Market Overview

A sharp deterioration in the US trade deficit spooked investors in the US yesterday that the strong dollar was beginning to have a significant impact on the US economy and that the disappointing GDP print for Q1 may not just be a one off. The data also resulted in a rally on EUR/USD which impacted across European equity markets as the negative correlation between the euro and the DAX continued. Focus will be more on employment in the US as the week builds up to an increasingly important Non-farm Payrolls on Friday. As Treasury yields continued to push higher Wall Street came under pressure yesterday, with the S&P 500 closing down 1.2%. Asian markets were again fairly mixed overnight, although the Nikkei remains closed for public holiday. European markets are slightly negative again at the open with a flurry of corporate data also to drive trading.

In forex trading the US dollar is coming under pressure early in the European session, with the euro and sterling continuing to build nicely off yesterday’s support. The only major that the dollar is performing well against is the Kiwi dollar which is under corrective pressure after New Zealand unemployment increased unexpectedly to 5.8%.

Traders will be looking out for the UK services PMI which is released at 0930BST and is expected to slide slightly to 58.6 (from 58.9). Attention will then turn towards the US with the ADP Employment report at 1315BST which is expected to only improve slightly to 192,000 from 189,000. The number is often seen as a harbinger for the crucial payrolls report on Friday (it was a strong indicator of the disappointment last month at least). There will also be some attention given to speakers from the Federal Reserve including chairman Janet Yellen (dove) and Dennis Lockhart (leaning hawk).

