Market Overview

Market confidence looks to have been shaken once again as the oil price is setting up for another bout of selling pressure. The rumours of an agreement between OPEC and Russia over production levels have somehow fuelled a sharp recovery on oil (something which to me shows just how nervous and volatile traders have become), despite there being little real ground to base the recovery on. Hope of a deal have faded and the oil price has dropped again, helped no doubt by the disappointment of the China PMIs. So there is a preference for the safer havens once more, with the Japanese yen once more strengthening and US Treasury yields again falling. Wall Street closed last night around flat but well off the lows in the wake of a dovish skew in comments from FOMC vice chairman Fischer. Asian markets followed a more risk off sentiment overnight as the Nikkei shed 0.6% as the yen strengthened again. European markets are trading lower as once more the oil price is the guiding hand for market direction.

Forex markets have become all rather choppy in recent days, although the uncertainty could give way once more to the safe haven split if the sell-off in oil does indeed resume. The euro has been supported as has the yen, whilst the commodity currencies are under pressure. The Reserve Bank of Australia has maintained its 2.0% interest rate but also noted in its statement that monetary policy needed to remain accommodative due to the impact of low commodity prices on the economy. Gold has just given back some of its gains from yesterday, whilst oil is lower by over 1% in early moves.

Traders do not have a great deal to go on today (this is the quiet day of the week), however Eurozone unemployment is announced throughout the morning, culminating with the regional data at 1000GMT which is expected to remain around 10.5%.

Chart of the Day – USD/CAD

Just as we are starting to get some more negative signals that question whether we have seen the interim high in oil, we are also getting some signs of the waning correction on Dollar/Loonie. The pair has been accelerating higher for the past 9 months as uptrends have become steeper, and the latest correction has merely unwound the price back to the support of the uptrend in place since mid-October. This is also coinciding with the support of the old breakout resistance in the band 1.3940/1.3990. The RSI has unwound and seems to be bottoming out around the mid-40s, whilst the Stochastics are also on the brink of turning higher too. The immediate support is yesterday’s low at 1.3905. There is still a sequence of lower daily highs and if this sequence can be broken this would be another suggestion of waning downside. Yesterday’s resistance at 1.4060 subsequently is the initial barrier to overcome, whilst the intraday hourly chart shows 1.4110 and 1.4155 as subsequent upside levels to test. The key support comes in at 1.3795. The fact that USD/CAD could be bottoming out does not bode overly well for general market sentiment.

