Market Overview

Markets are becoming ever more calm and volatility is draining away again. Across the major forex pairs that I largely concentrate on there is an increasing tendency for consolidation. A strong revision of US GDP has done little to inspire the dollar higher and we are faced with a series of rangebound forex charts. Furthermore, gold also seems to be flat-lining in front of the Swiss Gold referendum. Perhaps it is the result of the OPEC meeting that traders are waiting for, or maybe it is a break for Thanksgiving, but there is certainly a reluctance to take a view at the moment. Wall Street showed very little direction yesterday, with the S&P 500 down 0.1%, whilst Asian markets were also mixed overnight with the only big mover being the Australian ASX which gained on the back of the yesterday’s weakness on the Aussie dollar. European indices are trading mildly stronger in early exchanges.

In forex trading there is little real direction once again as the sideways consolidation on the dollar continues. Maybe the US data this afternoon will pave the way for some movement. Traders will initially be focused on the revision to UK Q3 GDP at 09:30GMT which is expected to stay flat at +0.7% for the quarter. Then the focus turns stateside, initially with the Durable Goods (+0.5% expected) and Weekly Jobless Claims (287k expected) both at 13:30GMT. We then get the revised University of Michigan consumer sentiment data at 14:55GMT which is expected to improve slightly to 90.2 from 89.4. Finally there are the New Home Sales at 15:00GMT which are expected to also improve by 0.8% to 471k (from 467k) and the Pending Home Sales which are expected to improve by 0.5%.

