Market Overview

Market volatility remains elevated as Wall Street sold off into the close having been initially strongly higher, the S&P 500 closed sharply lower again for a 6th down day out of the past 7. The oil price remains under pressure and now the plummet in the value of the Russian Ruble means that there are plenty of factors for traders to remain worried about. The Ruble remains extremely volatile and is around 2% lower in early trading today as the rout shows little sign of ending yet. However if there begins to be a stabilisation in the oil price then perhaps markets can begin to calm down. Also traders will be looking towards Janet Yellen and the FOMC tonight to hopefully provide some calming influence on the market.

Asian markets have broadly stabilized today, with the Nikkei 225 up 0.4% as Dollar/Yen has rebounded overnight. With such a strong rebound on the European markets and in light of the sharp correction on the US markets, indices such as the DAX Xetra and the FTSE 100 are trading sharply lower again in early exchanges.

In forex markets, the dollar has managed to claw back some of yesterday’s lost ground and is currently trading positively against all of the major currencies. The key moves have come with the unwinding of some of the yen strength from yesterday, whilst the Aussie and Kiwi dollars are again under pressure.

Traders will be looking forward to another heavy day of economic data today. Sterling will be impacted by the UK unemployment data out at 09:30GMT, with the expected drop of 19,800 to the claimant count. Also the focus will be on average earnings growth which is anticipated to improve further to 1.5% (from 1.3% last month). US inflation is announced at 13:30GMT with the expectation of CPI to dip to 1.4% (from 1.7%). The most important data is the FOMC announcement at 19:00GMT. The expectation is that the Fed will remove the term “considerable time” from its statement, which would pave the way for the beginning of rate hikes in the coming months. This is expected by the market but should still result in dollar strength if this is the case.

Chart of the Day – Silver

The silver price has been volatile over the past couple of days. However, as the gold price has managed to hold support against the later selling pressure of yesterday, the price of silver has fallen to a two week low and is undermining the good work done by the bulls in breaking the downtrend. The intraday hourly chart shows a deterioration of the outlook which has caused hourly momentum to turn more negative in the near term with resistance around $16.00, with a key near term reaction high at $16.62. This all suggests that the market is unsure over how sustainable the recent rebound is (could this also be a signal for gold weakness too?) and the pressure to the downside is growing and there could be further pressure on yesterday’s low at $15.50. Silver is trading around a percent higher today and is likely to remain volatile in light of wider market volatility, but also the FOMC tonight, which if the Fed moves hawkish then it would be negative for silver.

