Market Overview

Has there been a subtle shift in the market sentiment in the past 24 hours? Previously there has been significant selling pressure on equities, coupled with a preference for safe haven assets. However in the past day we have seen the VIX Volatility Index begin to pull lower, a recovery in gold begin to roll over, and the buying pressure in the yen begin to subside. The earnings for the big US banks started to come through yesterday with a broad picture of decent performance from JPMorgan Chase, Citigroup and Wells Fargo.

The performance on Wall Street was improved albeit a tad disappointing to close the session just flat having been higher throughout the day. The S&P 500 closed 0.2% higher on the day, with a decent rally also on Asian equities. There has been a slight disappointment overnight though as Chinese inflation continued to fall to 1.6% and also missed expectations, suggesting that the disinflationary forces in the global economy continue. European indices have started the day basically flat.

Forex trading has been fairly mixed overnight, with the dollar stronger against the yen and the Canadian dollar. Cable is looking to unwind some of yesterday’s losses, whilst the Australian dollar has been able to muster some strength against the dollar, with the rebound in consumer confidence and perhaps a suggestion that the Chinese inflation data may encourage further easing measures.

Traders will be focusing on the UK unemployment statistics today at 09:30BST. Jobless claims are expected to fall by 35,000 with unemployment forecast to drop to 6.1% (from 6.2%) but the most interesting segment will be the wage growth. UK average weekly earnings are expected to improve slightly to 0.8% (from 0.7%) but whilst wages lag inflation (yesterday coming in at 1.2%) the likelihood of a rate hike is low. There is also a look at US retail sales today at 13:30BST which is an important look at the US economy which is around 70% consumer driven. The expectation is for a -0.1% month on month reading.