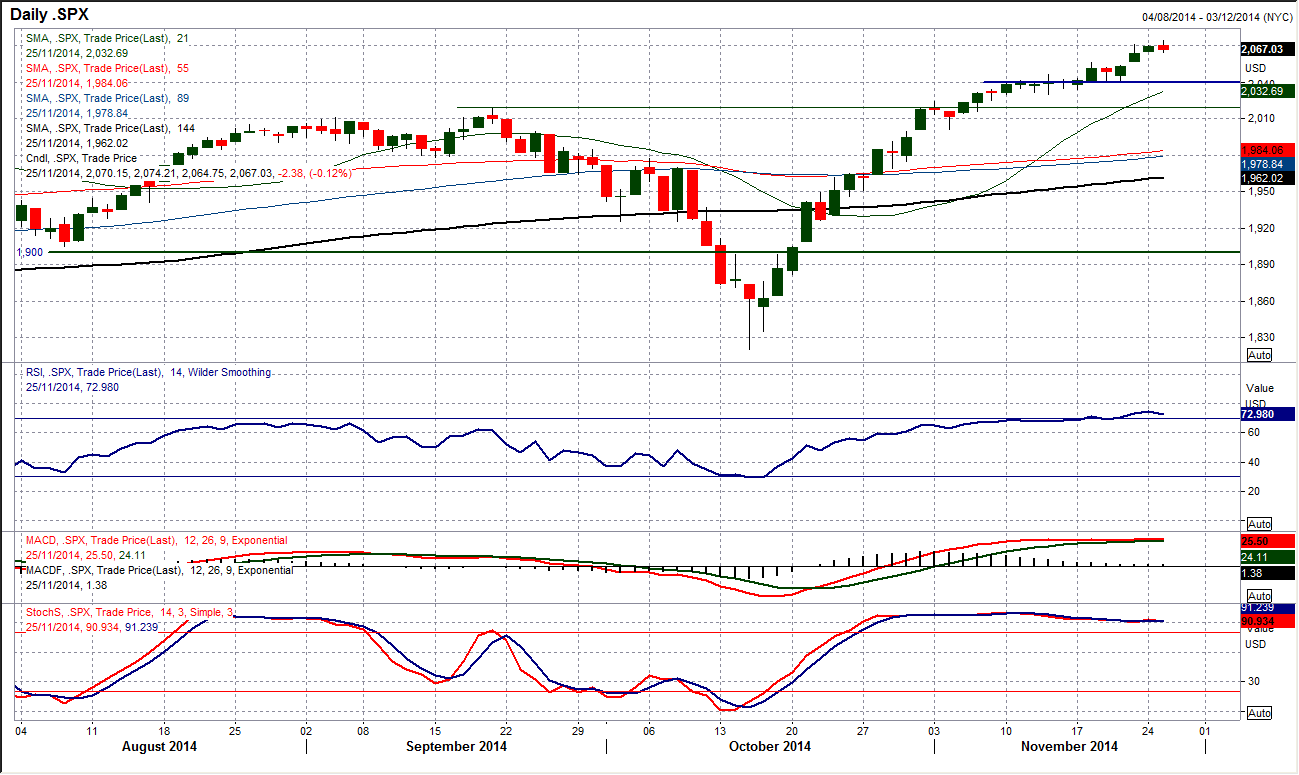

Chart of the Day – S&P 500

It is difficult to bat against what seems to be such an irresistible force that has become the S&P 500 as it moves ever higher into all-time high ground. Despite yesterday’s 0.1% decline, momentum is very strong with the RSI now the highest since June whilst MACD and Stochastics are both also positive. However I am increasingly cautious. The slow and steady nature of the gains in recent days suggest a lack of conviction compared to the strong candles that were seen earlier in the bull run. It is very rare that an index (even if it is Wall Street) can continue to post gains without any sniff of a correction, especially when the rate of upside begins to slow (see the S&P 500 in September). You could argue that the intraday hourly chart has now only got mildly positive momentum, which for a market that is into its sixth week without any real correction, could be a temptation to take some profits. Yesterday’s minor dip has done little to make even a dent yet in the bull run and there is an initial support on the hourly chart at 2056. The support at 2040 seems to be the first reaction low of any real consequence and how this reacts if it comes under pressure could be key to the state of this maturing bull run.