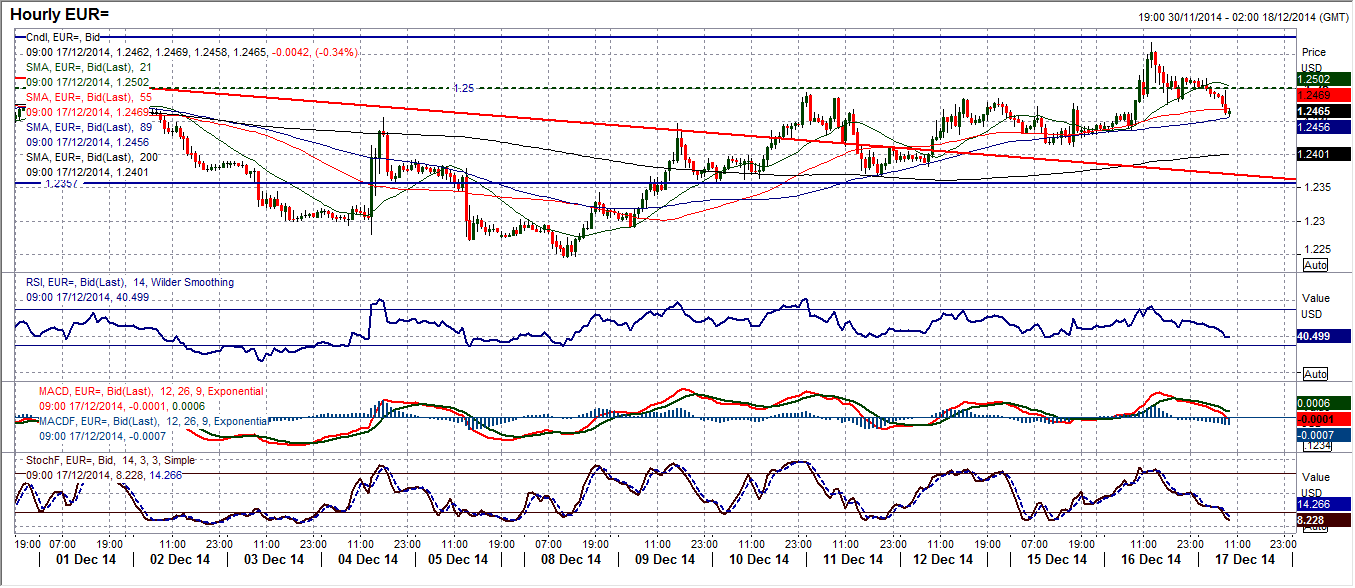

EUR/USD

A sharp move to the upside took the euro above the resistance at $1.2530 which was a first move above a key lower high within the old downtrend and adds further weight to the improving outlook. However, the bulls will still be cautious for a couple of reasons. Turning lower from $1.2569, the key resistance at $1.2600 remains intact and the buyers just lost some of the intraday momentum of the morning to close around the mid-point of the candle. The move is also back below the $1.2530 resistance too. On the intraday hourly chart there is a level of support around $1.2480 which was a breakout level and the bulls will hope can act as support now, but if this decisively fails then a drop back towards the next support at $1.2415 could be seen. The added element into the mix is the impact of the FOMC this evening. Trading could settle down in front of the decision, but if the Fed changes its stance in the hawkish direction (which many are expecting) there would conceivably be a sharp move to the downside. Support comes in at $1.2357 and the key low at $1.2245.