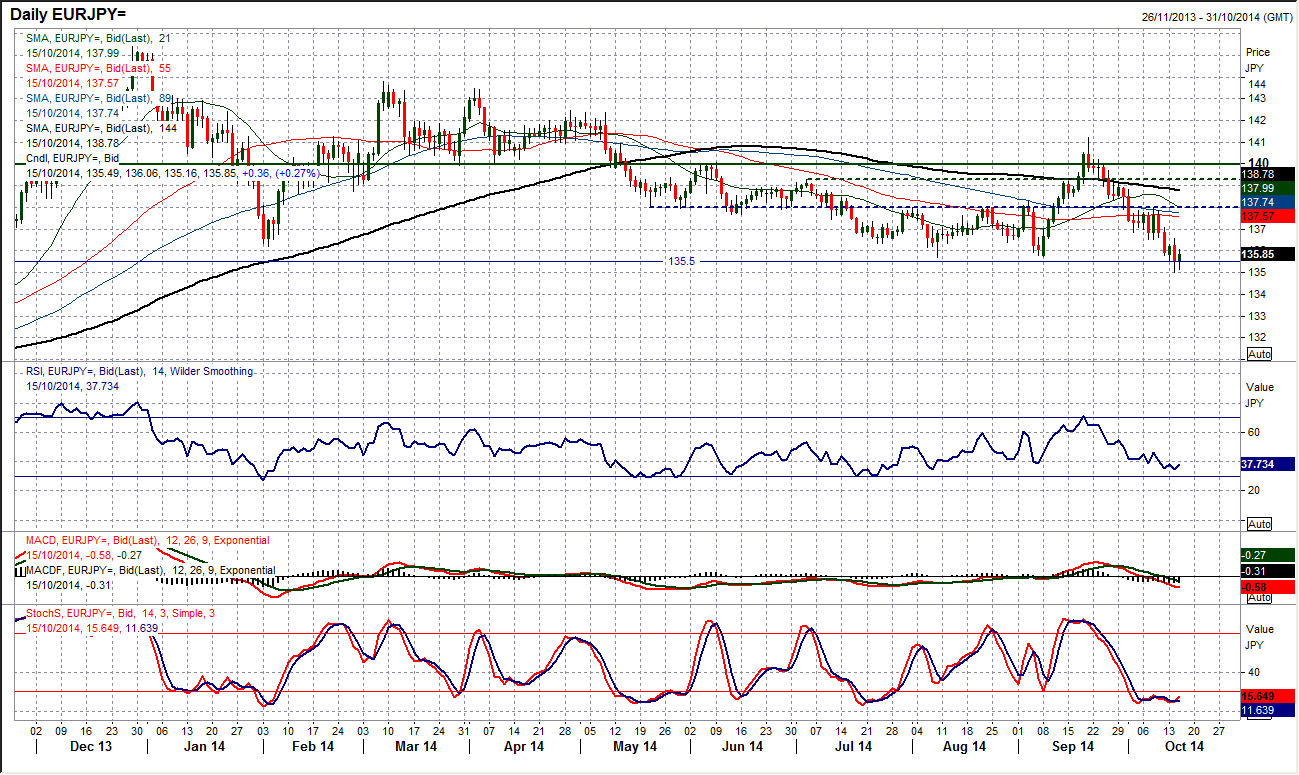

Chart of the Day – EUR/JPY

The downside pressure that has built up over the past 4 weeks has now changed the outlook from having become . Yesterday’s trading session ended up by being a bearish outside day and the move also took Euro/Yen to an 11 month low below the 135.68 August low. However, Euro/Yen has spent the past 11 months trading in a broad sideways trading band, using the old resistance at 135.50 as the basis of the lows in the band. Also looking at the momentum indicators there is no significantly bearish change which suggests that this is the time at which the range will be decisively broken. The RSI and MACD lines suggest that there is still a sideways trading outlook in process . The overnight rebound has left near term support at 135.00 and it will be interesting to see if this support begins to hold. The reaction over the next few days will be crucial as if there is a further breach of the 135.00 low then the next support is at 134.09 but then not until 131.18. The intraday hourly chart shows the move above 135.70 has been positive today, with the key near term resistance at 136.55.