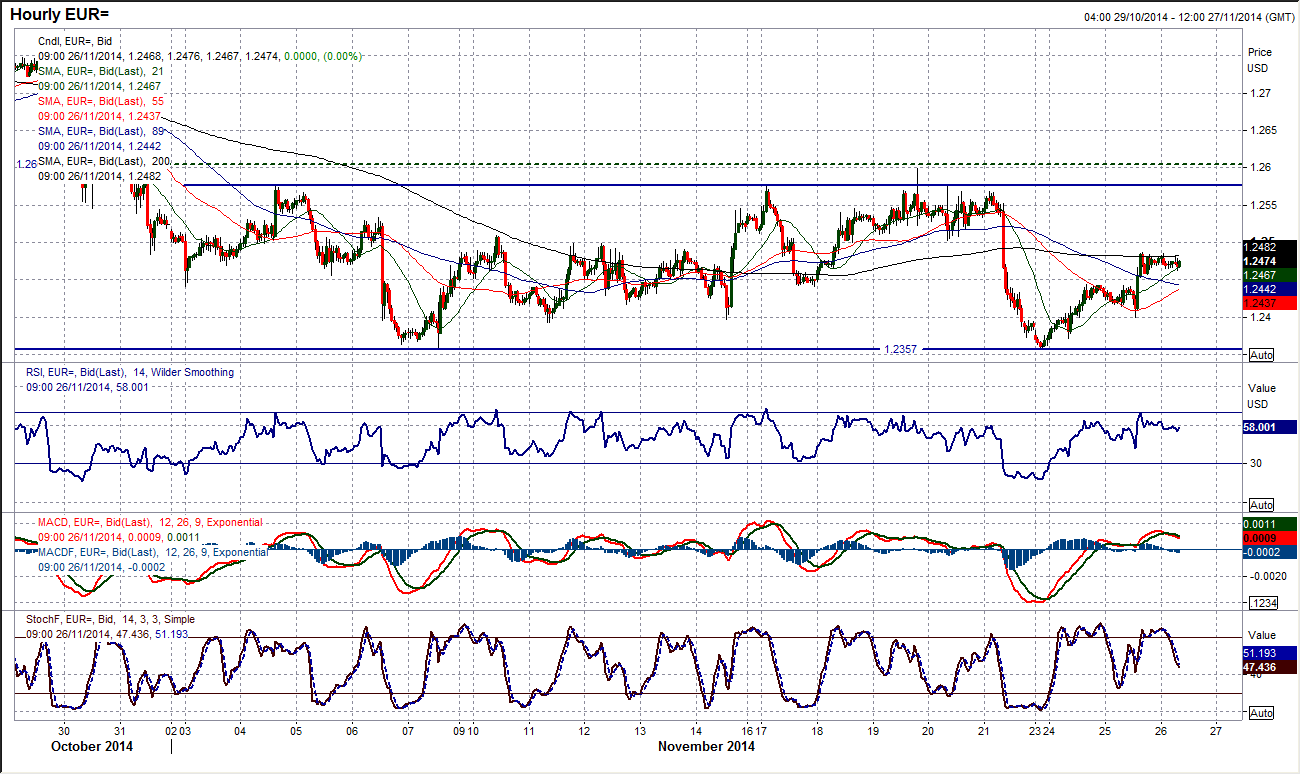

EUR/USD

A trading band on the euro between $1.2357 and $1.2600 that has been in place now for the past 3 weeks continues to play out as the euro gained for a second day in a row. The rate is now mid-range again as the resistance of the 3 month downtrend is once more approaching (today at $1.2540). So while all the momentum indicators on the daily chart remain in negative configuration and point towards a downside break, for now the euro is resisting. The intraday hourly chart shows the rate approaching the next mid-range resistance at $1.2500, with a higher low yesterday bang on $1.2400. I still view gains within this band as a chance to sell but the way the euro is trading currently, stops would need to be placed above the $1.2600 key resistance. I still expect a retest of $1.2357 and subsequently further lows.

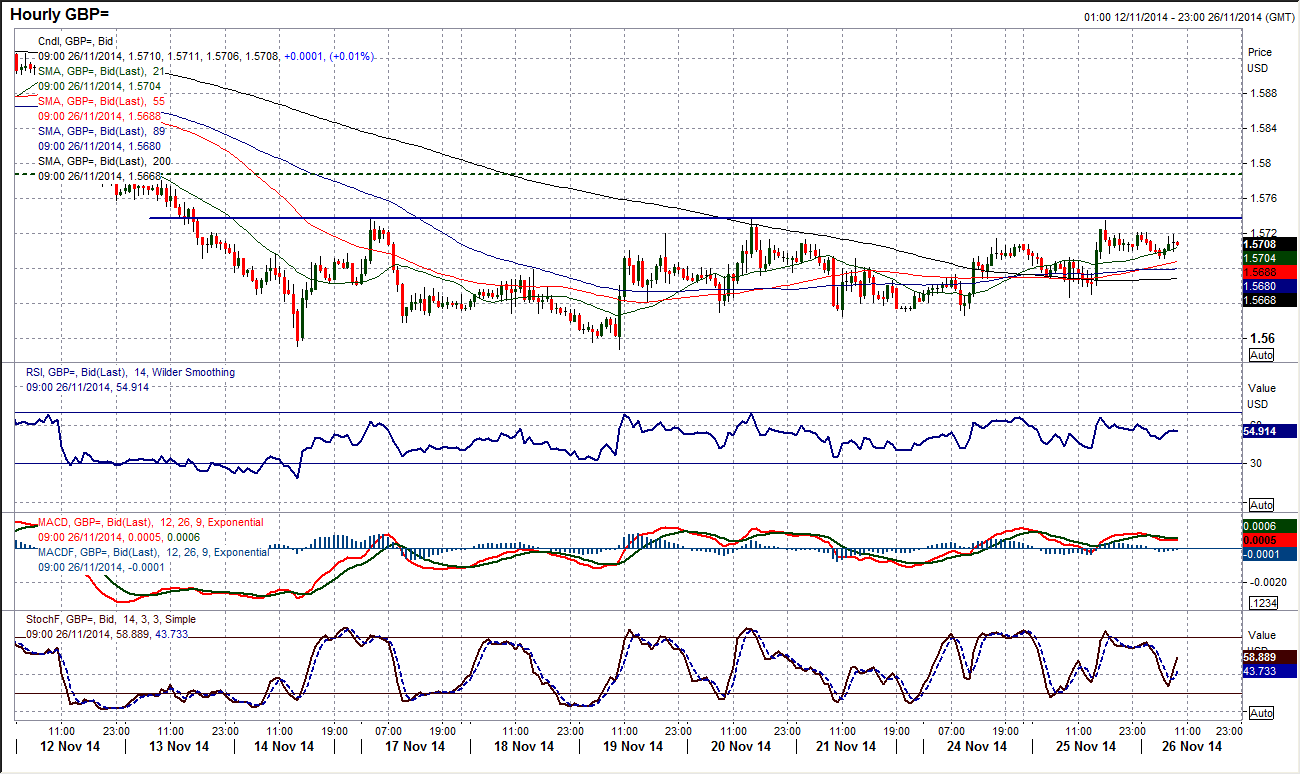

GBP/USD

Cable is in an even tighter range than the euro. Having bottomed at $1.5788 last week the rate has been stuck in a sideways band of around 150 pips under $1.5736. This range has allowed the momentum indicators to unwind slightly but the negative configuration remains and suggests that rallies will continue to be seen as a chance to sell. Remarkably, once more yesterday the resistance of the range high at $1.5736 was hit almost to the pip, but the hourly momentum indicators suggest that Cable is actually looking to mount a rally. A break through $1.5736 would complete a small base pattern and imply a move back towards $1.5885. This move should not be ruled out as it would still be merely a bear market rally back towards the resistance of the four month downtrend. With already two failed attempts to breach the resistance a breakout is by no means guaranteed, but for now the near term outlook is improving. There is support at $1.5647.