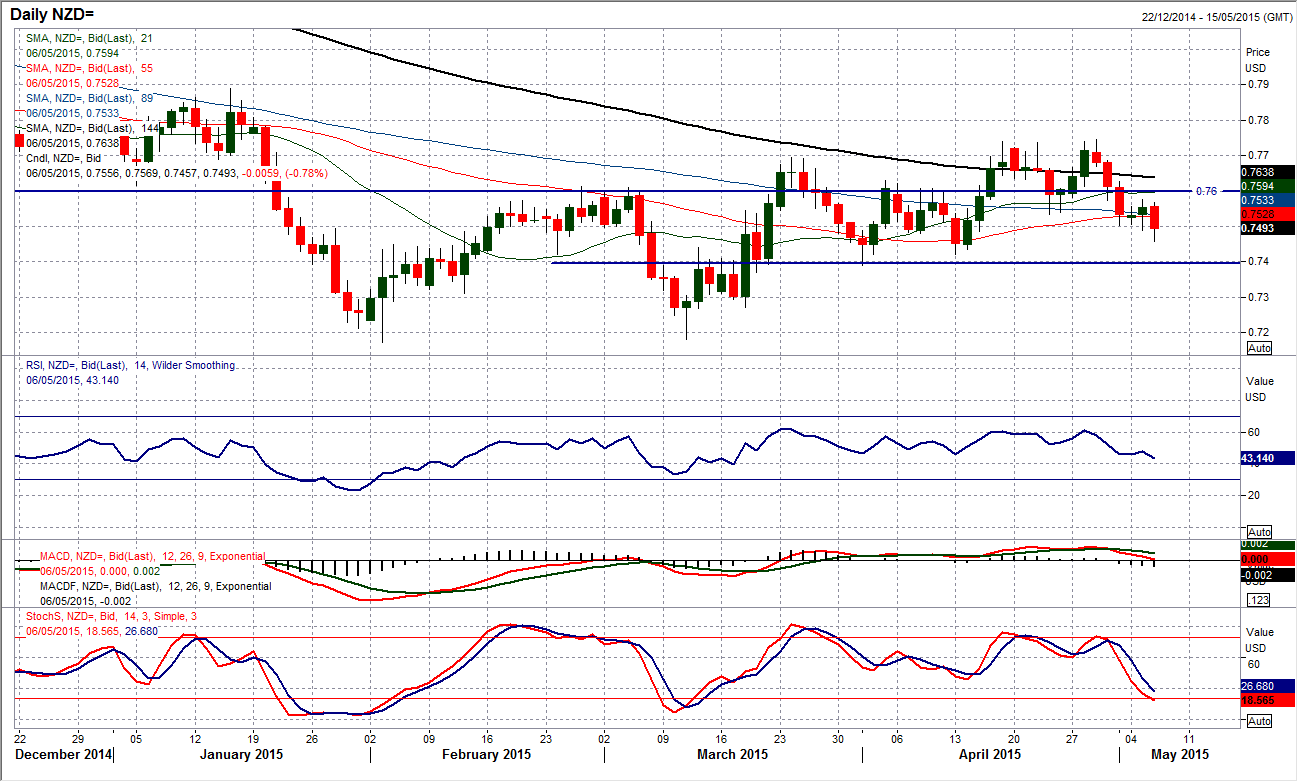

Chart of the Day – NZD/USD

The Kiwi is under pressure once more. Over the course of the past week, the Kiwi has been one of the worst performing major currencies and this has not been helped by a sharp move to the downside today (in the wake of worse than expected unemployment data). It now looks as though the support for the Kiwi that was formed yesterday has only been temporary and the pressure is growing to the downside. This could result in a test of the key near to medium term low at $0.7390 which is the April low. The daily momentum indicators show RSI and Stochastics already at a 7 week low, whilst the price is falling underneath all the moving averages which are converging to turn down in bearish sequence (a technical condition which suggests downside pressure is building up). The intraday hourly chart shows there is resistance now around $0.7500 which could be seen as a chance to sell. The bearish pressure would be abated if there was a rally above yesterday’s high at $0.7577.

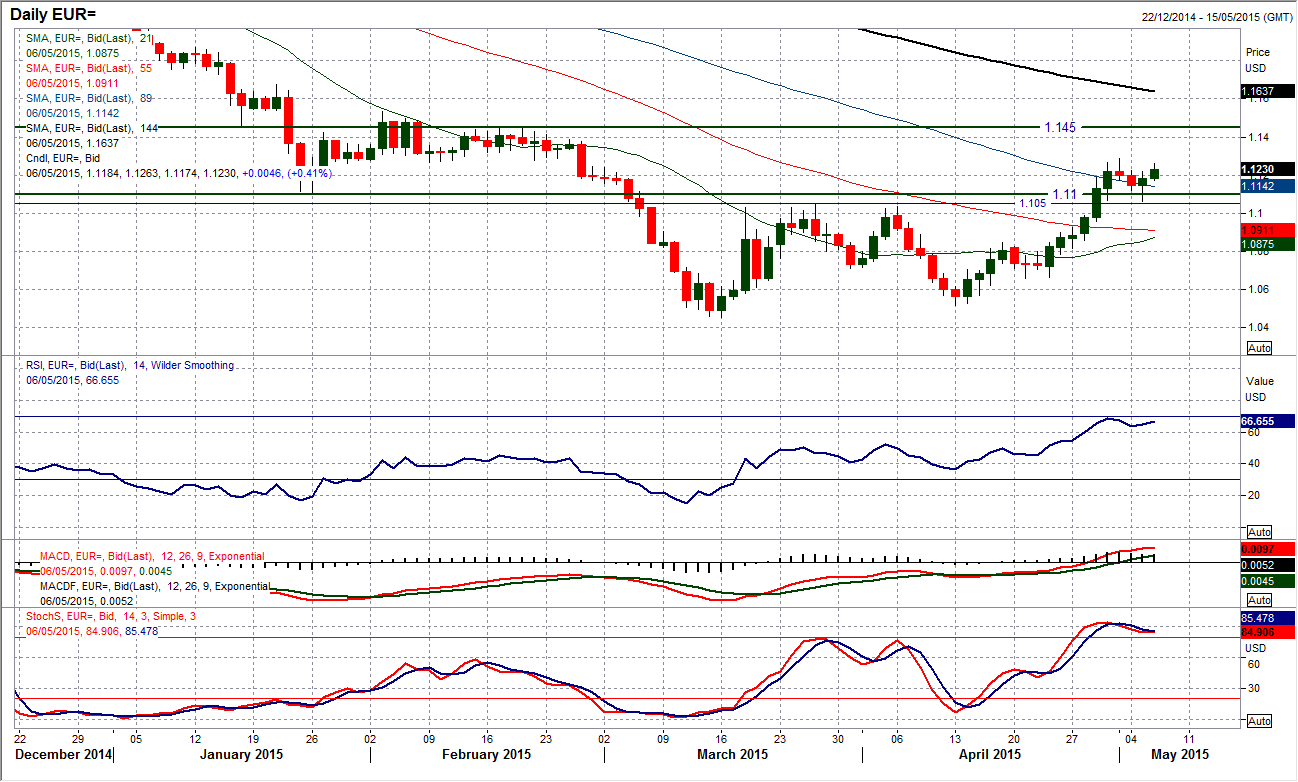

EUR/USD

The euro survived its first test of support yesterday since the breakout was achieved. This will have helped to improve the confidence of the recovery that had been wavering in the past couple of days. Yesterday’s low at $1.1065 was just above the band of support at $1.1035/$1.1050 which constituted the key upside break. A bullish daily candle was then achieved which has been followed by a strong start to today. This is putting pressure back on the high once more at $1.1289. Daily momentum has retained a positive configuration and the threat of the tailing off of the uptrend has been countered. The intraday hourly chart shows that the bulls have broken above the reaction high at $1.1224 and this leaves open the high. A successful breakout would open the next real resistance that does not come in until $1.1450 and the late February highs. The only caveat is that hourly momentum is a little choppy and the breakout above $1.1289 is needed to prevent the recent price movement from becoming a messy consolidation.

