Market Overview

Japan has once more fallen back into recession. With an annualised decline of 1.6% (which was forecast to gain by 2.1%) in Q3 this is a second successive quarter of negative growth and will draw serious questions over the policy of Abenomics. This should now ensure that the prospect of the second hike in the sales tax (from 8% to 10%) is now kicked into the long grass, but could also mean an early general election. The Nikkei 225 has dropped sharply by 3% and the yen has strengthened overnight. With Wall Street closing Friday again with miniscule gains (the 41st all-time closing high of 2014) the news out of Japan will dominate sentiment during the European session. European markets are trading lower in early exchanges.

The sell-off on the dollar on Friday has continued today as the major currencies have continued to claw back some of the considerable lost ground of recent weeks. However, in the last few hours the move has just begun to show signs of losing momentum once more. The main move has been seen on the stronger yen in a flight to safety after the disappointing GDP number that calls into question the effectiveness of Abenomics. The gold and silver prices have settled down and are broadly flat after Friday’s strong bounce.

The economic calendar is reasonably light today, with US industrial production this afternoon at 14:15GMT. A reading of +0.2% is expected after +1.0% was seen last month, although is a negative number is seen then it could drive a market correction coming so soon after the Japanese GDP number. Beyond that there are several ECB members speaking today including Mario Draghi, with traders looking out for any signs of further easing measures to be announced.

Chart of the Day – AUD/USD

Since the bullish key one day reversal on 7th Nov the Aussie has rebounded positively. In Asian trading today, the move has now overcome 0.8760 which is the first band of resistance which opens up the upper half of the old congestion band towards 0.8910. There is a caveat with this rebound, in that the recent trading sessions have contained a couple of long tailed candlesticks which suggests a lack of conviction perhaps with the move, also momentum indicators are still now yet bullish. This would suggest caution with running long positions as the dominant trend remains negative. A confirmed break above 0.8910 is needed to change the medium term outlook.

EUR/USD

An incredible turnaround on Friday saw the euro swing to a one week high and threaten an improvement in sentiment. A bullish outside day on the daily chart has taken the euro to test the first key near term resistance at $1.2577. Although minor resistances at $1.2509 and $1.2533 have been breached the resistance at $1.2577 is key because it is the first key reaction high on the intraday hourly chart that can has been left. Overnight the resistance has been hit to the pip before the euro has drifted off again. The daily chart shows that around $1.2600 is also an important test with the confluence of the neckline of the head and shoulders continuation and also a downtrend resistance. Subsequently, for now this rebound needs to be treated as yet another bear market rally and we should be looking for a chance to sell. The momentum indicators are mixed, having shown some sign of improvement with Friday’s move the Stochastics are advancing now, but RSI is still below 50 and is still just unwinding from a bearish position. It would take a move above $1.2770 to materially change the outlook to more positive.