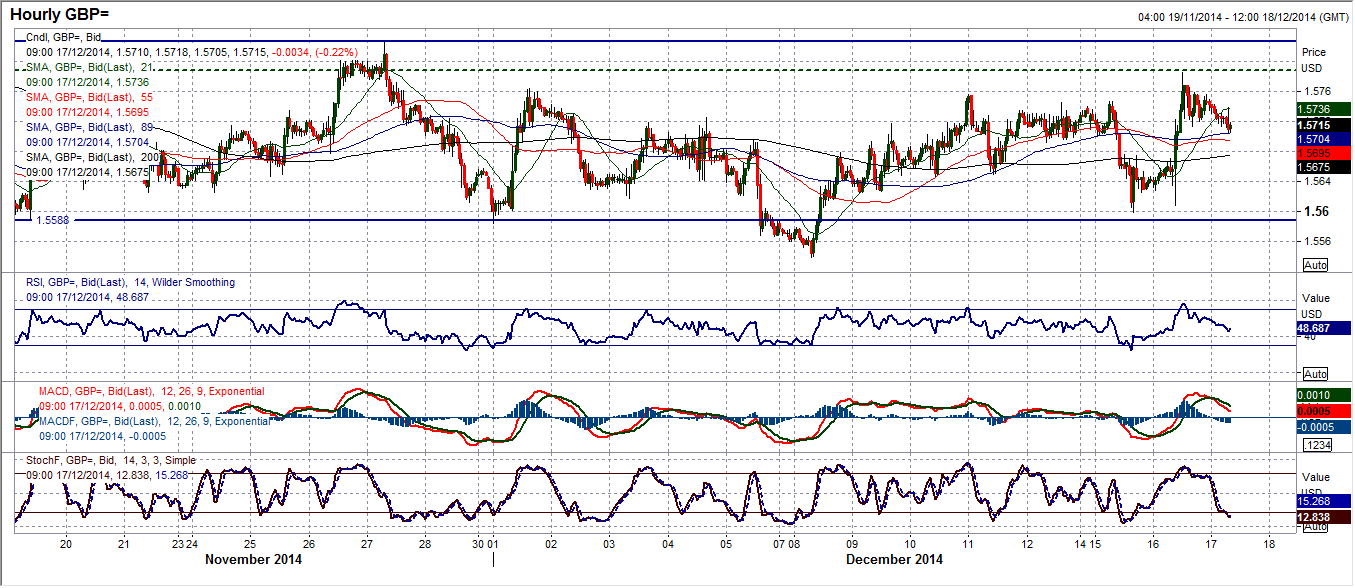

GBP/USD

A hugely strong day was seen on Cable yesterday, but as yet little has been achieved other than the continued consolidation of the past month. The move has though meant that Cable is the latest in a line of forex majors that are breaking/have broken key trends that have been depicting dollar strength, and in the case of Cable it is a 5 month downtrend. However there is a key resistance at $1.5825 which remains intact and for now the sequence of lower highs continues. Looking on the intraday hourly chart, there is still a feeling that this remains a range trade for now. Once more the hourly RSI has moved from below 30 to above 70, and once more with resistance formed at $1.5785 (around the range high) the rate has sold off. The RSI is once more pulling back towards 50 as Cable dips back again, whilst hourly moving averages remains neutral. Play the range today. Once more though the FOMC is likely to have a big impact on Cable, with the range high at $1.5825 being resistance and the range low at $1.5540 (and $1.5600 an interim support).

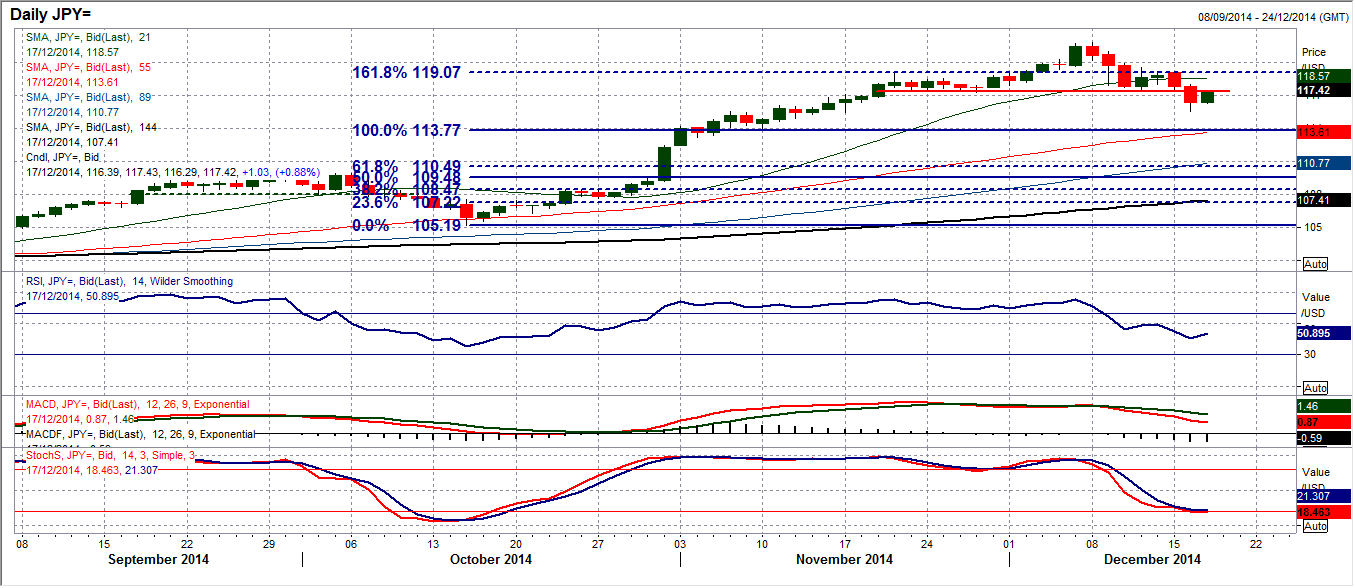

USD/JPY

Another incredible day on Dollar/Yen yesterday with a sharp move to the downside which has now completed a head & shoulders top pattern with a close below 117.22 support. This would now suggest that the correction now has an implied maximum target of 112.60, whilst a move back towards the previous Fibonacci projection target at the 100% level which is at 113.77 is a realistic near/medium term target. The rebound we have seen early today is unwinding some of the breakdown and is a pullback to the neckline. Looking on the intraday hourly chart the move probably needs to find resistance in the congestion band 117.22/118.00 for it to be considered near term corrective within the bear phase, with the rebound high yesterday at 117.75. However, the volatility is unlikely to subside today as the financial markets continue to fly around and the FOMC approaches tonight. A hawkish shift by the Fed would conceivably pull Dollar/Yen higher.

