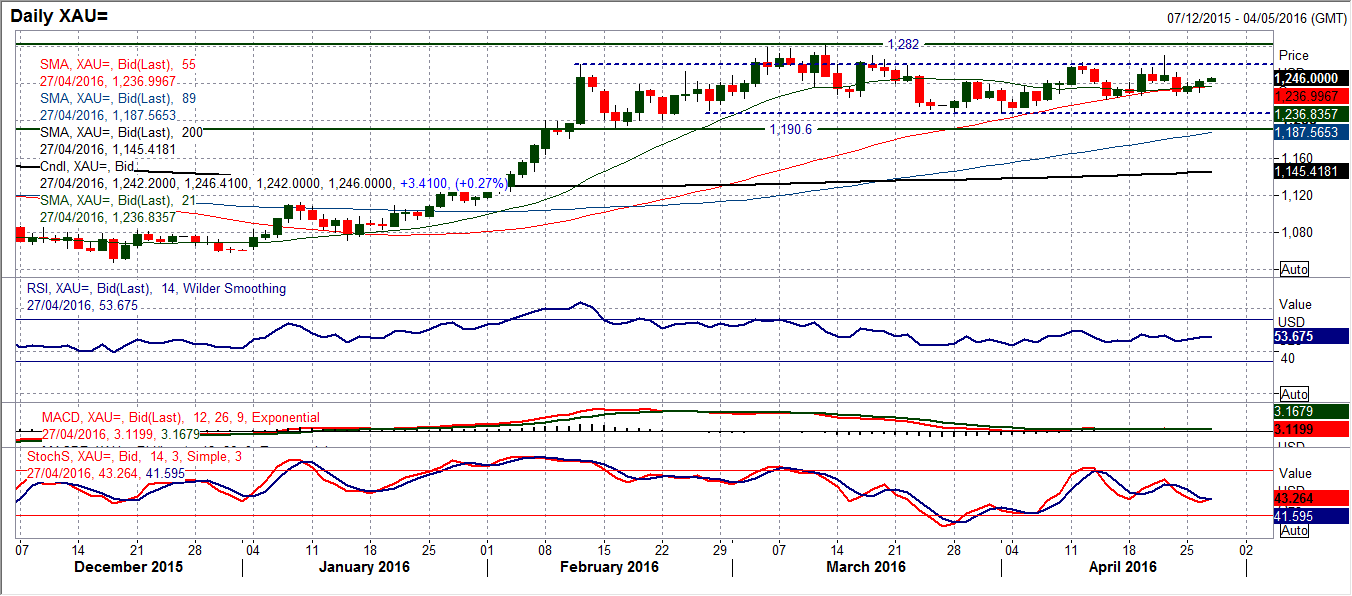

Gold

The mixed outlook on gold continues as the range remains firmly set and the early part of the week have been characterised by small bodied candles that reflect an uncertain market. This all comes ahead of the FOMC meeting this week (which historically has a key impact on the price of gold). The fact that there has been a slight pick-up in the price might be taken as a slight preference for a weaker dollar (and subsequently dovish FOMC outcome) but there is no real signal of conviction. The Hourly chart shows pressure on the $1243 pivot, but again I do not expect any real direction in front of the announcement. The range limits could come under pressure in the post-Fed moves, with initial resistance coming in around $1260 with $1282 being key. The support bands to watch remains initially the $1225 pivot and then $1208 with $1191 the key 11 week range support.

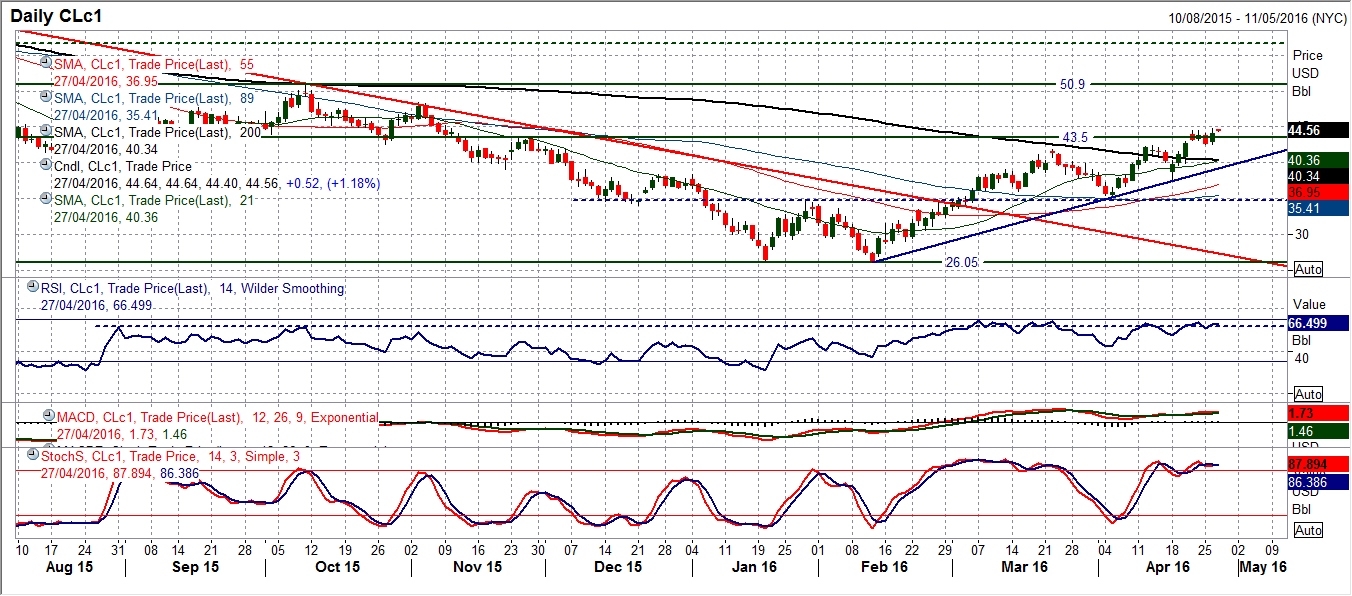

WTI Oil

The bulls managed to hold off the near term corrective outlook with the support coming in just above the band of support $41.50/$42.40 to form a bullish candle that saw strong gains (a weaker dollar certainly seems to have helped). This has once more pulled the price to breach Thursday’s high at $44.50. Despite failing to close above the resistance, the early gains today sustain the positive intent, although the bulls could be limited with the prospect and uncertainty ahead of the FOMC decision tonight (a hawkish move is likely to be negative for dollar denominated commodities such as oil). Technically the medium term outlook remains strong and any corrections continue to be seen as a chance to buy. Support around $42.40/$42.50 has been bolstered. The next real upside resistance above $44.85 is not until the key November high up at $48.35.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.