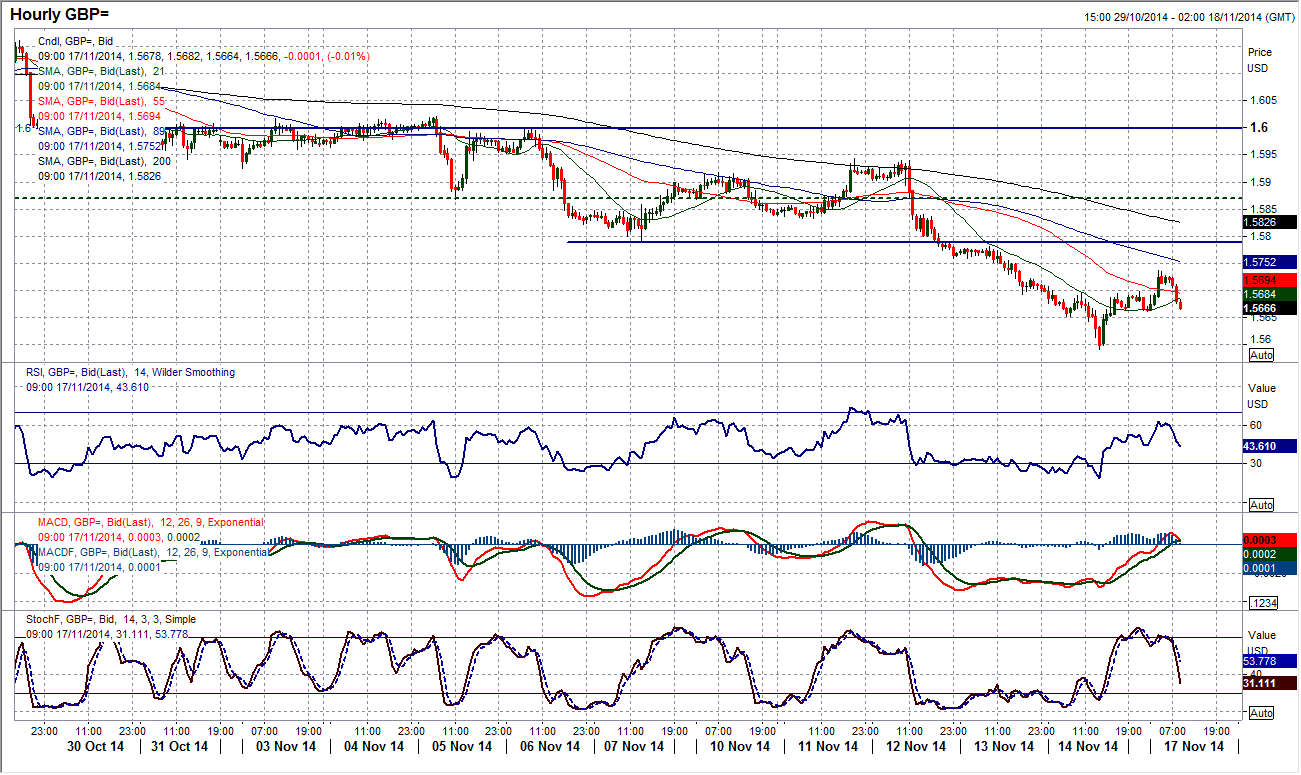

GBP/USD

Cable is nowhere near as advanced in its recovery outlook as the euro. As yet, Friday’s rebound merely looks like a dead cat bounce and traders are likely to be eyeing this as an opportunity to sell once more. The intraday hourly chart shows a small head and shoulders bottom that has formed above $1.5696 which gives us an implied rebound target of $1.5800, whilst the first real resistance comes in at the previous breakdown level at $1.5788. Bear market rallies will often under deliver in their rebounds before the sellers move back in again and it would not be a huge surprise if this were the case again. Hourly momentum indicators have already unwound and are in a position where the sellers may move back in. Buying a bear market rally would be very risky, with the medium/longer term trends all very negative still. Perhaps a better strategy would be to be look out for the sell signals before further downside is seen.

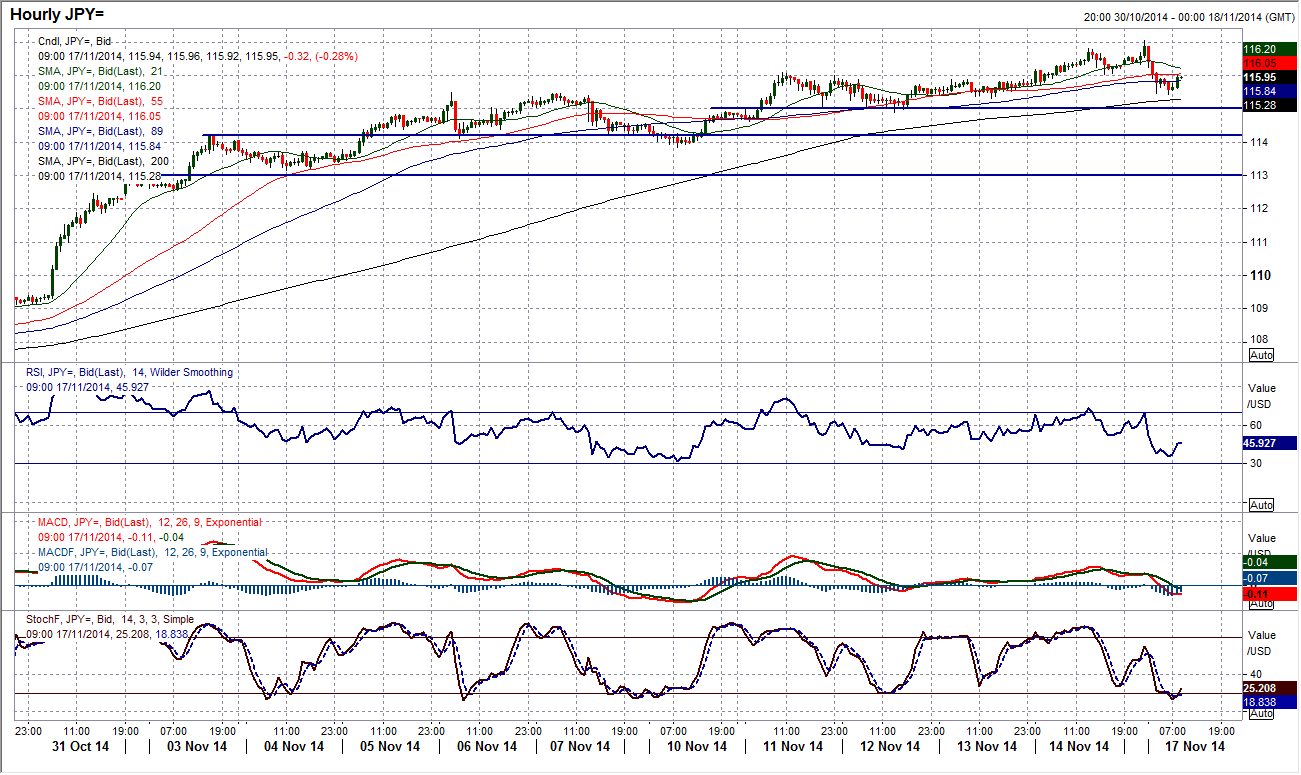

USD/JPY

The announcement of the disappointing GDP reading that showed Japan has fallen back into recession could throw the cat amongst the pigeons. Already the yen has strengthened to the extent at which an outside day has formed (with a new high at 117.04, Dollar/Yen has fallen below Friday’s low). A close below 115.71 today would complete a bearish key one day reversal. The intraday hourly chart suggests that there has been no significant damage done yet. For now, the hourly momentum indicators are simply unwinding, whilst Wednesday’s reaction low at 114.88 is the first real test. If we start to see support levels being broken then the outlook may need to be altered. The support at 114.20 is next and then 113.15. The bullish outlook is seeing its first real test.