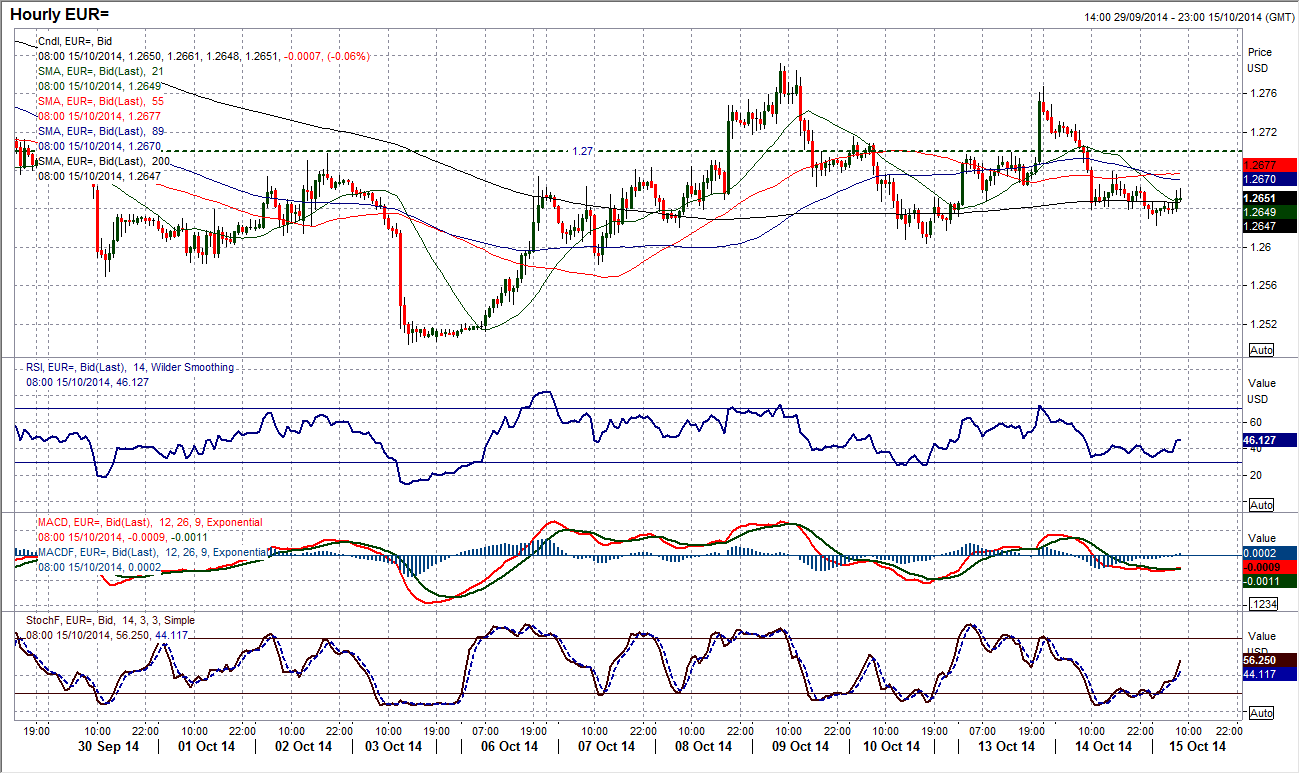

EUR/USD

The euro has entered into something of a messy phase of consolidation. Having broken an 8 week downtrend last week, the euro has been tending to move more net sideways. This is allowing the momentum indicators to continue to unwind. In the absence of any real recovery this suggests that the process is helping to renew downside momentum for the next leg lower. However in the meantime there is little real direction to speak of. The selling pressure from yesterday (which entirely unwound the gains of the previous session) has calmed down overnight and the intraday hourly technical indicators have flattened off moving into the European session. The support at $1.2604 protects a full retracement back towards $1.2500 which I see coming in due course. The $1.2700 neckline is now more of a near term pivot level so this can be seen as an overhead barrier prior to the key $1.2768 and $1.2791 resistances.

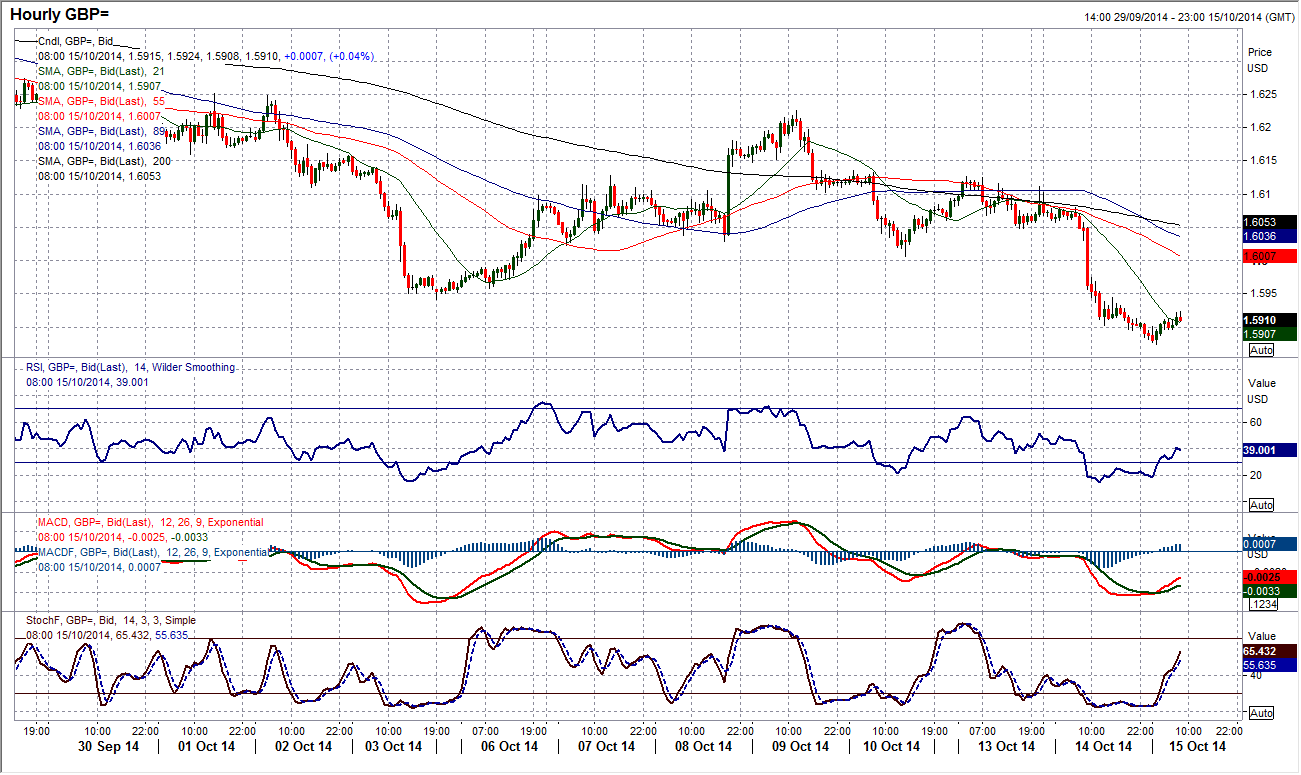

GBP/USD

The sharp selling pressure on sterling yesterday simply re-affirmed the bearish control on Cable. With the downtrend now into a 13th week, using rallies as a chance to sell remains the best strategy. The momentum indicators remain depressed with the MACD and Stochastics turning lower once more and the RI suggesting that despite the 11 month low seen yesterday there is still downside potential. The break of the support at $1.5940 yesterday has opened the key November low at $1.5850, however there is little reason to suggest that this support will be the limit to the downside in due course. The next key support beyond $1.5850 is at $1.5720 which is a combination of the old August 2013 high and the 61.8% Fibonacci retracement level of the huge $1.4812/$1.7191 bull run. The intraday hourly chart shows little encouragement, although there could be some near term unwinding of the precipitous sell-off from yesterday. The overhead resistance is now at the old support of $1.5940 and $1.6006.