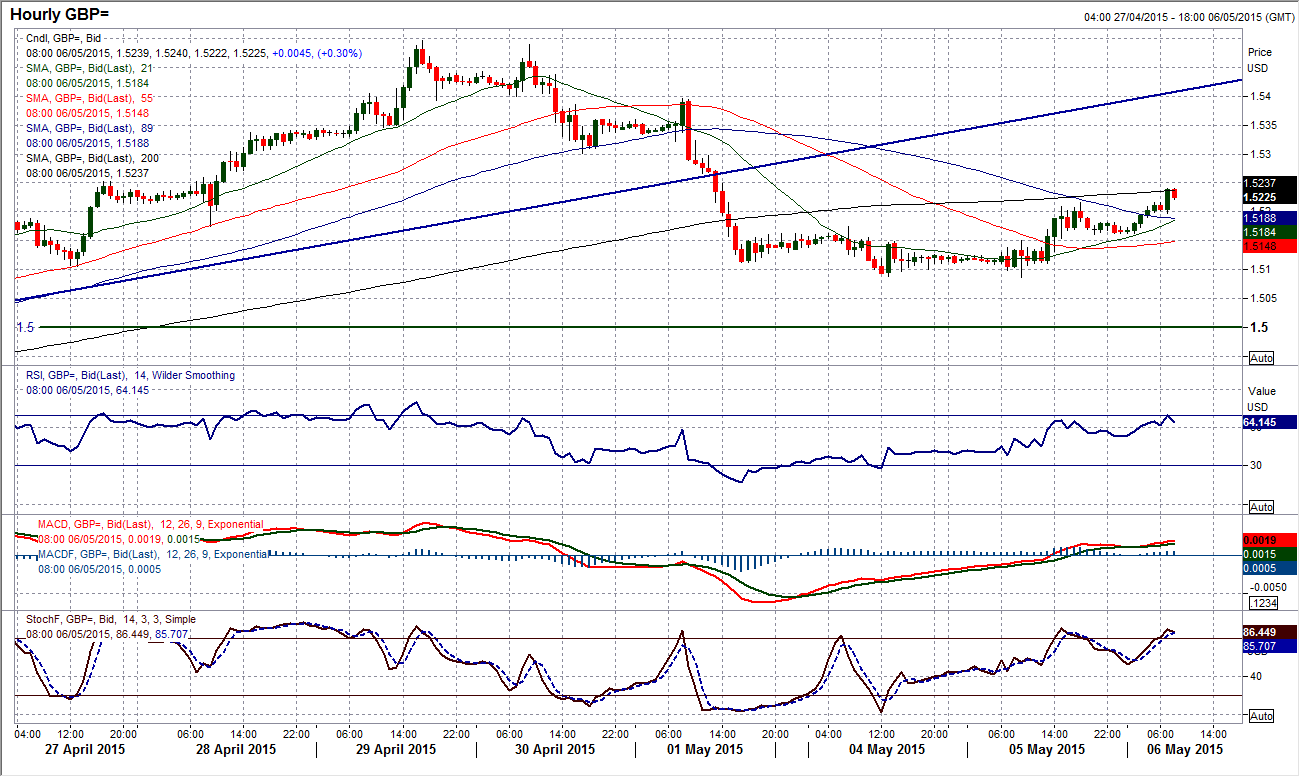

GBP/USD

There has been an element of support and stabilization that has taken over in the past 24 hours after the sharp moves from last week. This may be a function of the impending UK General Election which could drive significant volatility on Thursday and Friday this week, but for now the price is fairly steady. The price has twice found a low at $1.5088 in the past two days and if an intraday break can be sustained above yesterday’s high at $1.5217 then thoughts of a test of $1.5300 and maybe $1.5395 can be entertained. However, for now this does not look like a trending play, more of a consolidation, with all moving averages fairly well converged and momentum indicators such as the MACD histogram reasonably stable. This could be the calm before the storm.