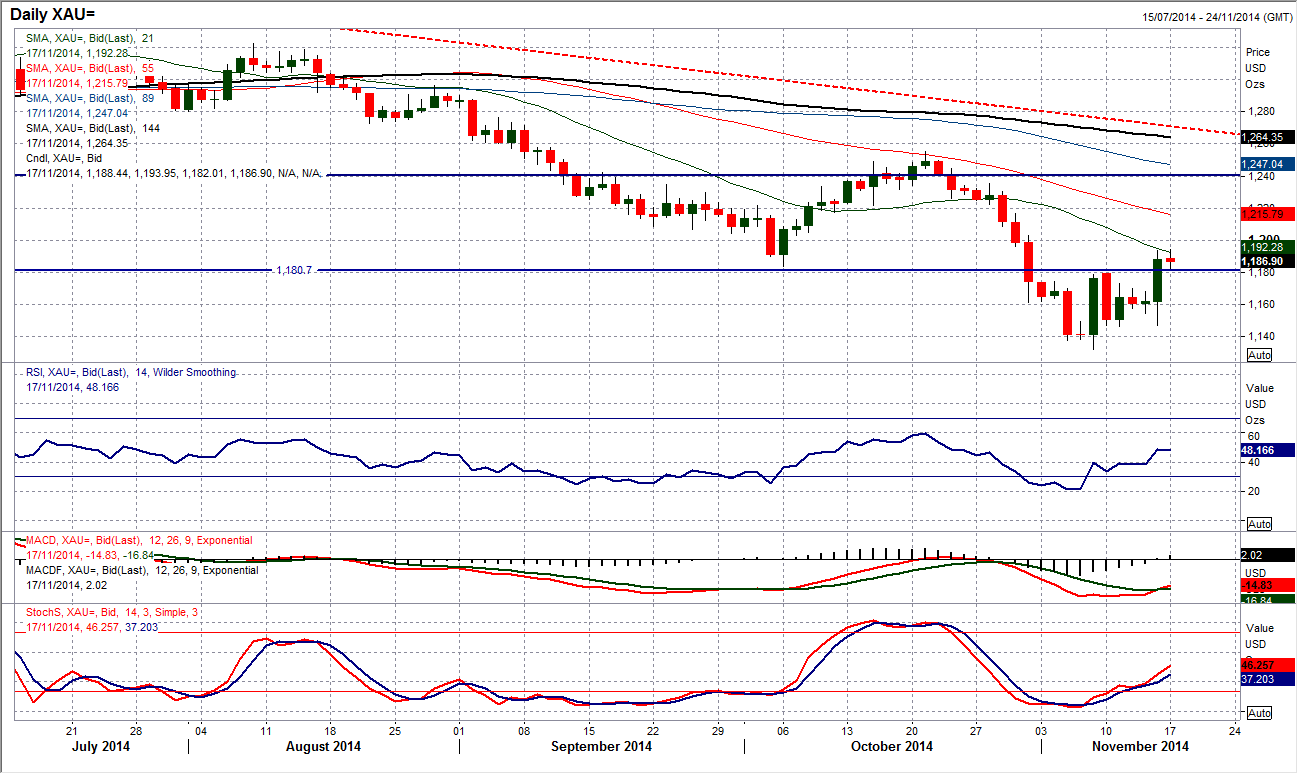

Gold

Friday’s rally on gold came out of the blue. There was little to trigger the move, with a sharp unwinding of some long US dollar positions being the main trigger. Still though the bullish outside day in gold that was subsequently seen and pushed the price through the key resistance at $1180.70. The significance of this in the medium term is difficult to ascertain yet. The momentum indicators are picking up now and the MACD lines have crossed over which is a positive signal. If we start to see gold trading consistently above the psychological $1200 resistance then there may be some legs in a near term rally. However ultimately this is likely to simply be another chance to sell. The first test for the bulls would be to hold above the $1180.70 level, and so far this is being seen.

WTI Oil

The implied target of the descending triangle at $75 has been achieved. With a strong rebound during the second half of Friday’s session (as the US dollar saw a huge intraday correction) support has now been left at $73.25. However this now seems to have simply left a 5 week downtrend channel in place. The rebound is counter-trend and would be risky to buy into, so perhaps it would be best to see how the rally plays out and then look to sell again at a higher level. The initial resistance comes in between $75.85, whilst the resistance around $78 is also around the top of the trend channel. Momentum indicators remain incredibly weak and suggest that rallies should still be seen as a chance to sell. It would need a move above resistance at $80 to suggest the outlook has turned around in any medium term sustainable way.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.