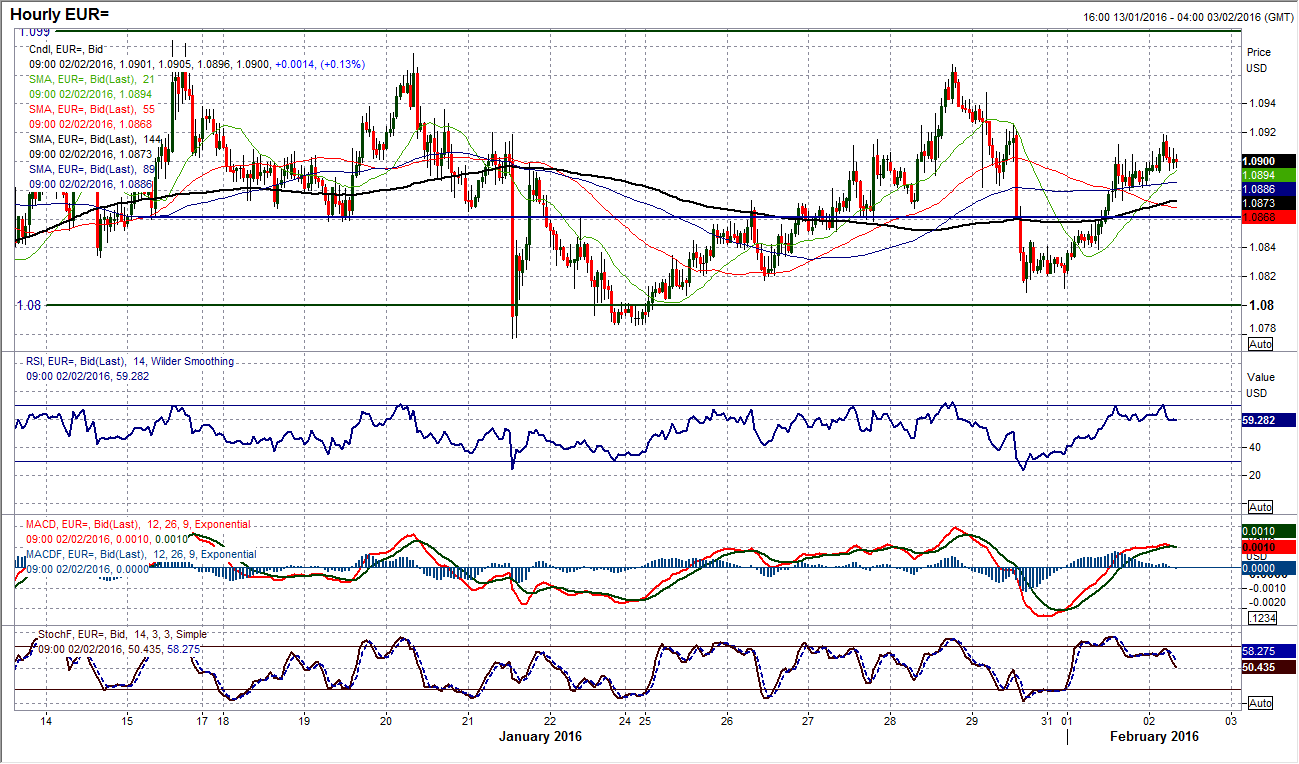

EUR/USD

With market sentiment again taking a turn for the worse, the euro has started to pick up again. The price action of the past couple of sessions simply goes to reaffirm the trading range that continues above the $1.0810 old key medium term pivot. Technical indicators remain neutrally configured and there is very little sign of where the breakout will come when it does. There is a marginal bearish bias to the range as there is still a sequence of lower highs in place over the past couple of months, but this is only very slight. On the hourly chart, with the latest rally within the range moving above $1.0900 and now with the hourly momentum indicators starting to lose steam, it is time to start thinking about using the rally towards resistance as a chance for near term selling opportunities. The overnight high at $1.0920 is also showing a minor bearish divergence with the hourly Stochastics. Support initially comes in around $1.0860. A move above $1.0967 the latest rally high would improve the outlook.

GBP/USD

It has been an incredible sequence of candles on Cable for the past week. There have now been 5 successive candles all with daily closes of over 100 pips. However, because the market has been so uncertain , they have negated each other. Coming into today’s session on the back of a strong bull candle should give the buyers the upper hand, however already some of these gains have been given back and the way the market has traded recently there is every reason that there will be another turnaround. Despite this though, the momentum indicators continue to unwind, with the Stochastics looking rather positive. However, looking at the hourly chart there has been a near term sell signal on the MACD lines and Stochastics which looks to be setting us up for yet another day of retracement. Yesterday’s high reinforced the resistance at $1.4445, whilst if the initial support at $1.4350 were to be broken then the next support at $1.4235 is once more back in play. Above $1.4445 opens $1.4490.