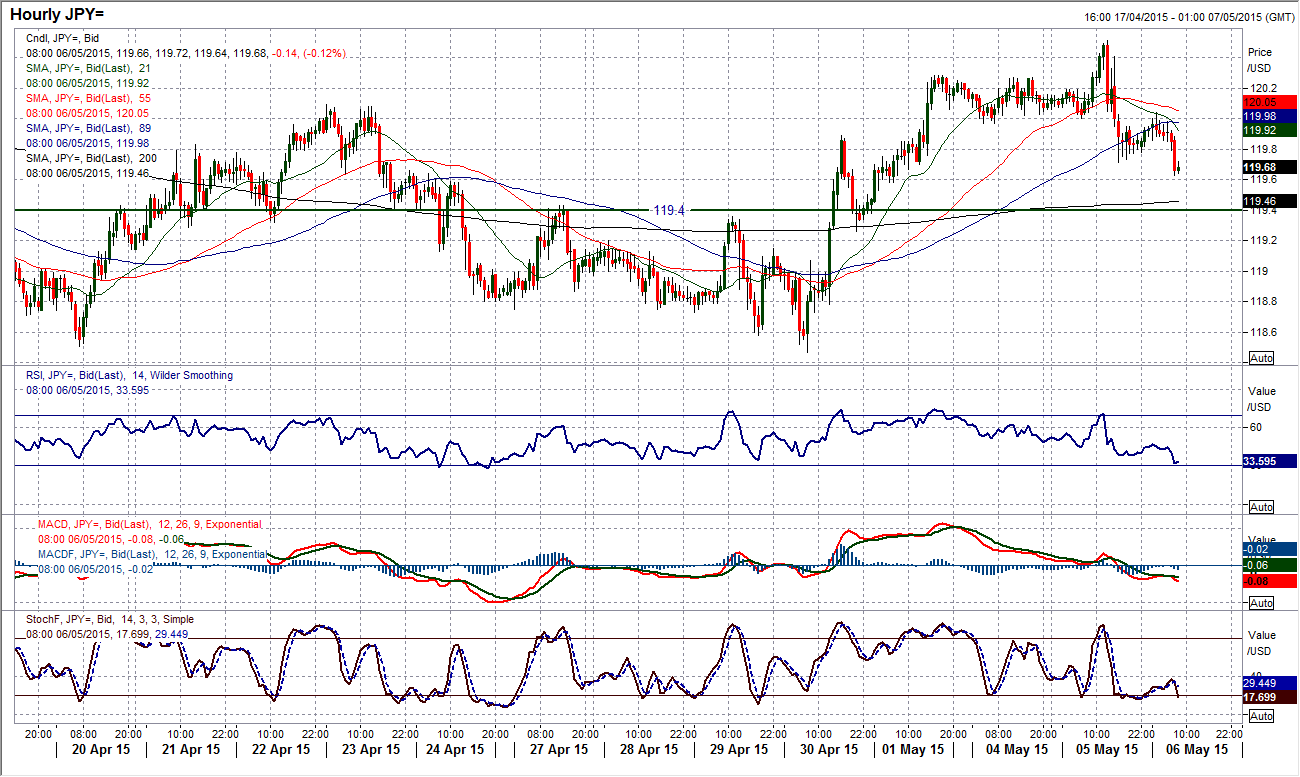

USD/JPY

Without wanting to sound like a broken record, Dollar/Yen has once again brought a two day rally to an end by posting a corrective candle. I would normally get more excited about a bearish engulfing candle (or a bearish key one day reversal) than I will here, but the candle has been posted following an extremely tight “doji” and there is no trend to really reversal. It does though suggest that the sellers within the trading range are looking to gain control once more. Leaving the resistance at 120.50, this could see another drift towards the pivot at 119.40. Intraday indicators are suggesting a slight bearish bias now, with moving averages rolling over and MACD more negative than it has been for several days. With initial resistance now around 120.00 the pressure could once more build towards the 119.40 pivot. Under there the support is at 118.80, 118.50 and the key range low at 118.30. As per usual, continue to play the 118.30/120.85 range until a decisive break is seen.