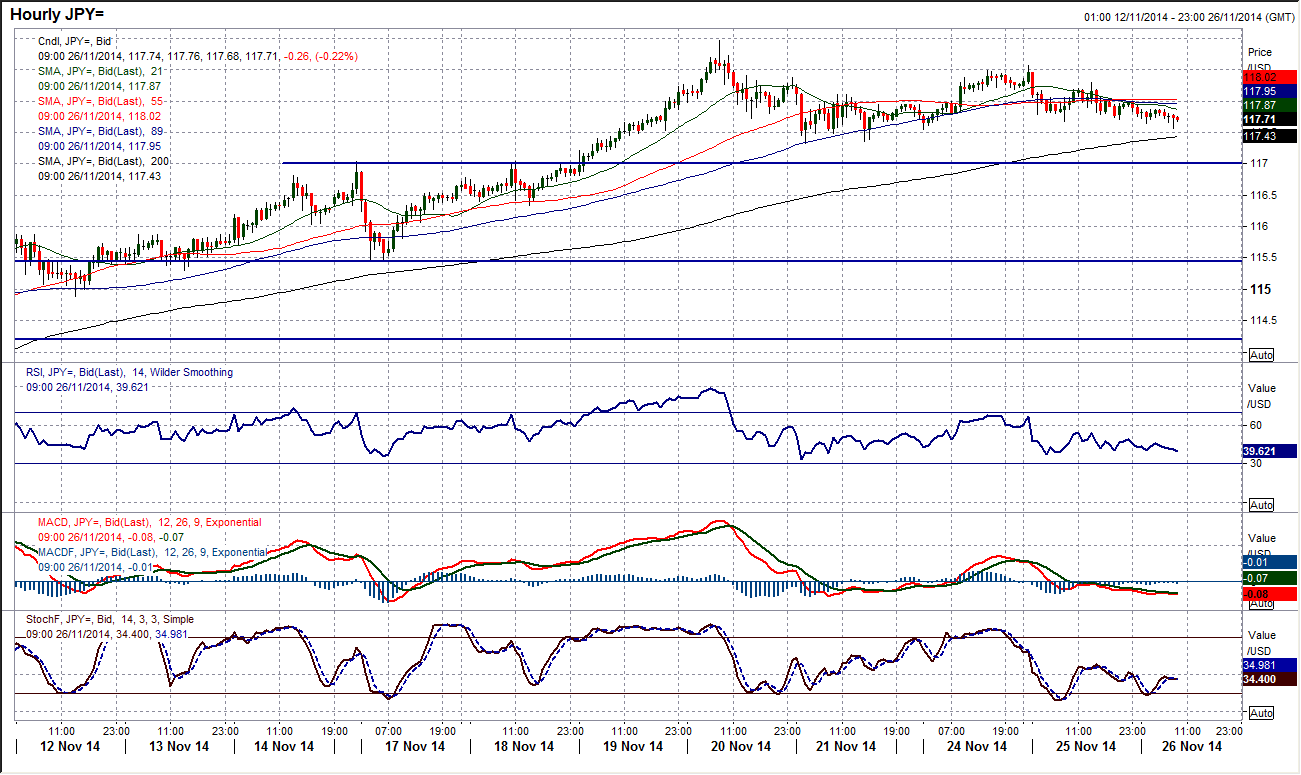

USD/JPY

The prospects of a dollar correction are growing, but until a breach of a key reaction low is seen we must be mindful that this may just be a consolidation within the uptrend. Since hitting the high at 118.96 last week, Dollar/Yen has developed a sideways trading band. The support at 117.33 has held for a few days but the pressure is growing. The daily momentum indicators suggest that upside momentum is waning, with the RSI turning lower (although still above 70) and MACD lines now threatening a crossover. The intraday hourly chart shows a lower peak yesterday at 118.57 with flattening hourly moving averages. Technically, the loss of support at 117.33 would not signal the end of the uptrend, which would theoretically remain intact until the reaction low at 115.44 has been breached. If it got to that stage the momentum indicators would certainly already have been calling for a correction, so watch then closely. For now this remains a consolidation but the bulls will need to return quickly to prevent this turning into a correction which then will need to begin talk of retracements.