USD/JPY

The dollar has formed some support around the lows of the previous band of support 106.80/107.40. The big question is, whether this is the formation of a low that could prove to be a medium term bottom and the basis of the next leg higher. It is too early to say, but the initial signs are there. The Stochastics are now crossing over below 20, whilst the RSI has turned up from the mid-40s. These are two early positive signals but there is more that needs to be seen to confirm. Dollar/Yen now needs to build on the support left at 106.73 and the intraday hourly chart shows an encouraging sign with a break of the recent 7 day downtrend. The hurdle the bulls will be looking at today is the resistance at 107.50, with the subsequent resistance at 108.18. This is very early stage still, but promising once more for the medium term dollar bulls.

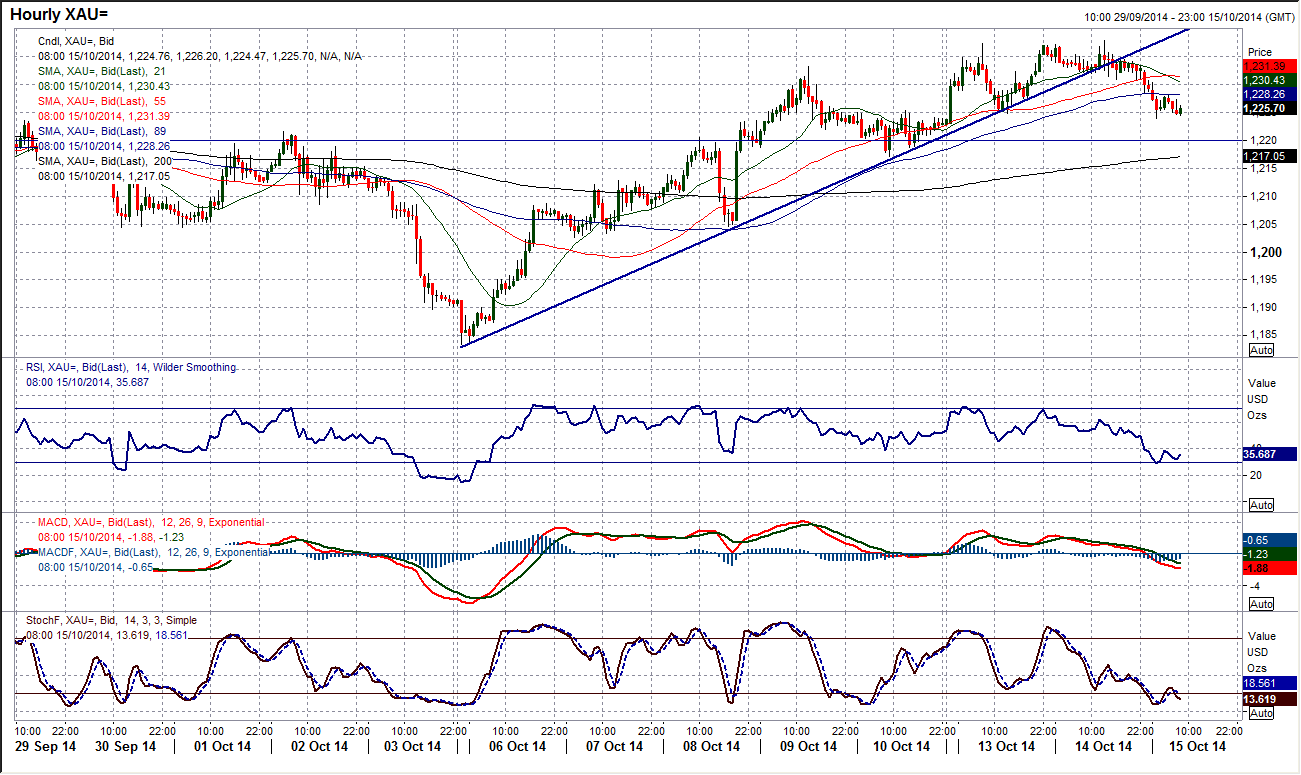

Gold

Has the rally run out of steam? Following the peak at $1237.90 yesterday, the gold price has come under some corrective pressure. The decline has now broken an uptrend that had formed over the past 7 days and the bulls are at threat of losing control. The intraday hourly chart shows the initial reaction low within the old uptrend t $1225 has already been breached. The confirmation of a loss of control would come with a breach of the support at $1217.10. The hourly RSI and MACD lines suggest that momentum is turning increasingly negative now near term. The inference of this is that the key medium term resistance at $1240.60 remains intact and the bull rebound is now under serious scrutiny. The price may just enter into a period of near term consolidation though and with the $1217.10 support intact there is no reason to get overly bearish quite yet, however running long positions may now be questionable.