Gold

Again, much like Dollar/Yen, the gold price remains stuck in a range, albeit a slightly more interesting one. It is more interesting as the candles are more decisive with the range now from $1170/$1224. This has extended lower from $1178 but I see the old range as still intact as there is yet to be a closing break of $1178. Two positive trading sessions have once more dragged the price from the range lows again. However yesterday’s candle was a touch disappointing as what had looked to be a strong session resulted in the bulls losing impetus towards the end of the day to close around the mid-point of the candle. Although there has been a positive start to today’s trading, this still leaves question marks over the recent rebound. A failure to break above yesterday’s high at $1199.60 would add to the questions. Momentum indicators on the daily chart suggest there is no real great impetus in the rebound and rallies towards the top of the range should be seen as a chance to sell once more as the range continues. The intraday hourly chart is once more using the rising 21 hour moving average (at $1194) as a good gauge of support. Yesterday’s low at $1185.40 is now a key near term support.

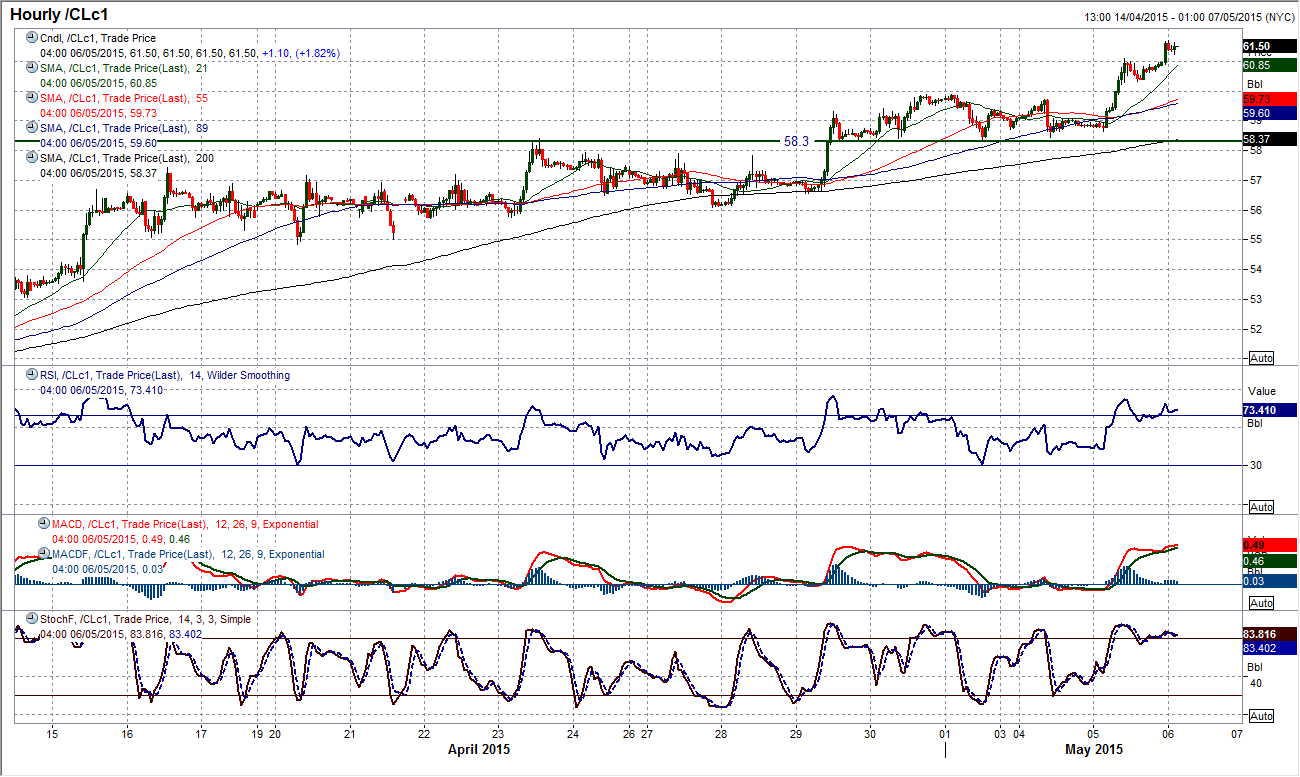

WTI Oil

Momentum remains with the bulls as another strong upside breakout yesterday. The price continues to build towards the upside target from the base pattern at $65.00. The daily chart shows strong momentum across the board, with the RSI now looking to push towards 70. If this is a strong trend forming then there will be little problem with the RSI reaching such lofty levels and would be merely indicative of the strength of the trend. The next resistance is approaching at $63.72, but in truth the sell–off was so precipitous during late November into December that there is actually very little meaningful resistance to prevent the rally from continuing. The intraday hourly chart shows the consistent stepped advance in recent days and the latest breakout has left a key support now at $58.30. Look to use any dips into the initial support that starts around $59.90 for a chance to buy.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.