Gold

The gold price is yet another chart that is increasingly turning into a consolidation with a loss of direction. The reaction low at $1175.50 is growing of importance, but in the last two days the gold price has become rangebound and seems to be waiting for the next catalyst (this is likely to be the calm before the storm of the Swiss Gold referendum). Arguably the recovery outlook remains on with a series of higher lows in place and support now forming back above the old $1180.70 key level. However hourly momentum has been neutralised and the resistance at $1207.70 remains intact. We could be waiting now for the fundamentally driven breakout.

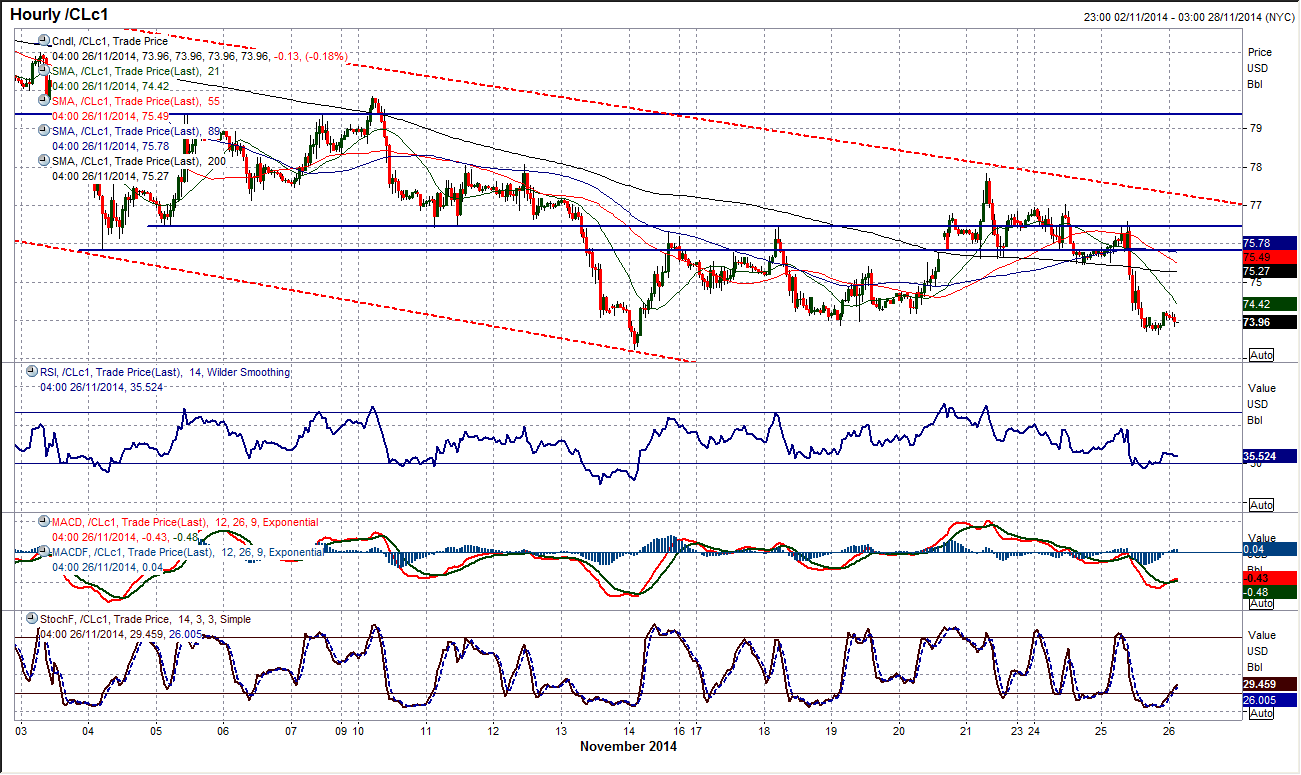

WTI Oil

Technically the top of the downtrend channel has provided the resistance and the selling pressure has come back in as the support at $75.62 has been breached again. This has completed a small head and shoulders top that gives a downside target at $73.40, which is just above the recent low at $73.25. The issue for the technical trader is now that the oil prices are moving on fundamental rumours and newsflow. For the next two days (at least) that makes calling WTI on a technical basis a difficult business. The sell-off yesterday afternoon came as there were signs coming from some of the fringe meetings in Vienna (prior to Thursday’s crucial OPEC meeting) suggesting there were no agreements on production cuts. For the next few days any mention of the words “production cuts” whether they be positive or negative will drive volatility. Staying close to the newsflow is vital at least until this OPEC meeting is out of the way.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.