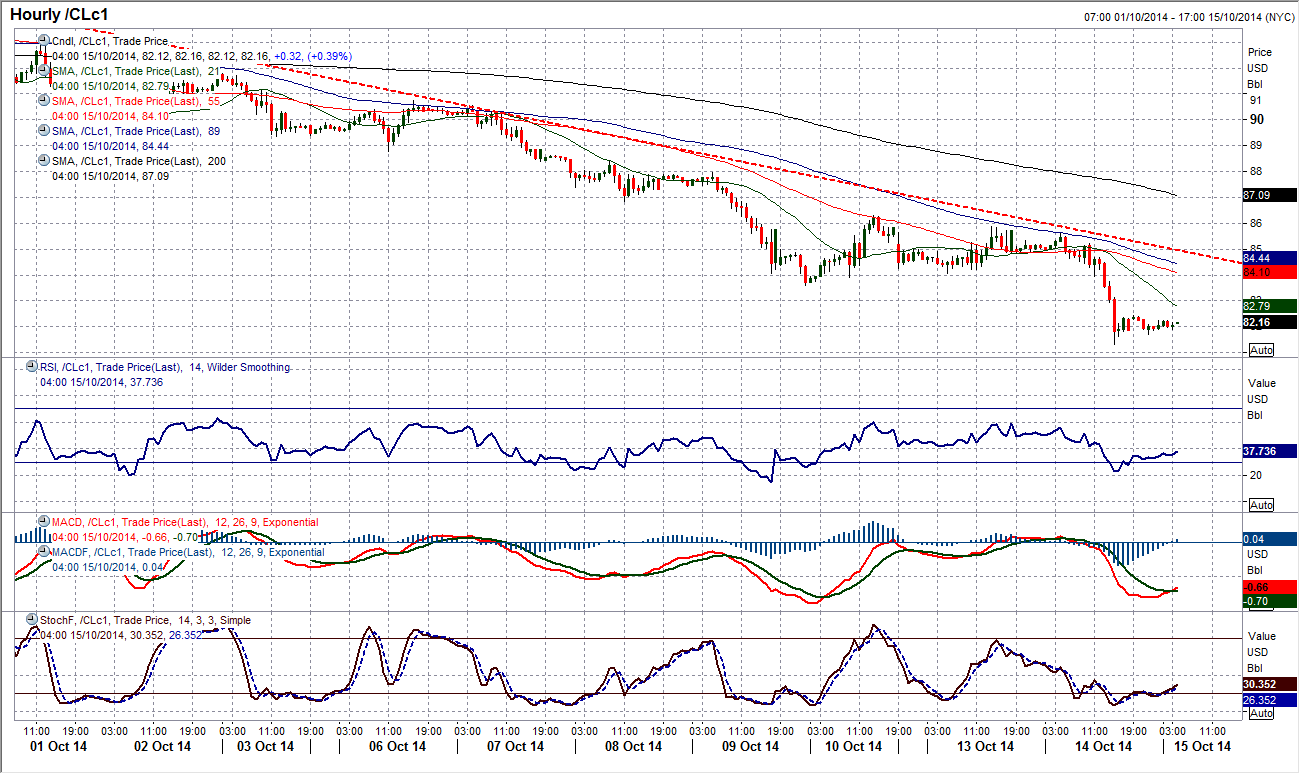

WTI Oil

The oil price had been managing to form some support above $83.59 but this once again broke spectacularly yesterday evening. WTI yesterday also had the biggest volume day since August 2011. This RSI is still extremely stretched around 26 but this just shows how bearish the momentum is. With no explicit reversal signals on any of the momentum indicators (RSI, MACD, or Stochastics) there is still an expectation that the bears will take hold once more. On the intraday hourly chart the resistance of a downtrend in place since 30th September is now around $85 with the bears in control. The break below $83.59 support has now opened the next bear phase that could result in a retreat towards the June 2012 low at $77.28. Overhead price resistance is with the breakdown at $83.59.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.