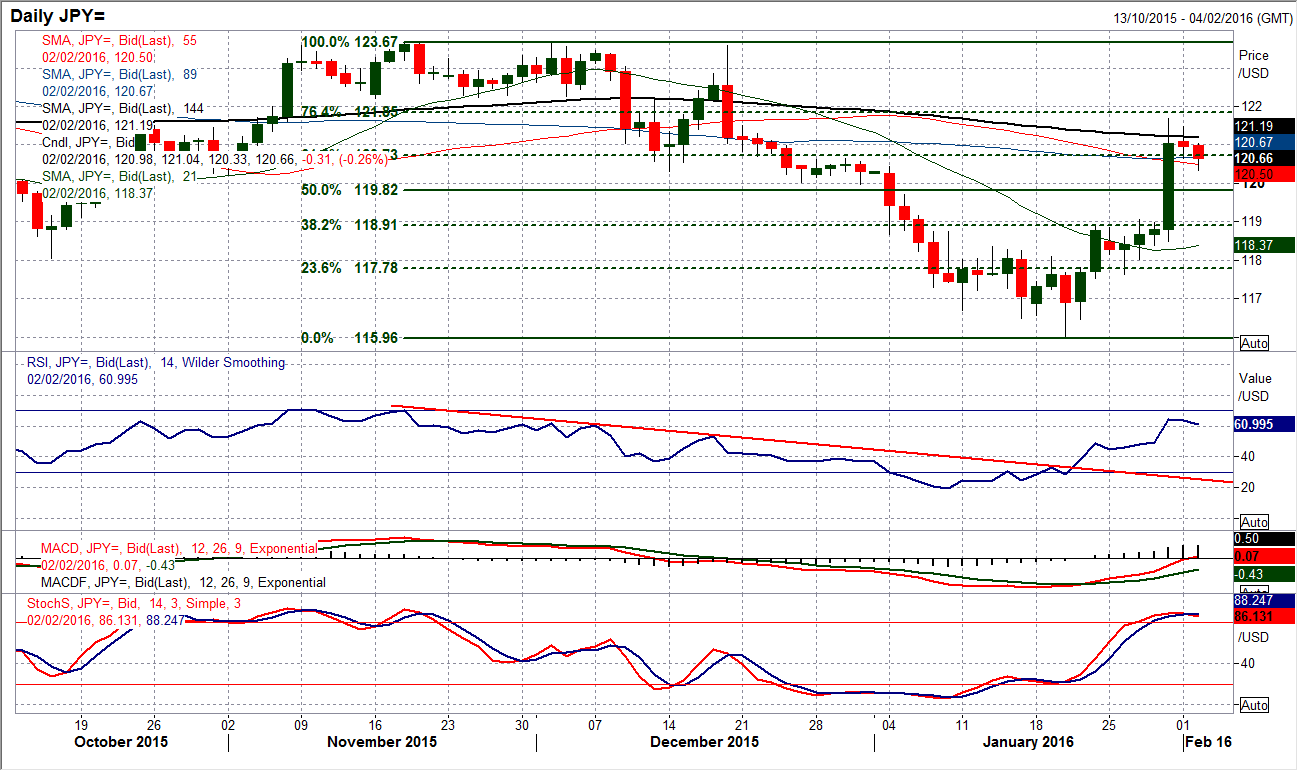

USD/JPY

The market is still trying to find a level after the shock BoJ move but a renewed safe haven flow could now be a drag on the pair once more. In my analysis video yesterday I discussed the fact that Dollar/Yen was trading entirely outside the Bollinger Bands and that the move was looking extreme. We have subsequently seen a stuttering in the rally and today the start of a potential retracement. This is a move to be taken with caution now as the speed of the rally which burst through so much overhead supply now means that there is little real support until initially 120.00 but more significantly 119.00. The bulls will be looking to now overcome what is developing into a series of lower highs, with the latest overnight at 121.15, with 121.40 above there and 121.68 increasingly key.