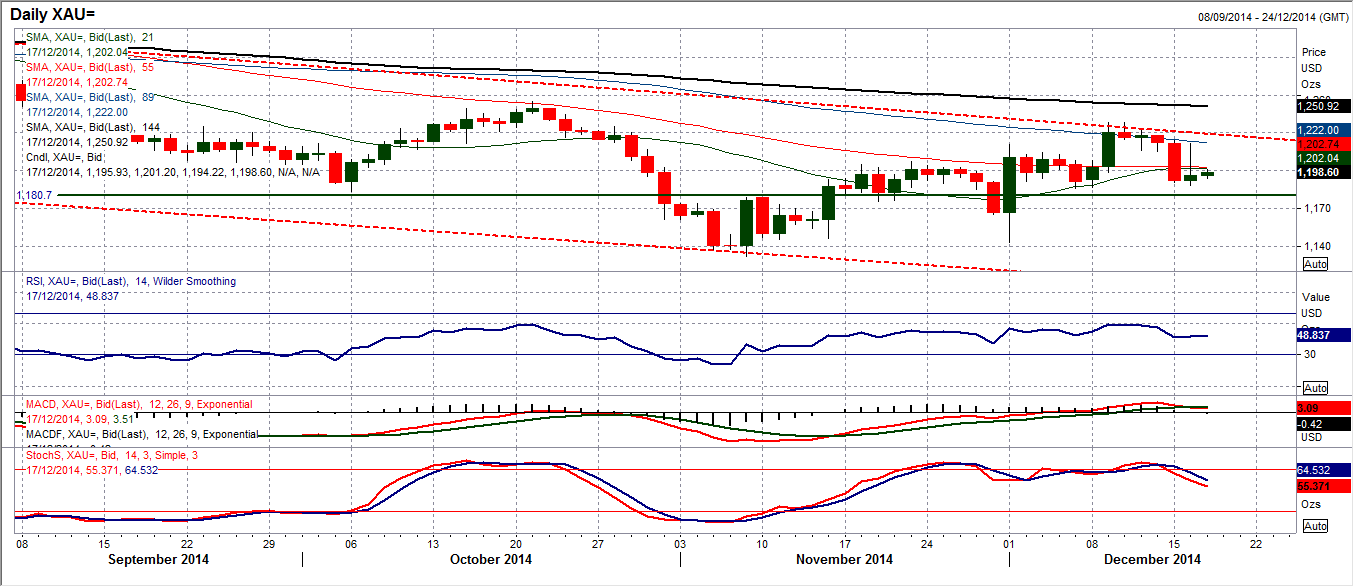

Gold

Volatility has been high over the past couple of days after Monday’s sharp move lower was met with an early rebound that entirely unwound the move on Monday, only to all but lose the rebound in the afternoon. Theoretically this retracement of the retracement is a bearish reaction, but the support at $1186.10 remains intact and again the gold price has found support and is slightly higher today. Therefore the near term outlook remains clouded and the key long term downtrend is still intact, and also the Stochastics have already rolled over and this may add downside pressure. If the $1186.10 support is now breached it would complete a top pattern that would signal downside possibly back towards $1140 again. Theoretically, a hawkish Fed tonight would add downside pressure to the gold price.

WTI Oil

Whilst there is still the continuation of the sequence of lower highs and lower lows, the interesting feature of yesterday’s trading was a rally during the US session which has left us with a green candlestick on the daily chart. It formed a “spinning top” candle stick, which with a bullish body to the candle is a mildly positive candle. This is the first positive candlestick for a week and comes as the RSI is around 18 (ie. deeply oversold). However, let’s not fall into the trap of calling a rally without any confirmation signals. There is still nothing yet on the daily chart to suggest there is anything hugely sustainable in this move, however it could just be an element of support coming in with some consolidation. A low at $53.68 has been formed on the intraday hourly chart and is a tentative line in the sand now. Can this stem the tide? The bears remain in control and I think we need a lot more than just one positive session, but for now it is a start.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.