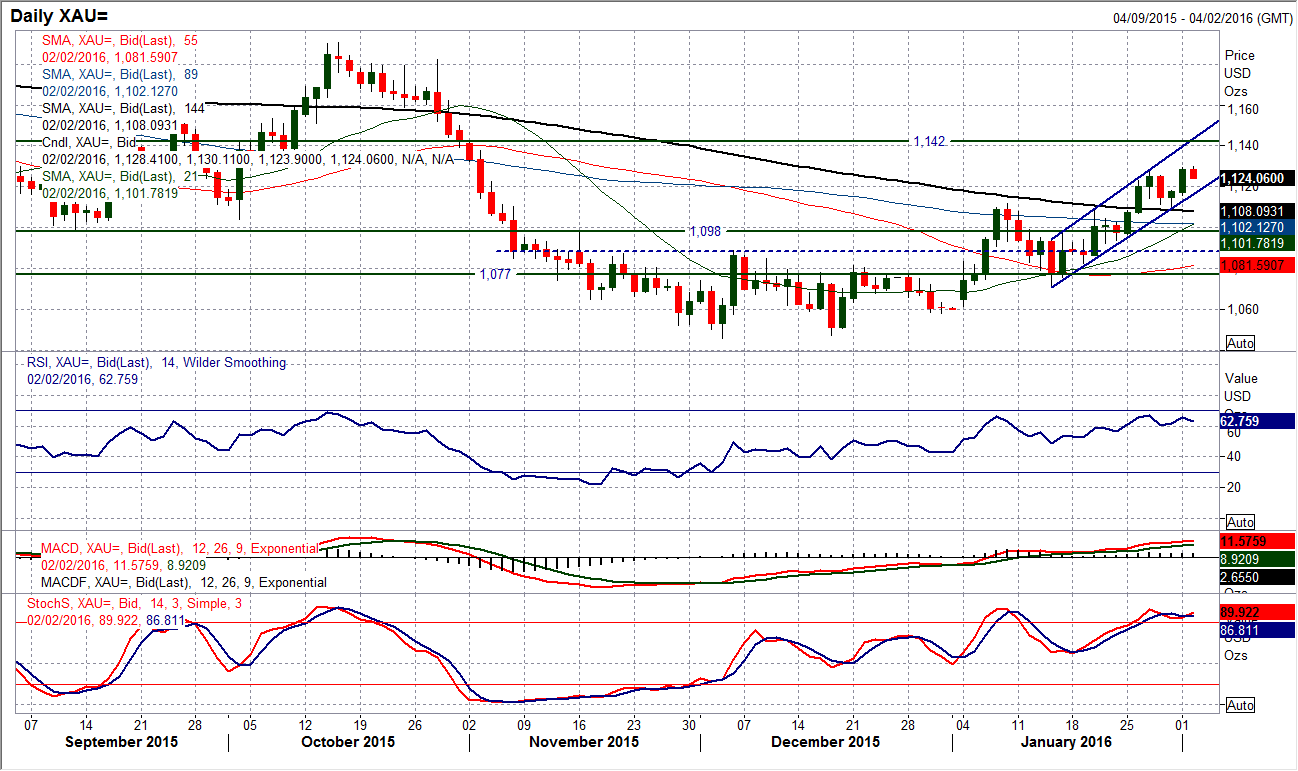

Gold

The uptrend channel remains firmly intact as once more the bulls have used a minor correction as a chance to buy. From a longer term perspective I am positive by the way the 144 day moving average has been used as a basis of support and with momentum indicators maintaining their bullish configuration. The push once more into a new multi month high yesterday above the $1127.80 resistance reflects strength in the price, and with no suggestion of any negative divergence on momentum the bulls remain solid. So continue to use the dips as buying opportunities with the trend channel pointing towards further gains. The next resistance back above yesterday’s high at $1129.80 is $1136.50, but the bulls will also be eyeing the old key floor at $1142. The hourly chart shows that using the unwinds on the hourly RSI back towards the 40/50 area is where the bulls have habitually returned. There is now support at $5 increments, at $1120, $1115 and with the key support around $1110.

WTI Oil

I spoke yesterday about the warning signs that were beginning to creep in for what seemed to be the waning health of the recovery. The subsequent sharp bearish candle suggests that I was right to be concerned. There is now a serious possibility that the market is now ready to sell off again. The uptrend since the bottom at $26.20 has been decisively breached on both the daily and hourly charts. The daily momentum indicators are beginning to turn lower with the RSI having unwound to turn lower from around 50 and the Stochastics giving a crossover sell signal, the bearish signs are lining up. A close back below the reaction low at $31.75 now confirms the breakdown of the rally. This does not necessarily mean that there will be a direct run back to the lows again, but certainly suggests the return of a more choppy trading phase and that the highs in place at $34.40/$34.80 are now key resistance. There is a near term pivot in place at $32.80 which adds to the overhead supply. Trading above the pivot around $30 will maintain a certain degree of bull confidence, with support subsequently at $29.25.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.